With a market cap of $29.6 billion, Iron Mountain Incorporated (IRM) is a global leader in storage and information management solutions, serving more than 240,000 customers across 61 countries. The company helps organizations securely manage their physical and digital assets through services spanning records management, data management, digital transformation, data centers, secure shredding, and IT asset disposition.

Companies valued $10 billion or more are generally considered “large-cap” stocks, and Iron Mountain fits this criterion perfectly. With a strong focus on security, sustainability, and innovation, Iron Mountain enables businesses to protect information, reduce costs, ensure compliance, and unlock greater value from its assets.

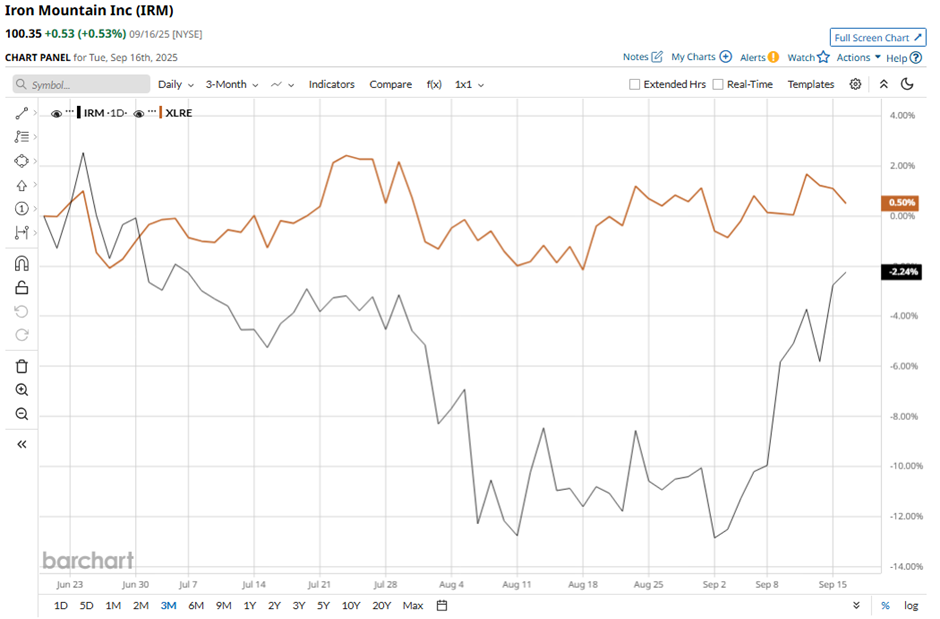

Despite this, shares of the Boston, Massachusetts-based company have dipped nearly 23% from its 52-week high of $130.24. IRM stock has decreased 1.7% over the past three months, lagging behind the Real Estate Select Sector SPDR Fund’s (XLRE) over 1% rise during the same period.

Longer term, Iron Mountain’s shares have fallen 4.5% on a YTD basis, underperforming XLRE's 3.7% gain. Moreover, the stock has declined 15.1% over the past 52 weeks, compared to XLRE's 6.3% drop over the same time frame.

Despite recent fluctuations, IRM stock has been trading below its 200-day moving average since early February.

Shares of Iron Mountain fell 5.8% on Aug. 6 despite record Q2 2025 revenue of $1.7 billion, adjusted EBITDA of $628 million, and AFFO per share of $1.24, as investors focused on weaker bottom-line results. The company posted a net loss of $43 million, compared with net income of $35 million a year earlier, driven largely by foreign exchange losses on intercompany balances.

In contrast, its rival SBA Communications Corporation (SBAC) has shown less pronounced decline than IRM stock on a YTD basis, falling 2.3%. However, SBAC stock has decreased 18.7% over the past 52 weeks, lagging behind IRM’s performance during the same period.

Despite the stock’s underperformance, analysts are moderately optimistic, with a consensus rating of "Moderate Buy" from 10 analysts. The mean price target of $115 represents a premium of 14.6% to current levels.