/Boston%20Scientific%20Corp_%20logo%20on%20iPad-%20by%20Kate%20Krav-Rude%20via%20Shutterstock.jpg)

Boston Scientific Corporation (BSX), headquartered in Marlborough, Massachusetts, develops, manufactures, and markets medical devices for use in various interventional medical specialties globally. With a market cap of $149.7 billion, the company’s products are used in interventional cardiology, cardiac rhythm management, peripheral interventions, electrophysiology, neurovascular intervention, endoscopy, and more.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BSX perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical devices industry. Boston Scientific's strengths include its trusted brand, R&D-driven innovation, diversified product portfolio, global reach, and strategic acquisitions, which have solidified its position in the medical tech market.

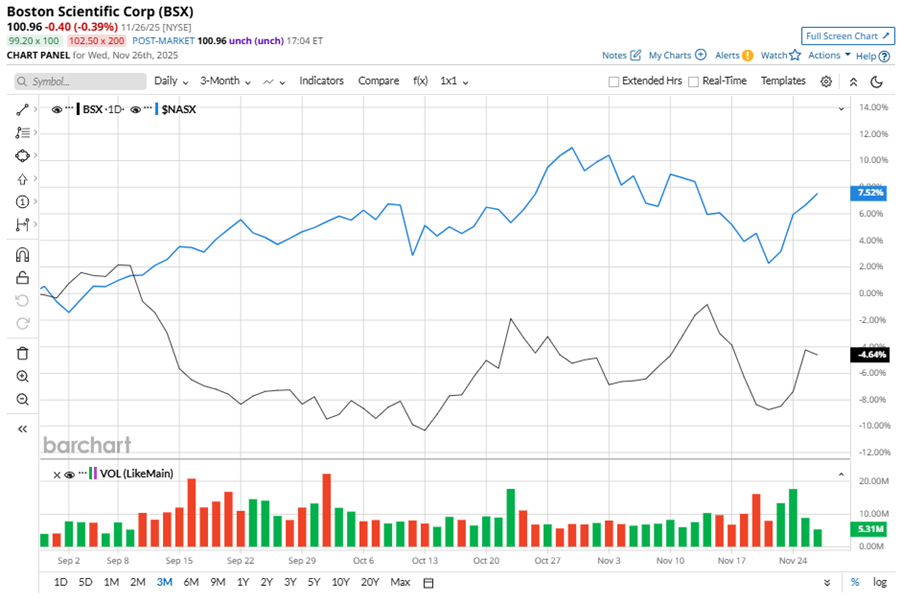

Despite its notable strength, BSX slipped 7.8% from its 52-week high of $109.50, achieved on Sep. 9. Over the past three months, BSX stock declined 5.1%, underperforming the Nasdaq Composite’s ($NASX) 7.8% gains during the same time frame.

In the longer term, shares of BSX rose 13% on a YTD basis and climbed 11.9% over the past 52 weeks, underperforming NASX’s YTD gains of 20.2% and 21.1% returns over the last year.

To confirm the bearish trend, BSX has been trading below its 200-day moving average since mid-September, with slight fluctuations. However, the stock has been trading above its 50-day moving average since late October, with some fluctuations.

On Oct. 22, BSX shares closed up by 4% after reporting its Q3 results. Its adjusted EPS of $0.75 surpassed Wall Street expectations of $0.71. The company’s revenue was $5.1 billion, beating Wall Street's $5 billion forecast. The company expects full-year adjusted EPS in the range of $3.02 to $3.04.

In the competitive arena of medical devices, Stryker Corporation (SYK) has lagged behind the stock, with a 3.4% gain on a YTD basis and a 4.5% downtick over the past 52 weeks.

Wall Street analysts are bullish on BSX’s prospects. The stock has a consensus “Strong Buy” rating from the 32 analysts covering it, and the mean price target of $127.55 suggests a potential upside of 26.3% from current price levels.

.png?w=600)