/Broadridge%20Financial%20Solutions%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

With a market cap of $26.6 billion, Broadridge Financial Solutions, Inc. (BR) is a global fintech and outsourcing provider that delivers investor communications, trade processing, and technology solutions to banks, broker-dealers, asset managers, and corporate issuers. Through its two segments: Investor Communication Solutions and Global Technology & Operations, the company delivers services ranging from regulatory and shareholder communications to front-to-back securities processing and data-driven solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Broadridge Financial Solutions fits this criterion perfectly. The New York-based company plays a critical role in financial market infrastructure, offering services such as proxy voting, shareholder disclosure, post-trade management, and wealth and investment management platforms.

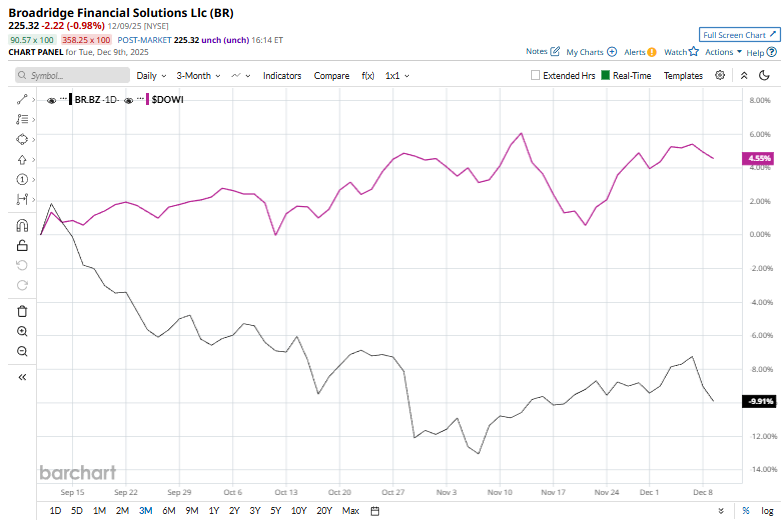

However, shares of BR have declined 17.1% from its 52-week high of $271.91. BR stock has dropped 10.7% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 4% rise over the same time frame.

In the longer term, BR stock is down marginally on a YTD basis, lagging behind DOW’s 11.2% gain. Moreover, shares of the fintech firm have plunged 3.5% over the past 52 weeks, compared to DOWI’s 7.1% return over the same time frame.

BR shares have been trading below their 200-day moving average since mid-September and have recently dipped below their 50-day moving average, reinforcing a downtrend.

Broadridge’s shares inched marginally higher on November 19 after the company announced a strategic partnership with Xceptor to integrate Xceptor Tax into Broadridge’s Global Tax and Client Reporting platform. By combining Broadridge’s asset-servicing infrastructure with Xceptor’s intelligent automation, the platform streamlines data flows, centralizes documentation, and enhances compliance. The integrated system is designed to help financial institutions accelerate tax-reclaim processing, reduce operational risk and cost, and manage increasingly complex global tax requirements.

In comparison, rival Leidos Holdings, Inc. (LDOS) has outperformed Broadridge stock. LDOS stock has gained 28.4% on a YTD basis and 15.4% over the past 52 weeks.

Due to the stock’s weak performance, analysts remain cautious on BR. The stock has a consensus rating of “Hold” from the nine analysts in coverage, and the mean price target of $266.43 is a premium of 18.2% to current levels.