With a market cap of $64.5 billion, Air Products and Chemicals, Inc. (APD) is a leading global provider of industrial gases, equipment, and related services. The company produces atmospheric gases such as oxygen, nitrogen, and argon, as well as process and specialty gases including hydrogen, helium, carbon dioxide, and syngas for a wide range of industries.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Air Products and Chemicals fits this criterion perfectly. In addition, it designs and manufactures advanced cryogenic and gas-processing equipment used in air separation, natural gas liquefaction, and hydrocarbon recovery.

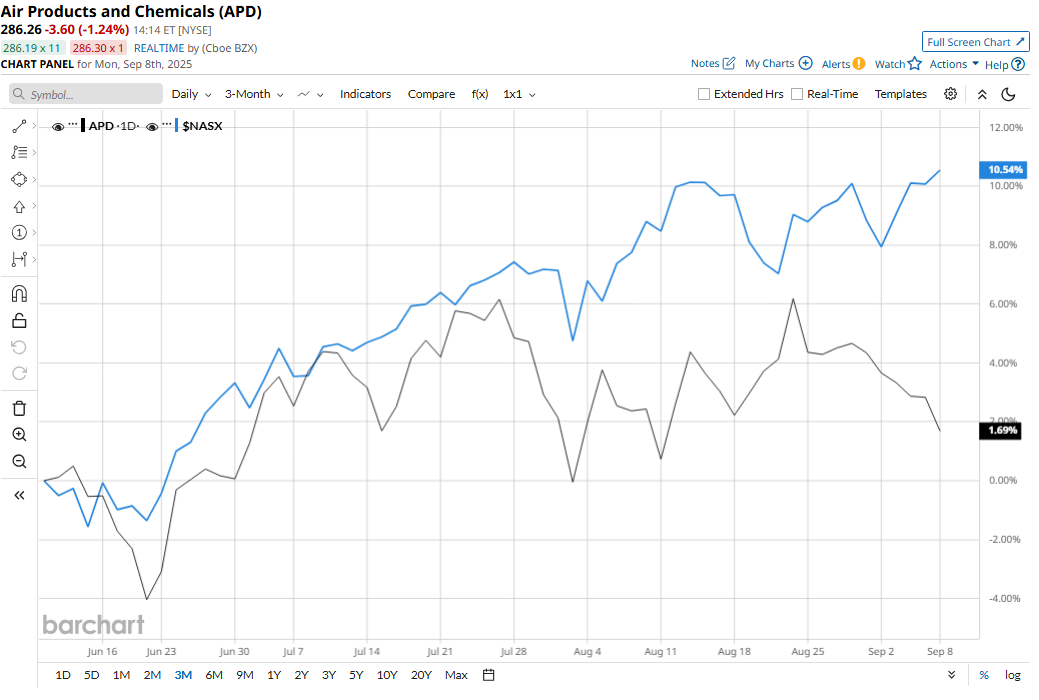

Despite this, shares of the Allentown, Pennsylvania-based company have declined 15.7% from its 52-week high of $341.14. APD stock has risen 2.8% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 11.7% increase over the same time frame.

In the longer term, shares of Air Products and Chemicals are down marginally on a YTD basis, lagging behind NASX’s nearly 13% gain. Moreover, shares of the company have increased over 7% over the past 52 weeks, compared to NASX’s 30.7% return over the same time frame.

Despite a few fluctuations, APD stock has been trading above its 50-day moving averages since June.

Despite beating expectations with Q3 2025 adjusted EPS of $3.09, Air Products’ stock fell marginally on Jul. 31 because the company issued a weaker outlook. Management projected Q4 EPS of $3.27–$3.47, below the Street’s estimate, and narrowed its fiscal 2025 guidance to $11.90 - $12.10. Investor sentiment was also weighed down by a 6% volume decline in the Americas, a 200 bps margin contraction to 29.7%, and ongoing headwinds from weak helium demand, project exits, and the impact of its prior LNG business sale.

In contrast, rival DuPont de Nemours, Inc. (DD) has outpaced APD stock on a YTD basis, rising 1% on a YTD basis. However, DD stock has dropped 2.7% over the past 52 weeks, lagging behind APD stock.

Despite the stock’s underperformance relative to the Nasdaq, analysts remain moderately optimistic on Air Products and Chemicals. The stock has a consensus rating of “Moderate Buy” from 23 analysts in coverage, and the mean price target of $323.55 is a premium of nearly 13% to current levels.