/Broadridge%20Financial%20Solutions%2C%20Inc_%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

With a market cap of $29.3 billion, Broadridge Financial Solutions, Inc. (BR) is a global financial technology leader that provides investor communications and technology-driven solutions to banks, broker-dealers, asset managers, corporate issuers, and other financial institutions. Broadridge plays a critical role in enhancing transparency, efficiency, and engagement across the financial services industry.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Broadridge Financial Solutions fits this criterion perfectly. Through its two segments: Investor Communication Solutions and Global Technology & Operations, the company delivers services ranging from regulatory and shareholder communications to front-to-back securities processing and data-driven solutions.

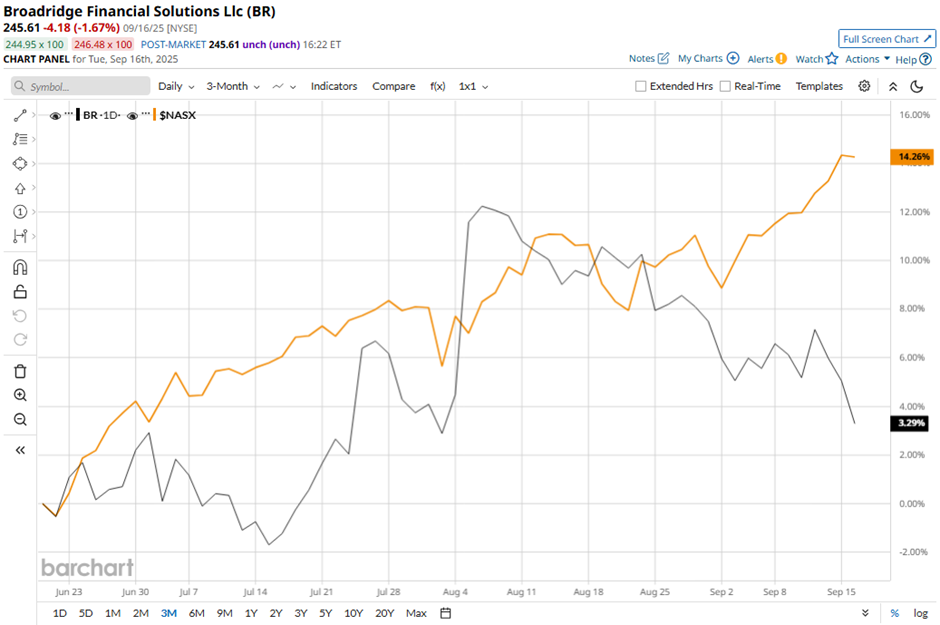

Despite this, shares of the Lake Success, New York-based company have declined 9.7% from its 52-week high of $271.91. BR stock has risen 2.8% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 13.4% increase over the same time frame.

In the longer term, BR stock is up 8.6% on a YTD basis, lagging behind NASX’s 15.7% gain. Moreover, shares of the fintech firm have soared 16.1% over the past 52 weeks, compared to NASX’s nearly 27% return over the same time frame.

Yet, the stock has been trading above its 200-day moving averages since last year.

Shares of Broadridge Financial surged 6.8% on Aug. 5 after the company reported strong Q4 2025 results that topped Wall Street estimates, with adjusted EPS of $3.55 and revenue of $2.07 billion. Growth was fueled by a 5% increase in its Investor Communication Solutions segment and a 12% jump in its Global Technology & Operations business, reflecting robust demand for proxy communications, digital wealth, and market infrastructure services.

Investor sentiment was further lifted by management’s upbeat fiscal 2026 guidance, targeting 5% - 7% recurring revenue growth and 8% - 12% adjusted EPS growth.

In comparison, rival Leidos Holdings, Inc. (LDOS) has outperformed Broadridge stock. LDOS stock has gained 26.7% on a YTD basis and 17.9% over the past 52 weeks.

Due to the stock’s weak performance, analysts remain cautious on BR. The stock has a consensus rating of “Hold” from the nine analysts in coverage, and the mean price target of $277.57 is a premium of 13% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.