/Carnival%20Corp_%20logo%20at%20night%20by-%20JHVEPhoto%20via%20Shutterstock.jpg)

Miami, Florida-based Carnival Corporation & plc (CCL) is a cruise company that provides leisure travel services. Valued at $35.6 billion by market cap, the company offers cruise vacations specializing in ocean-based experiences, providing a mix of luxury, premium, and budget-friendly options.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CCL perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the travel services industry. Carnival's strength lies in its scale and diversified portfolio, enabling cost leadership and differentiation across multiple cruise brands. Its strong brand portfolio, including Carnival Cruise Line and Princess Cruises, drives customer loyalty and pricing power, leveraging core competencies across various market segments.

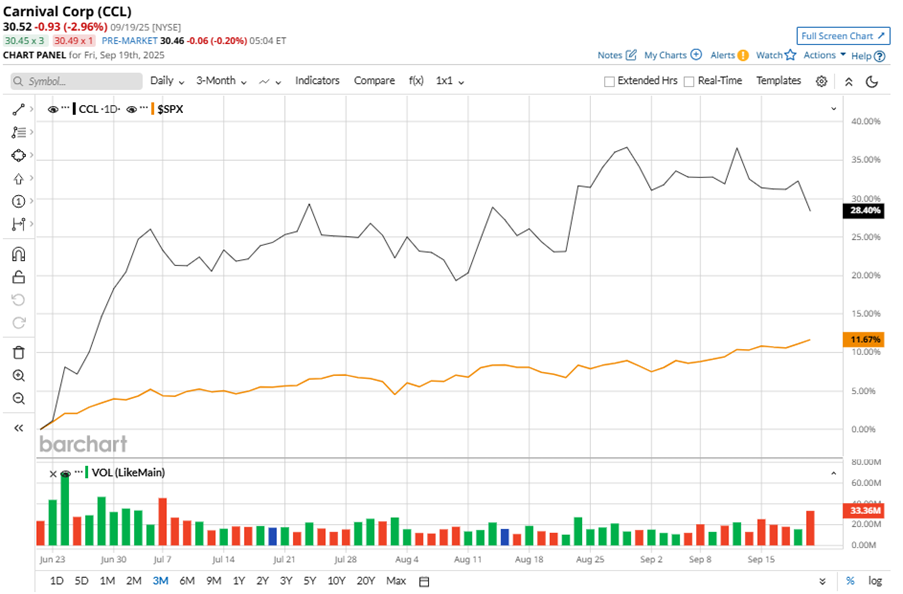

Despite its notable strength, CCL slipped 7% from its 52-week high of $32.80, achieved on Sep. 11. Over the past three months, CCL stock has gained 29.3%, outperforming the S&P 500 Index’s ($SPX) 11.4% gains during the same time frame.

In the longer term, shares of CCL rose 22.5% on a YTD basis and climbed 62.7% over the past 52 weeks, considerably outperforming SPX’s YTD gains of 13.3% and 16.6% returns during the same time frame.

To confirm the bullish trend, CCL has been trading above its 50-day and 200-day moving averages since early May.

CCL is gearing up for a competitive market by advancing its fleet strategy with targeted newbuilds and upgrades. The company has achieved success with AIDAdiva's refurbishment and is preparing for new ship launches, including Carnival Festivale and Carnival Tropicale, which will feature innovative amenities. With moderate capacity growth, Carnival aims to strengthen its market position, enhance guest experiences, and reduce debt, positioning itself to capture market share amidst increasing competition.

On Jun. 24, CCL shares closed up by 6.9% after reporting its Q2 results. Its adjusted EPS of $0.35 beat Wall Street expectations of $0.24. The company’s revenue was $6.3 billion, beating Wall Street forecasts of $6.2 billion.

CCL’s rival, Royal Caribbean Cruises Ltd. (RCL), has outpaced the stock with 42.4% gains on a YTD basis and a 91.5% uptick over the past 52 weeks.

Wall Street analysts are bullish on CCL’s prospects. The stock has a consensus “Strong Buy” rating from the 25 analysts covering it, and the mean price target of $34.04 suggests a potential upside of 11.5% from current price levels.