/Allegion%20plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Dublin, Ireland-based Allegion plc (ALLE) is a global leader in security products and solutions, catering to both commercial and residential needs. With a market cap of $15.3 billion, the company specializes in locks, access control systems, and door hardware, offering innovative solutions under renowned brands like Schlage and Von Duprin.

Companies worth $10 billion or more are generally described as "large-cap stocks." Allegion fits right into that category, reflecting its significant presence and influence in the security and safety industry, providing cutting-edge products to enhance security worldwide.

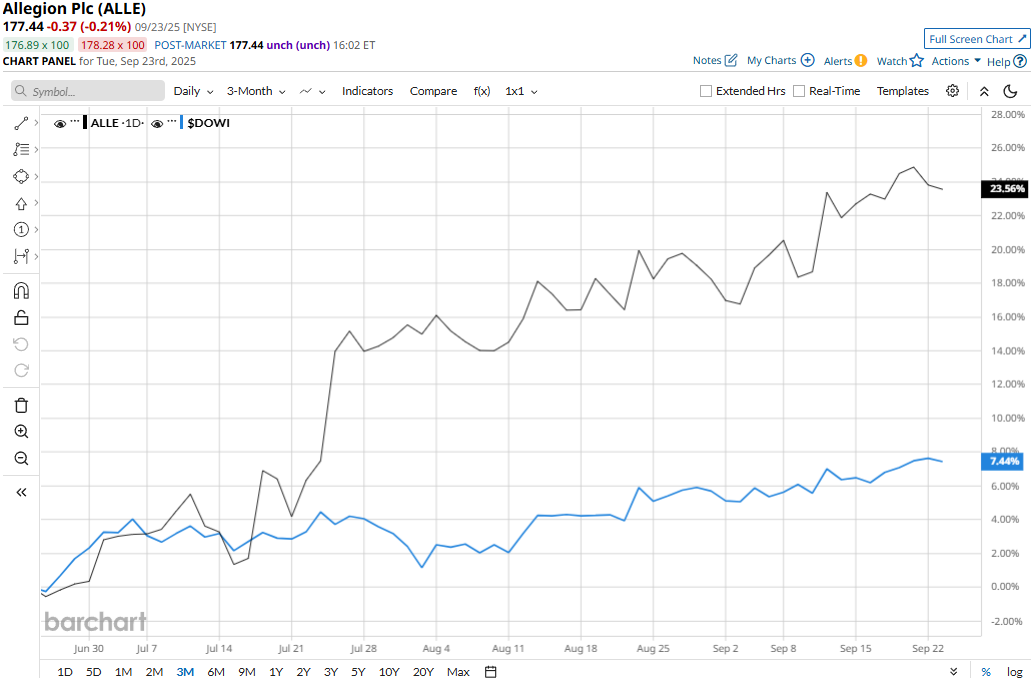

Allegion touched its all-time high of $180.34 on Sept. 19, and is currently trading 1.6% below that peak. Meanwhile, the stock has soared 24.6% over the past three months, notably outpacing the Dow Jones Industrial Average’s ($DOWI) 8.7% uptick during the same time frame.

Over the longer term, ALLE’s performance looks even more impressive. The stock has surged 35.8% on a YTD basis and 24.4% over the past 52 weeks, outperforming the Dow’s 8.8% gains in 2025 and 9.9% returns over the past year.

Further, ALLE has traded consistently above its 50-day and 200-day moving averages since late April, underscoring its uptrend.

Allegion’s stock prices soared 6% in a single trading session following the release of its solid Q2 results on Jul. 24. Driven by notable growth in volumes and realization, the company’s organic revenues increased by 3.2%. Further, its topline was also positively impacted by contributions from acquisitions and favorable currency movements. Overall, Allegion’s topline came in at $1.02 billion, up 5.8% year-over-year and 2% ahead of the Street’s expectations. Meanwhile, its adjusted EPS increased 4.1% year-over-year to $2.04, beating the consensus estimates by 2%, boosting investor confidence.

When compared to its peer, Allegion has notably outperformed ADT Inc.’s (ADT) 24.2% surge in 2025 and 17.5% gains over the past 52 weeks.

Among the 11 analysts covering the ALLE stock, the consensus rating is a “Moderate Buy.” As of writing, the stock is trading above its mean price target of $175.89.