As the artificial intelligence (AI) boom continues to reshape industries, there has also been some attention on the companies that form the foundational infrastructure for powering AI, apart from the immediate buzz of AI chipmakers.

Top ‘AI Utility’ Picks Powering: IREN, NBIS

Shay Boloor, the chief market strategist at Futurum Equities, highlights that the “next wave of the AI trade’s industrial,” identifying companies like IREN Ltd. (NASDAQ:IREN) and Nebius Group NV (NASDAQ:NBIS) as prime “AI Utility” picks poised for significant growth.

Boloor emphasizes that while names like IREN and NBIS have already seen substantial movement, they remain compelling buys. “You gotta think about who is building a grid that can actually run on every new data center, every GPU cluster, every additional megawatts of power,” Boloor explained, underscoring what he calls the “AI utility theme.”

This surging demand isn’t speculative; it’s being “locked in through multi-year contracts from all these hyperscalers – Amazon, Microsoft, and Google.”

NBIS Runs ‘Most Efficient’ Cooling Systems

Digging into his specific picks, Boloor points to the unique advantages of NBIS. The company, he notes, has secured significant deals, including a “17 billion with Azure.”

NBIS stands out for running “some of the most efficient cooling systems in the world” and controlling operations “from hardware design to power sourcing,” making it a critical player in the high-density computing environment AI demands.

IREN Has The ‘Cheapest Renewable Power’

IREN, another key “AI Utility,” earns Boloor’s conviction for its access to remarkably inexpensive power. “They also run the cheapest renewable power in the world,” he stated, highlighting costs as low as “three and a half cents per kilowatt an hour.”

Furthermore, IREN is deeply integrated with the cutting-edge of AI hardware, running “tens of thousands of NVIDIA H100 class GPUs” and partnering “directly with NVIDIA on their liquid cooling rack design.”

This strategic positioning at the intersection of cheap, sustainable power and advanced cooling solutions makes IREN indispensable to the escalating demands of AI.

Diversified Portfolio On How To Invest In AI’s Insatiable Thirst For Power

Boloor’s insights come amidst projections that global data center AI power demand is set to quadruple within the next decade, reaching an astonishing 1,500 terawatt-hours by 2034.

Boloor’s comprehensive outlook extends beyond just these two companies, painting a broader picture of investment opportunities across the entire energy supply chain needed to support AI’s exponential growth.

He identifies critical roles for battery storage firms like Tesla Inc. (NASDAQ:TSLA) and Eos Energy Enterprises Inc. (NASDAQ:EOSE) to stabilize grids, nuclear energy providers such as Oklo Inc. (NYSE:OKLO), Nuscale Power Corp. (NYSE:SMR), and Constellation Energy Corp. (NASDAQ:CEG) for clean baseload power.

Also, transmission companies like Vistra Corp. (NYSE:VST) and South Jersey Industries for expanding the grid. Natural gas and renewables are also cited as crucial components in his diversified “AI Power” portfolio.

Price Action

Shares of IREN jumped 5.09% in premarket on Monday. It was up 471.41% on a year-to-date basis and 600.70% over the year.

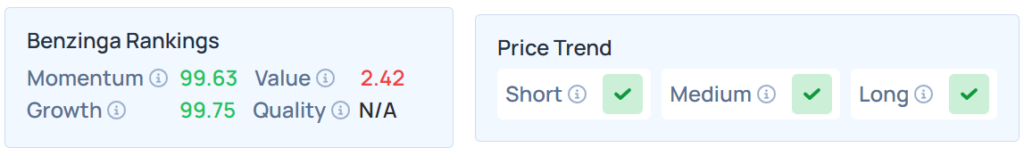

Benzinga’s Edge Stock Rankings indicate that IREN maintains a stronger price trend over the short, medium, and long terms, with a robust growth ranking. Additional performance details are available here.

Meanwhile, Nebius was up 3.60% in premarket, with a 324.71% YTD return and 547.90% over the year.

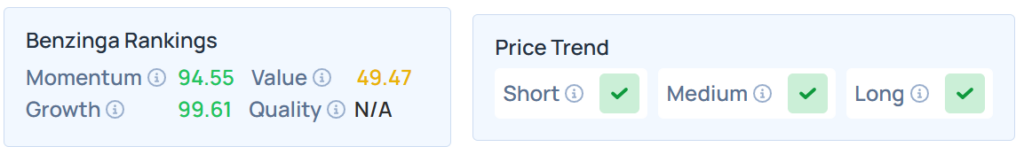

NBIS maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

On Friday, the S&P 500 index ended 2.71% lower at 6,552.51, whereas the Nasdaq 100 index declined 3.49% to 24,221.75. Dow Jones also tumbled 1.90% to 45,479.60.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher on Monday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.