/Adobe%20Inc%20logo%20on%20phone%20on%20desk-by%20Tattoboo%20via%20Shutterstock.jpg)

With a market cap of $151.3 billion, Adobe Inc. (ADBE) is one of the world’s largest software companies. The company operates through three core segments: Digital Media; Digital Experience; and Publishing and Advertising, delivering solutions that empower individuals and enterprises to create, manage, and optimize digital content.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Adobe fits this criterion perfectly. Its flagship offerings, including Creative Cloud and Document Cloud, drive the majority of revenue through subscription and licensing models, serving a wide range of creative professionals, businesses, and consumers worldwide.

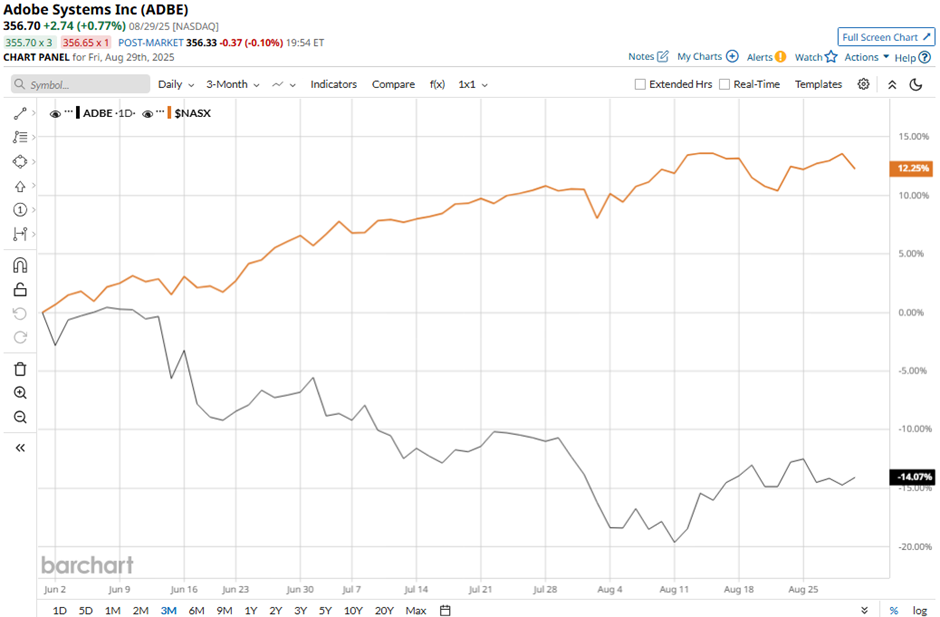

Despite this, shares of the San Jose, California-based company have declined 39.3% from its 52-week high of $587.75. ADBE stock has decreased 13.7% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 11.9% rise over the same time frame.

In the longer term, Adobe stock is down 19.8% on a YTD basis, underperforming NASX’s 11.1% gain. Moreover, shares of the software maker have dropped 36.4% over the past 52 weeks, compared to NASX’s 22.2% return over the same time frame.

Despite recent fluctuations, the stock has been trading mostly below its 50-day and 200-day moving averages since last year.

Despite beating expectations with Q2 2025 adjusted EPS of $5.06 and revenue of $5.9 billion, Adobe’s shares fell 5.3% the next day. Investors grew cautious as concerns mounted that the company’s AI integration such as Firefly with OpenAI and Google models, would take longer to generate meaningful returns, despite management raising full-year revenue guidance to $23.5 billion - $23.6 billion.

Moreover, ADBE stock has significantly underperformed its rival Automatic Data Processing, Inc. (ADP). ADP stock has gained 11.5% over the past 52 weeks and 3.9% on a YTD basis.

Despite the stock’s weak performance, analysts remain moderately optimistic on Adobe. The stock has a consensus rating of “Moderate Buy” from 36 analysts in coverage, and the mean price target of $485.39 is a premium of 36.1% to current levels.