/Aptiv%20PLC%20on%20building%20by_%20filmestria%20via%20iStock.jpg)

With a market capitalization of $18.1 billion, Aptiv PLC (APTV) is a prominent technology company specializing in advanced automotive solutions, with a focus on electrification, connectivity, and autonomous driving. Headquartered in Schaffhausen, Switzerland, Aptiv evolved from Delphi Automotive and now operates in over 45 countries.

Companies worth more than $10 billion are generally labelled as “large-cap” stocks, and Aptiv fits this criterion perfectly. With a global footprint, deep industry expertise, and a strong technology pipeline, Aptiv maintains a durable competitive edge in a rapidly evolving automotive market.

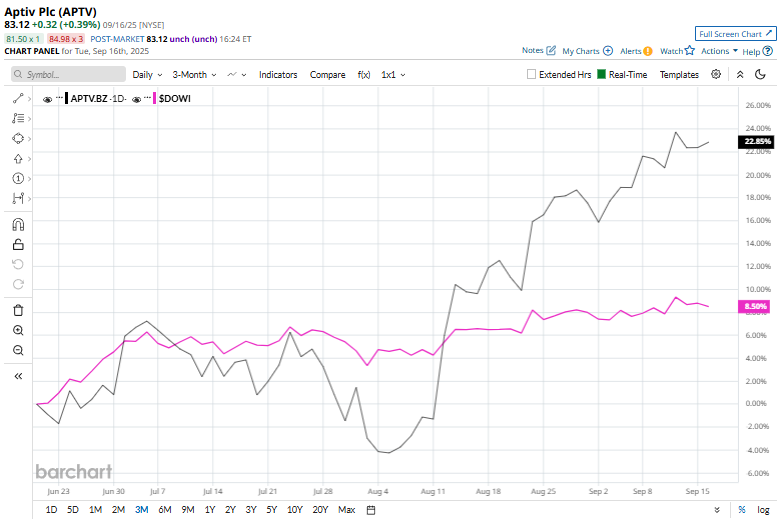

APTV has touched its 52-week high of $84.72 recently on Sept. 15. Shares of the company have gained 20.2% over the past three months, significantly outpacing the broader Dow Jones Industrial Average’s ($DOWI) 7.6% rise during the same time frame.

Aptiv stock is up 37.4% on a YTD basis, outpacing $DOWI’s 7.8% rise. Moreover, shares of APTV have climbed 20.8% over the past 52 weeks, exceeding $DOWI’s 9.9% return over the same time frame.

APTV has been trading above its 50-day and 200-day moving averages since early May, indicating an uptrend.

On Jul. 31, APTV shares closed up by 2.9% after reporting its Q2 results. The company reported an adjusted EPS of $2.12, marking a 34.2% increase compared with the same quarter last year, reflecting strong operational execution and margin improvement. Revenue came in at $5.2 billion, up 3.1% year-over-year, driven by growth across both its Signal and Power Solutions and Advanced Safety and User Experience segments.

On the bright side, APTV has outperformed its rival, Genuine Parts Company (GPC), which has dropped 1.7% over the past 52 weeks and has returned 19.5% on a YTD basis.

The stock has an overall consensus rating of “Moderate Buy” from 22 analysts covering the stock. Its mean price target of $87.82 implies an upswing potential of 5.7% from the prevailing market prices.