Houston, Texas-based Camden Property Trust (CPT) engages in the ownership, management, development, repositioning, redevelopment, acquisition, and construction of multifamily apartment communities. With a market cap of $11.6 billion, Camden operates as one of the major owners of apartments in the United States.

Companies worth $10 billion or more are generally described as "large-cap stocks." Camden fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the residential REIT industry.

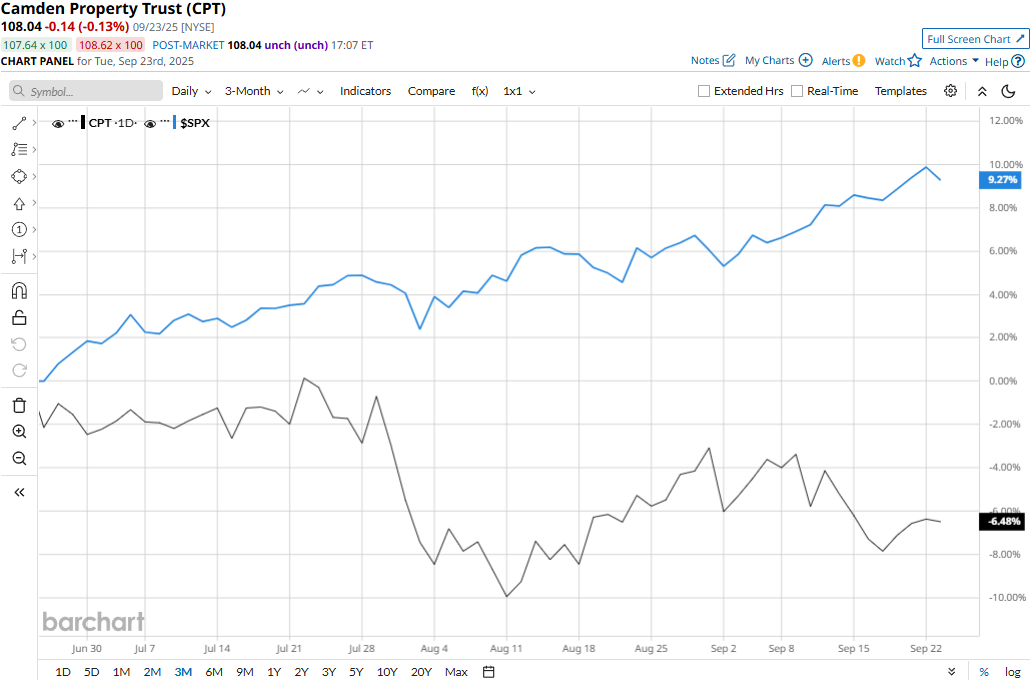

Despite its notable strengths, CPT stock has plunged 15.4% from its three-year high of $127.69 touched on Sept. 24, 2024. Meanwhile, the stock dropped 7.1% over the past three months, notably underperforming the S&P 500 Index’s ($SPX) 10.5% surge during the same time frame.

Camden’s performance has remained grim over the longer term as well. The stock is down 6.9% on a YTD basis and 14.9% over the past 52 weeks, underperforming SPX’s 13.2% surge in 2025 and 16.4% returns over the past year.

CPT stock has remained mostly below its 50-day and 200-day moving averages since early April, underscoring its bearish trend.

Despite delivering better-than-expected results, Camden’s stock prices dipped 2.1% in the trading session following the release of its Q2 results on Jul. 31. The company’s property revenues for the quarter increased 2.4% year-over-year to $396.5 million, beating the consensus estimates by a thin margin. Meanwhile, the company’s cash flows remained under pressure, its core funds from operations (CFFO) decreased by a marginal 18 bps year-over-year to $187.6 million. However, its CFFO per share of $1.70 surpassed the Street’s estimates by 59 bps.

The drop in CPT stock prices can be attributed to the broader market downturn observed during the trading session, due to the chaos created by President Trump’s tariff announcements.

On the positive note, when compared to its peer, CPT has slightly outperformed Invitation Homes Inc.’s (INVH) 7.1% decline in 2025 and 18.7% plunge over the past 52 weeks.

Among the 26 analysts covering the CPT stock, the consensus rating is a “Moderate Buy.” Its mean price target of $122.12 suggests a 13% upside potential.