/Berkshire%20Hathaway%20Inc_%20logo%20on%20phone-by%20FelloeNeko%20via%20Shutterstock.jpg)

Berkshire Hathaway Inc. (BRK.B) is a globally recognized conglomerate with a market value of $1.1 trillion. The Nebraska-based company is distinguished by its conservative investment approach, emphasis on long-term shareholder value, and autonomous management structure, overseeing a vast portfolio of operating businesses and equity holdings across multiple industries.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and BRK.B definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the insurance-diversified industry.

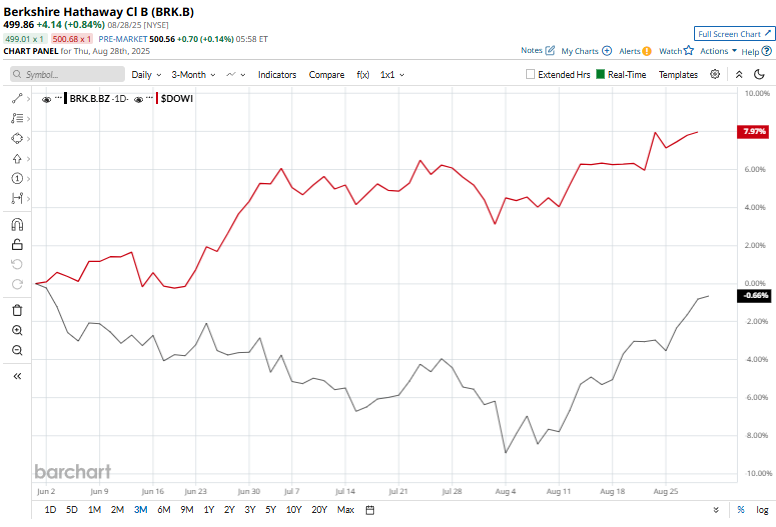

Berkshire slipped 7.8% from its 52-week high of $542.07, achieved on May 2. Over the past three months, BRK.B stock declined marginally, underperforming the broader Dow Jones Industrial Average’s ($DOWI) 8.4% rise during the same time frame.

Moreover, in the longer term, shares of Berkshire rose 10.3% on a YTD basis and climbed 7.6% over the past 52 weeks, compared to $DOWI’s YTD return of 7.3% and 11.1% gains over the last year.

Berkshire has been trading above its 200-day and 50-day moving averages since mid-August, indicating an uptrend.

On Aug. 2, Berkshire Hathaway released its fiscal 2025 second-quarter earnings and its shares dipped 2.9% in the next trading session. Its net income dropped to $12.4 billion from $30.4 billion a year ago due to a $3.8 billion Kraft Heinz write-down, while operating earnings held steady at $11.2 billion.

Top rival, JPMorgan Chase & Co. (JPM), has taken the lead over Berkshire, showing resilience with a 36.1% uptick over the past 52 weeks and a 25.6% gain in 2025.

Wall Street analysts are moderately bullish on BRK.B’s prospects. The stock has a consensus “Moderate Buy” rating from the seven analysts covering it, and the mean price target of $537.75 suggests a potential upside of 7.6% from current price levels.