Bunge Global SA (BG) is a storied leader in the agribusiness, food & ingredients sectors with roots dating back to 1818. The company’s operational headquarters is located in Chesterfield, Missouri.

Through its diverse operations from grain and oilseed origination to edible oils, milling, sugar, and bioenergy, it plays a critical role in feeding the world’s livestock, fueling the food industry, and enabling bioenergy solutions. Bunge Global commands a market cap of about $15.4 billion, reflecting its significant scale, global footprint, and investor confidence.

Companies with a market cap of $10 billion or more are typically recognized as “large-cap stocks,” a classification that reflects their financial heft, robust performance, and global market presence. Bunge Global firmly resides in this category, underlining its scale, stability, and ability to execute across global, diversified markets.

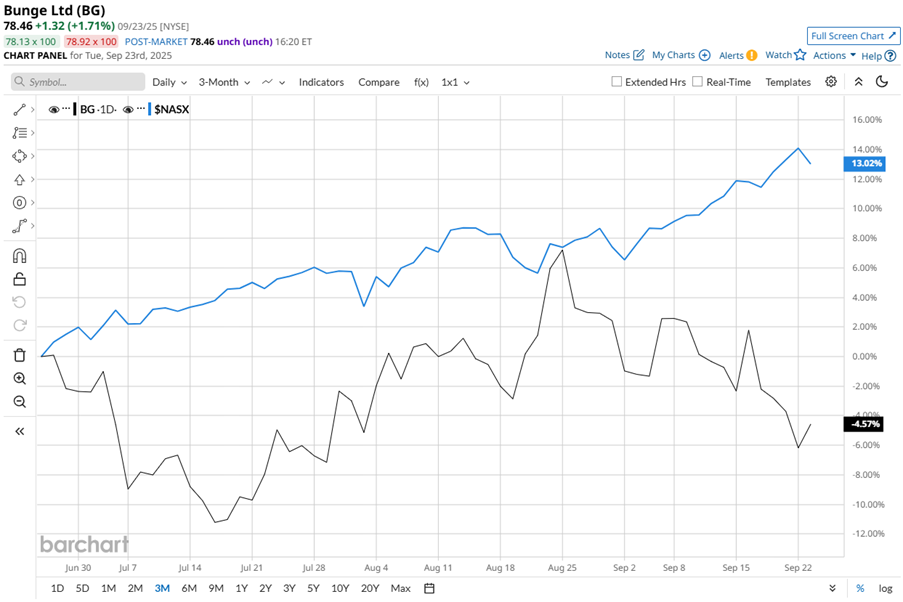

But the stock’s journey has not been smooth lately. BG stock hit its 52-week high of $99.39 last October and now sits about 21.1% below that mark. Over the last three months, shares have slipped 6.8%, while the Nasdaq Composite ($NASX) sprinted ahead with a 15% gain over the same period.

Stretching the lens further, and the picture stays lopsided – BG stock has barely moved year-to-date (YTD) and tumbled 19.5% over the past 52 weeks, while the Nasdaq soared 16.9% YTD and 25.6% in a year.

BG’s chart has mostly carried bearish momentum, stuck under its 50-day and 200-day moving averages through the past year. But since early August, the stock clawed its way above both lines, showing signs of life. Recent fluctuations, however, hint that the fight isn’t over, with momentum still trying to prove it’s more than a bounce.

Bunge Global has experienced a notable decline in its stock price over the past year, primarily due to a combination of cyclical commodity pressures, geopolitical trade tensions, and integration challenges. Geopolitical factors, such as China’s imposition of tariffs on all U.S. goods, have further strained Bunge’s revenue streams, particularly affecting its soybean trading operations.

Bunge Global is holding its ground in 2025 while rival Tyson Foods, Inc. (TSN) struggles. TSN has declined 6.3% in 2025, underperforming BG on shorter-term momentum. Meanwhile, TSN slipped 10.9% over the past year - its losses remain milder compared to Bunge’s steeper decline in the high teens.

Among the nine analysts covering the BG stock, the consensus rating is a “Moderate Buy,” a downgrade from the “Strong Buy” rating two months ago. Its mean price target of $89.78 suggests a 14.4% upside potential from current price levels.