Best Buy (BBY) stock is down less than 1% on Tuesday after the electronics retailer reported earnings.

Considering how the market is trading — the S&P 500 is currently off 1.2% — and how retail stocks have reacted to earnings this quarter — Abercrombie & Fitch (ANF) is down 30% as of this writing — today’s flat price action for Best Buy looks pretty good.

That said, Best Buy stock is hardly thriving. The shares fell 16% last week as Walmart (WMT) and Target (TGT) created an avalanche of selling pressure in the retail space. Further, Best Buy stock is currently down 50% from its all-time high.

With the shares cut in half from the high, some investors wonder whether a recovery rebound may be on the way.

Some may think that's unlikely after the retailer missed on earnings and slashed its full-year outlook. But could that be a good thing?

The fact that Best Buy stock isn’t getting crushed right now is a win for the bulls. With the weakness in retail stocks and the market's poor trading on the day, Best Buy stock has every reason to be down big today. Yet it’s not…

Trading Best Buy Stock

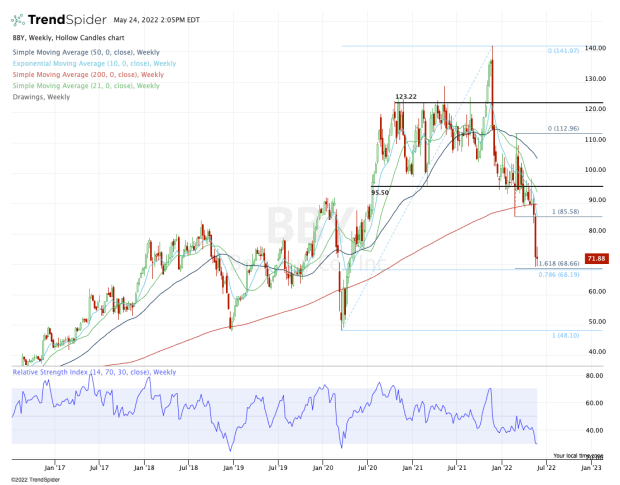

Chart courtesy of TrendSpider.com

There’s good news and bad news with Best Buy stock, the latter being that the shares have already been cut in half.

The good news is that there’s a very clear level to watch on the downside, which is $68 to $70.

While it’s still early in the week, we have back-to-back weeks with a low near $69.

Further, this zone is where the 161.8% downside extension comes into play from the more recent range, and where the 78.6% retracement comes into play from the November high to the March 2020 covid lows.

If that’s too much technical jargon, it’s just to say that the $58 to $60 area is significant. Aggressive buyers can consider a long position in this zone, provided Best Buy stock continues to close above it.

If the area fails as support, there’s no telling where it may fall to. Longer term, I don’t think we could rule out $50 as a potential landing spot if enough negative headwinds continue to work against it.

On the upside, keep an eye on this week’s high near $76. If we bounce, that’s the first notable area to watch. Above $77.50 and $85 may be in play, along with the 10-week moving average.