The AES Corporation (AES), headquartered in Arlington, Virginia, is a global energy company committed to shaping the future of clean, reliable, and accessible power. With operations spanning multiple continents, AES builds, owns, and operates a diversified portfolio of generation, utilities, renewables, energy storage, and transmission infrastructure.

Its sharp focus on innovation is helping industries, communities, and governments make the energy transition in more sustainable ways. AES has a market capitalization of $9.3 billion, reflecting its scale and ambition in the challenging but increasingly vital energy sector.

Companies with a valuation between $2 billion and $10 billion are typically labeled “mid-cap stocks.” AES neatly falls into this group, indicating a meaningful scale and strong influence within the diversified utilities sector.

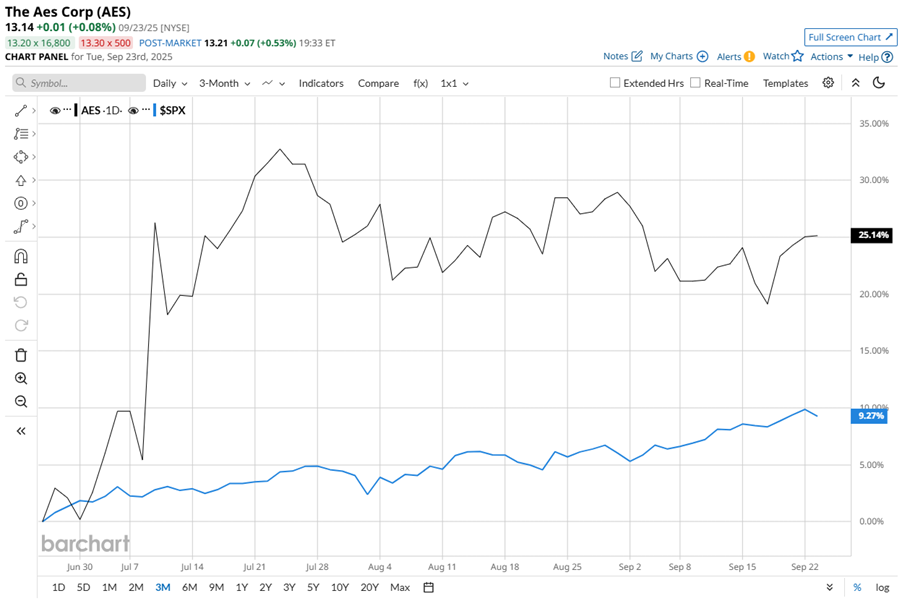

Despite its prominence, the stock is down by 35.3% from its 52-week high of $20.30, achieved last year. However, shares of AES have gained 29.5% over the past three months, outpacing the broader S&P 500 Index’s ($SPX) gains of around 10.5% during the same period.

Longer term, AES is up just 2.1% on a year-to-date (YTD) basis, lagging behind SPX’s 13.2% gains. Meanwhile, the stock has declined 32% over the past 52 weeks, compared to SPX’s 16.4% returns over the same time frame.

AES has spent much of the past year under pressure, trading below both its 50-day and 200-day moving averages. Recently, however, the stock has shown signs of strength – moving above the 200-day since mid-July and the 50-day since early July, albeit with some fluctuations.

Over the past year, AES stock has experienced a significant decline, as investor confidence waned and financial pressures mounted with weakening revenues, concerns over high debt levels, and regulatory or policy headwinds affecting clean-energy incentives.

However, in more recent months, the stock has shown signs of recovery, delivering positive returns, suggesting that market sentiment is beginning to turn more favorable.

Its rival, Sempra (SRE), has declined 1.9% in 2025, underperforming AES but it has surged 2.4% over the past year, performing better compared to AES.

Meanwhile, analysts are cautiously optimistic about AES. Out of the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” Its mean price target of $14.30 suggests an 8.8% upside potential from current price levels.