/Autozone%20Inc_%20big%20rig%20by-%20DakotaSmith%20via%20iStock.jpg)

With a market cap of $71.2 billion, AutoZone, Inc. (AZO) is the nation’s leading retailer and distributor of automotive replacement parts and accessories. Operating across the U.S., Puerto Rico, Mexico, Brazil, and with sourcing offices in Shanghai, the company serves both Do-It-Yourself (DIY) and Do-It-for-Me (DIFM) markets.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks and AutoZone fits this criterion perfectly. AutoZone provides a wide range of automotive hard parts, maintenance products, accessories, and non-automotive items through its stores, commercial sales programs, and online platforms.

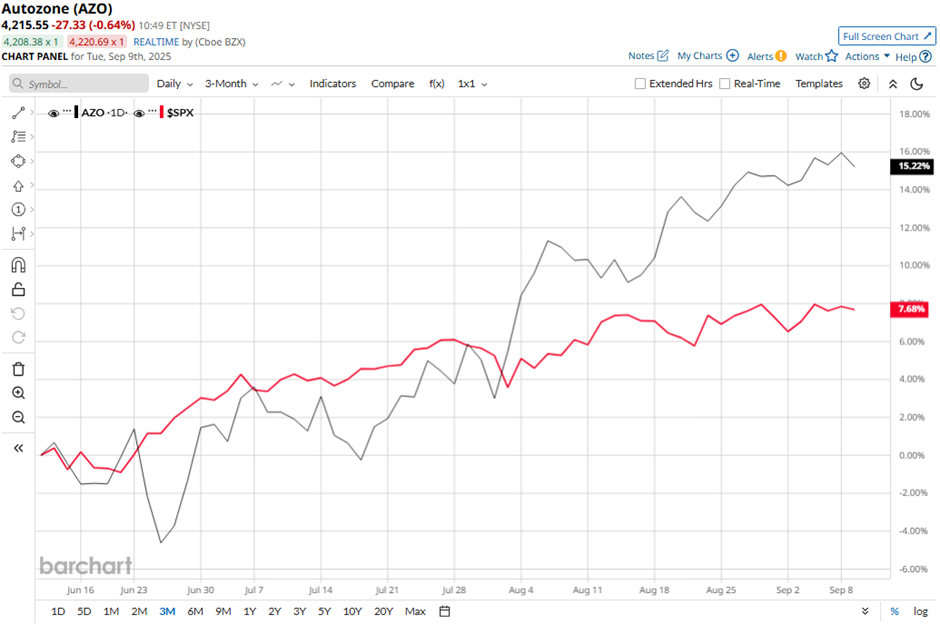

Shares of the Memphis, Tennessee-based company have fallen marginally from its 52-week high of $4,259.21. AutoZone’s shares have increased 14.2% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 8.2% gain over the same time frame.

In the longer term, AZO stock is up 31.8% on a YTD basis, outpacing SPX’s 10.5% rise. Moreover, shares of the auto parts retailer have surged 35.3% over the past 52 weeks, compared to the 18.8% return of the SPX over the same time frame.

Despite a few fluctuations, AZO stock has been trading above its 50-day and 200-day moving averages since last year.

Despite reporting better-than-expected Q3 2025 revenue of $4.46 billion, shares of AutoZone fell 3.4% on May 27 because earnings missed forecasts. Net income declined 6.6% to $608.4 million, or $35.36 per share, below Wall Street’s expectation and down from $651.7 million, or $36.69 per share, a year earlier. Weaker margins from softening demand, currency fluctuations, and higher supply chain costs further pressured investor sentiment, outweighing the positive 5% domestic same-store sales growth.

However, rival Genuine Parts Company (GPC) has lagged behind AZO stock. GPC stock has gained 18.6% on a YTD basis and 1.4% over the past 52 weeks.

Due to the stock’s outperformance over the past year, analysts remain bullish on AZO. It has a consensus rating of “Strong Buy” from the 27 analysts in coverage, and the stock is trading above the mean price target of $4,180.46.