/Cadence%20Design%20Systems%2C%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $94.6 billion, Cadence Design Systems, Inc. (CDNS) is a global leader in electronic design automation (EDA). The company provides software, hardware, semiconductor IP, and services that enable the design, analysis, and verification of integrated circuits, systems-on-chip, printed circuit boards, and complete electronic systems.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Cadence Design Systems fits this criterion perfectly, exceeding the mark. Serving industries such as consumer electronics, hyperscale computing, automotive, aerospace, 5G communications, and life sciences, Cadence empowers innovation through its System Design Enablement (SDE) strategy.

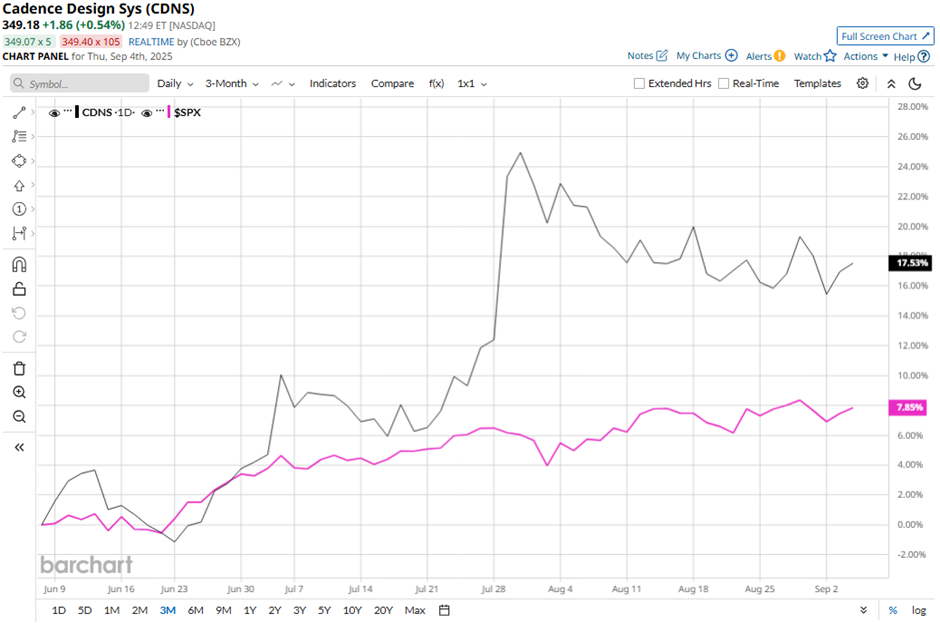

Shares of the San Jose, California-based company have fallen 7.1% from its 52-week high of $376.45. Cadence Design Systems’ shares have increased 18.8% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 8.5% gain over the same time frame.

In the longer term, CDNS stock is up 16.4% on a YTD basis, exceeding SPX’s 10.1% rise. Moreover, shares of the hardware and software products maker have surged 37.6% over the past 52 weeks, compared to the 17.3% return of the SPX over the same time frame.

CDNS stock has been trading above its 50-day and 200-day moving averages since late April.

Shares of Cadence jumped 9.7% after reporting Q2 2025 adjusted EPS of $1.65 and revenue of $1.3 billion, above the estimates. The company also raised its annual revenue forecast to $5.21 billion - $5.27 billion and lifted its 2025 adjusted EPS outlook to $6.85 - $6.95. Additionally, the lifting of U.S. export curbs allowed Cadence to resume sales to China, a key market that contributed 9% of Q2 sales.

In comparison, rival Strategy Inc (MSTR) has gained 11.5% on a YTD basis, lagging behind Cadence Design Systems’ performance. However, over the past 52 weeks, MSTR stock has climbed 158.5%, outpacing CDNS over the same period.

Due to the stock’s strong performance relative to the SPX, analysts remain bullish on CDNS. The stock has a consensus rating of “Strong Buy” from the 20 analysts in coverage, and the mean price target of $374.47 is a premium of 7.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.