/Ametek%20Inc%20logo%20on%20building-by%20Eric%20Glenn%20via%20Shutterstock.jpg)

With a market cap of $43.3 billion, AMETEK, Inc. (AME) is a global industrial technology company specializing in electronic instruments and electromechanical devices, serving the aerospace, energy, medical, and industrial sectors.

Companies worth $10 billion or more are generally labeled as “large-cap” stocks, and AMETEK fits this criterion perfectly. The company benefits from operational efficiency, solid cash flow, and a broad global footprint, giving it resilience and long-term growth potential.

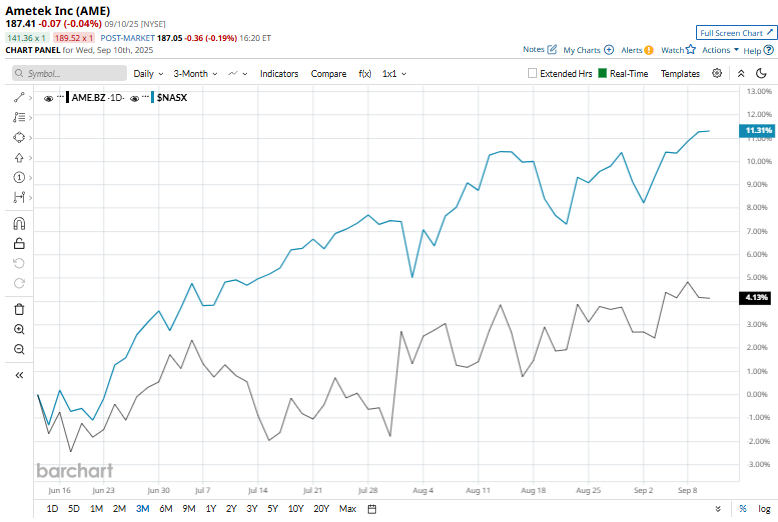

AMETEK stock has dropped 5.5% from its 52-week high of $198.33. Shares of AME have gained 4.2% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 11% rise over the same time frame.

Longer term, AME stock has declined marginally on a YTD basis, whereas $NASX has risen 13.3%. Moreover, shares of AMETEK have risen 4% over the past 52 weeks, lagging behind the $NASX’s 28.6% over the same time frame.

Despite some fluctuations, the stock has been trading above its 50-day and 200-day moving averages since early August, implying a recent uptrend.

On July 31, AMETEK shares rose 4.6% after the company delivered better-than-expected Q2 2025 results, reporting adjusted EPS of $1.78 and revenue of $1.8 billion. The Electromechanical Group led growth with a 6% year-over-year sales increase to $618.5 million, fueled by strong organic demand, record operating income, margin expansion, and contributions from the FARO Technologies acquisition.

Boosting confidence further, AMETEK raised its 2025 adjusted EPS guidance to $7.06–$7.20 and upgraded its annual sales growth outlook to the mid-single digits from its earlier low-single-digit forecast.

In contrast, rival Rockwell Automation, Inc. (ROK) has notably outpaced the AME stock. Shares of ROK have soared 29.5% over the past 52 weeks and gained 18.8% on a YTD basis.

The stock has a consensus rating of “Moderate Buy” from the 19 analysts covering it, and the mean price target of $207.94 implies an upswing of 11% from the current market prices.