/Assurant%20Inc%20logo%20on%20phone-%20by%20rafapress%20via%20Shutterstock.jpg)

Atlanta, Georgia-based Assurant, Inc. (AIZ) provides protection services to connected devices, homes, and automobiles. Valued at $10.7 billion by market cap, the company offers mobile device solutions, extended service contracts, insurance products, vehicle protection, and housing-related coverage, including lender-placed, renters, and homeowners insurance.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and AIZ perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the insurance - property & casualty industry. Assurant’s growth is fueled by its leading mobile device solutions and insurance products. The company’s consistent performance showcases its innovation and adaptability to consumer needs.

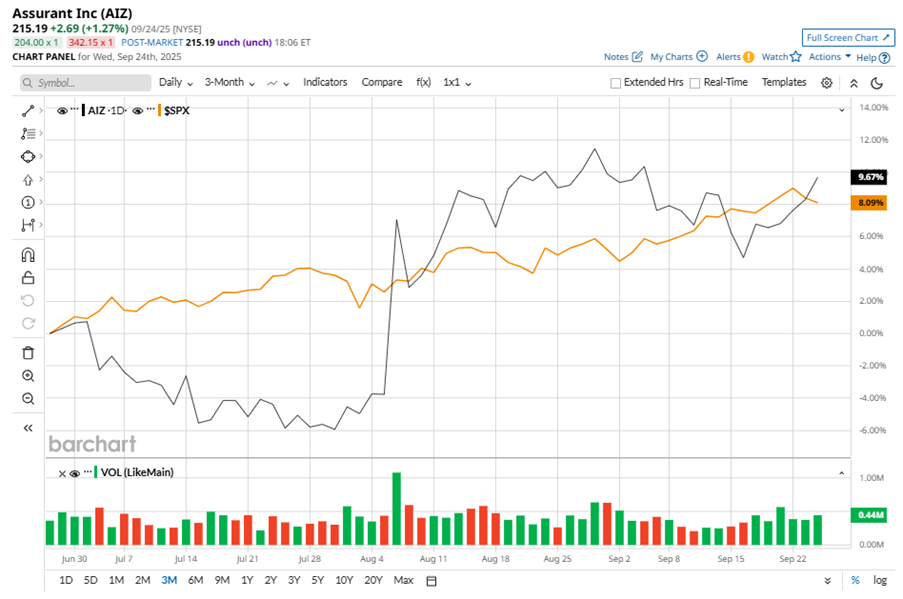

Despite its notable strength, AIZ slipped 6.7% from its 52-week high of $230.55, achieved on Nov. 25, 2024. Over the past three months, AIZ stock has gained 8.7%, underperforming the S&P 500 Index’s ($SPX) 9% gains during the same time frame.

In the longer term, shares of AIZ rose marginally on a YTD basis and climbed 9.1% over the past 52 weeks, underperforming SPX’s YTD gains of 12.9% and 15.8% returns during the same time frame.

To confirm the bullish trend, AIZ has been trading above its 50-day and 200-day moving averages since early August, with slight fluctuations.

On Aug. 5, AIZ reported its Q2 results, and its shares closed up more than 11% in the following trading session. Its adjusted EPS of $5.56 surpassed Wall Street expectations of $4.43. The company’s revenue totaled $3.2 billion, representing an 8% year-over-year increase.

In the competitive arena of insurance - property & casualty, The Hartford Insurance Group, Inc. (HIG) has taken the lead over AIZ, showing resilience with 20.5% gains on a YTD basis and 13.2% returns over the past 52 weeks.

Wall Street analysts are bullish on AIZ’s prospects. The stock has a consensus “Strong Buy” rating from the nine analysts covering it, and the mean price target of $239.33 suggests a potential upside of 11.2% from current price levels.