/Biogen%20Inc%20logo%20on%20HQ-by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $21.8 billion, Biogen Inc. (BIIB) is a global biotechnology leader specializing in therapies for neurological and neurodegenerative diseases. Its portfolio includes multiple sclerosis treatments such as Tecfidera, Vumerity, Avonex, Plegridy, and Tysabri, as well as Spinraza for spinal muscular atrophy and several biosimilars.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Biogen fits this criterion perfectly. Through strategic collaborations and continued innovation, Biogen is advancing treatments in Alzheimer’s disease, neuromuscular disorders, movement disorders, and beyond.

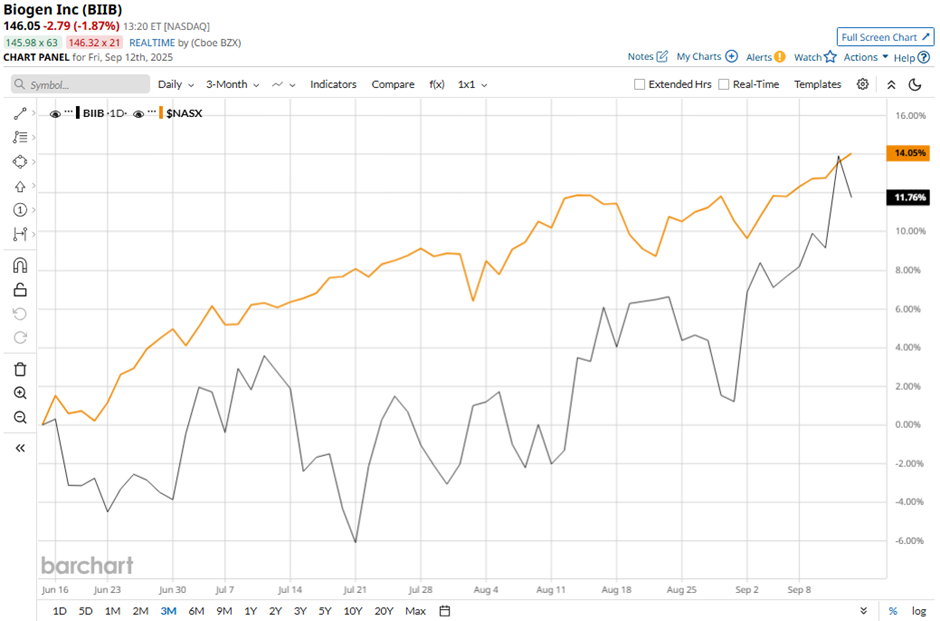

Despite this, shares of the Cambridge, Massachusetts-based company have declined 28.3% from its 52-week high of $204.18. BIIB stock has risen nearly 11% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 12.6% increase over the same time frame.

In the longer term, BIIB stock is down nearly 4% on a YTD basis, lagging behind NASX’s 14.7% gain. Moreover, shares of the company have decreased 25.8% over the past 52 weeks, compared to NASX’s over 26% return over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day moving average since late May.

Shares of Biogen rose 1.1% on Jul. 31 after the company reported Q2 2025 adjusted EPS of $5.47 and revenues of $2.65 billion, both surpassing expectations. Stronger-than-expected MS drug sales, particularly Vumerity and Tysabri, helped offset declines in older MS drugs and Spinraza. Additionally, management raised its full-year adjusted EPS guidance to $15.50 - $16, reflecting a more optimistic 2025 outlook.

In contrast, rival Organon & Co. (OGN) has performed weaker than BIIB stock. OGN stock has declined 28.5% on a YTD basis and 47.4% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on BIIB. The stock has a consensus rating of “Moderate Buy” from the 34 analysts in coverage, and the mean price target of $170.24 is a premium of 16.5% to current levels.