Investors want to know: Are growth stocks out of the woods? In effect, it’s the same as asking if Cathie Wood’s Ark Invest is out of the woods.

The flagship fund — the Ark Innovation ETF (ARKK) — is one of the more widely followed ETFs in the stock market today. It acts as a go-to investment for growth investors and as a barometer of growth stocks for investors who choose not to invest in this area of the market.

Its top holdings are companies like Zoom Video (ZM), Roku (ROKU), Tesla (TSLA), Block (SQ) and others.

In essence, as go growth stocks, so goes ARKK.

Noteworthy is that the ARKK ETF hasn’t made new lows since May, when all the other major indices did when they broke down in June.

There’s some promise in that observation, as growth stocks tend to lead the market. They typically peak before the overall market — note that ARKK peaked in February 2021 — and they tend to bottom before the market as well.

Now that does not mean that either the market or ARKK has officially hit bottom. But to see some constructive divergence — i.e., the S&P 500 hit new lows while ARKK did not — is at least encouraging.

Despite Friday’s 5.5% spill, ARKK also managed to close above resistance. Let’s look.

Trading ARKK

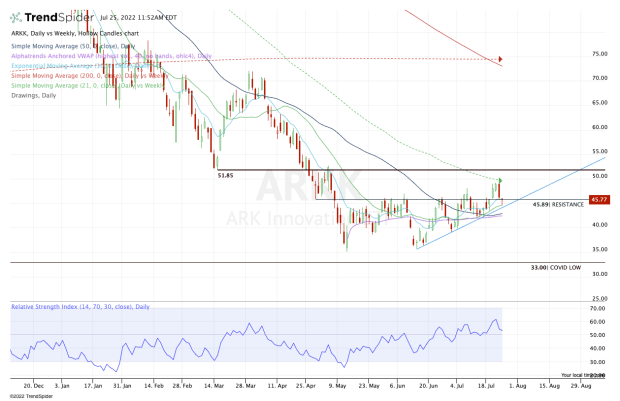

Chart courtesy of TrendSpider.com

Notice how the $46 level has been a big resistance mark for this ETF. This level was temporary support in late April, but failed in early May and has been acting as a lid ever since.

Even though ARKK has not made new lows, it also has not had rip-roaring strength to the upside. Instead, it’s been steadily chopping its way higher.

Last week the shares pushed toward $50 and came up just short, running into the 21-week moving average. Now the bulls are anxious to find out whether the $45 to $46 resistance zone can flip around and act as support this week.

It’s also as short-term trends like the 10-day and 21-day moving averages and uptrend support (blue line) have a chance to act as support.

This battle is even more critical with earnings season upon us.

If support holds, bulls can look for a retest of last week’s high near $49.30. If ARKK can clear $50 and the 21-week moving average, then the $52 mark is in play. Above that and shares can really fly if we’re in the midst of a vicious bear-market rally.

Conversely, if support fails, the $42.50 level will be thrust into an important role. That’s as the 50-day moving average and daily VWAP measure come into play near this mark. If it fails to hold, we could see $40 again.

Below $40 puts the mid-$30s back in play, which has acted as significant support twice now this year.