Camden, New Jersey-based The Campbell's Company (CPB) manufactures and markets food and beverage products in the United States and internationally. Valued at nearly $10 billion by market cap, Campbell’s operates through Meals & Beverages and Snacks segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." CPB fits right into that category, with its market cap exceeding this threshold, reflecting its notable size and influence in the packaged food industry.

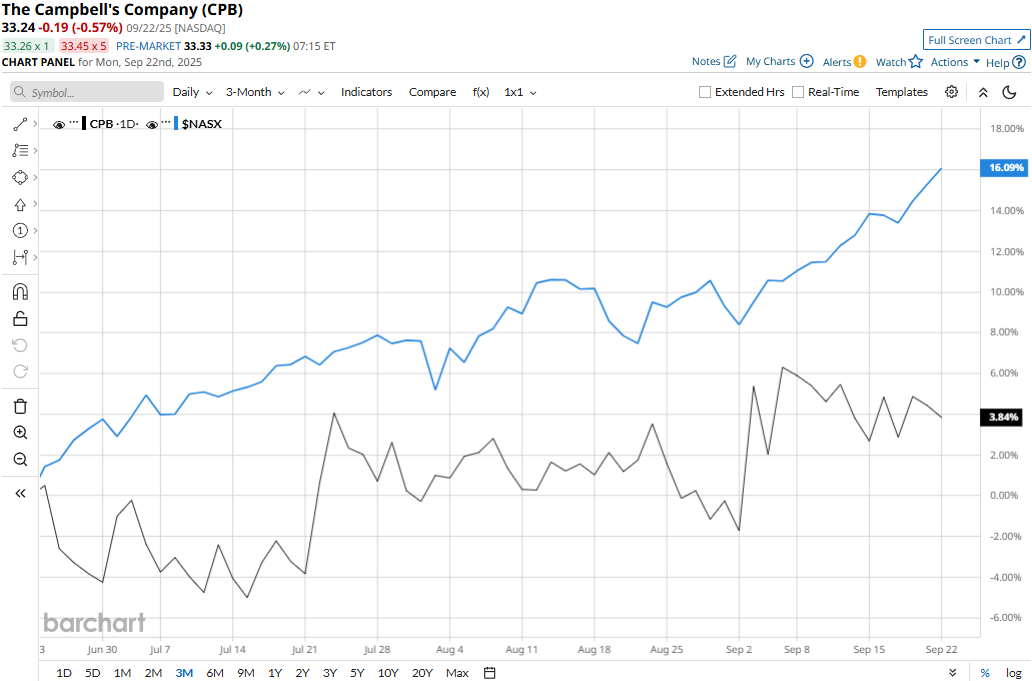

Despite its notable strengths, CPB stock has plummeted 34.8% from its 52-week high of $51.01 touched on Sept. 23, 2024. Meanwhile, the stock has observed a modest 4.4% uptick over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 17.2% surge during the same time frame.

CPB’s performance looks much grimmer over the longer term. The stock has plunged 20.6% in 2025 and 35.1% over the past 52 weeks, underperforming NASX’s 18% surge in 2025 and 27% returns over the past year.

The stock has remained constantly below its 200-day moving average since November last year and climbed slightly above its 50-day moving average in recent months, underscoring its longer-term bearish movement and recent upturn.

Campbell's stock prices rose 7.2% in a single trading session following the release of its better-than-expected Q4 results on Sept. 3. Although the company’s organic sales remain under pressure, its overall topline came in at $2.3 billion, up 1.2% year-over-year and mostly in line with the Street’s expectations. Meanwhile, its adjusted EPS dipped by 1 cent from the year-ago quarter to $0.62 and surpassed the consensus estimates by 8.8%.

When compared to its peer, Campbell's has performed slightly better than Hormel Foods Corporation’s (HRL) 22.5% plunge in 2025, but underperformed HRL’s 23.5% decline over the past year.

Among the 19 analysts covering the CPB stock, the consensus rating is a “Hold.” As of writing, the stock is trading slightly below its mean price target of $33.83.