/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

IonQ (IONQ) shares are in focus at the time of writing after the company based out of College Park, Maryland announced a major technical breakthrough, achieving 99.99% two-qubit gate fidelity.

IONQ is now the world’s only quantum technology company to have achieved that milestone. The news arrives only weeks after it completed its $1.07 billion acquisition of Oxford Ionics.

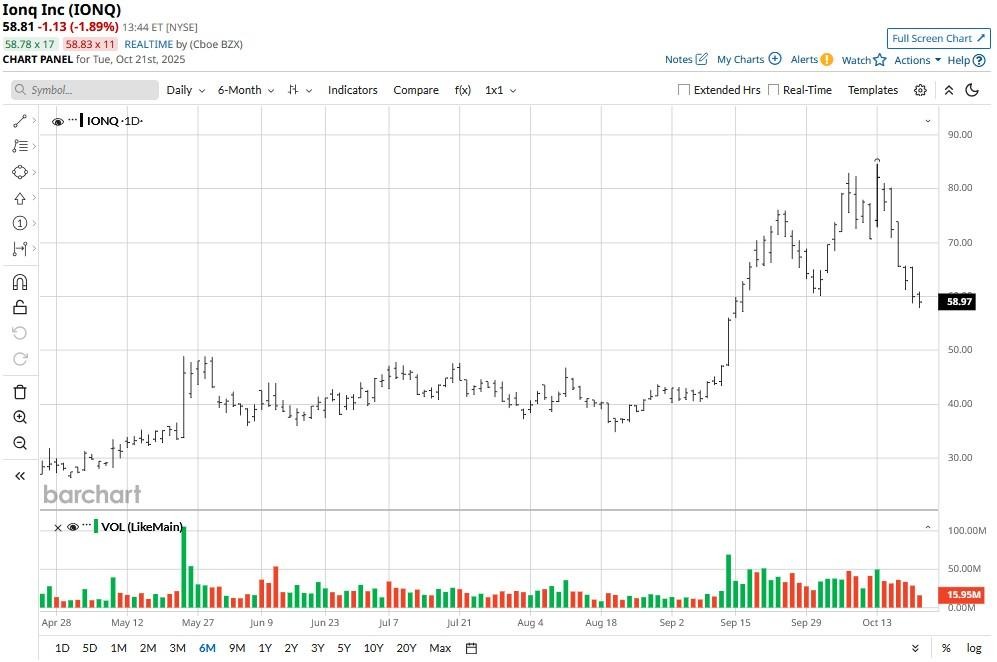

That said, IonQ stock is currently down over 30% versus its year-to-date high set on Oct. 13.

Could This World Record Drive the IonQ Stock Price Higher?

Crossing the “four-nines” fidelity threshold isn’t just a technical flex, it’s a significant leap toward commercial viability.

Higher gate fidelity means fewer errors, enabling more complex quantum algorithms and reducing the cost of scaling systems. IONQ’s proprietary Electronic Qubit Control (EQC) tech played a key role in this achievement, replacing traditional laser-based control with precision electronics.

Niccolo de Masi – the chief executive of the quantum computing company – called it “ a watershed moment,” noting this level of performance brings fault-tolerant quantum systems closer to real-world deployment.

For IonQ shares’ investors, this signals the NYSE-listed firm isn’t just innovating, it’s accelerating toward dominance.

IONQ Shares Remain Speculative But Attractive

While quantum computing more broadly remains speculative at best, IONQ’s strategic acquisitions and technical momentum makes it a top pick within this sub-sector of technology.

The company’s recent Oxford Ionics deal adds patented ion trap innovations and a United Kingdom footprint, bolstering its global reach.

With plans to demonstrate 256-qubit systems in 2026 and a roadmap to scale to millions of qubits by 2030, IonQ is positioning itself as a foundational player in quantum infrastructure.

While profitability remain distant, expanded partnerships, IP portfolio, and performance milestone make IONQ stock attractive for those interested in betting on a big future for quantum computing.

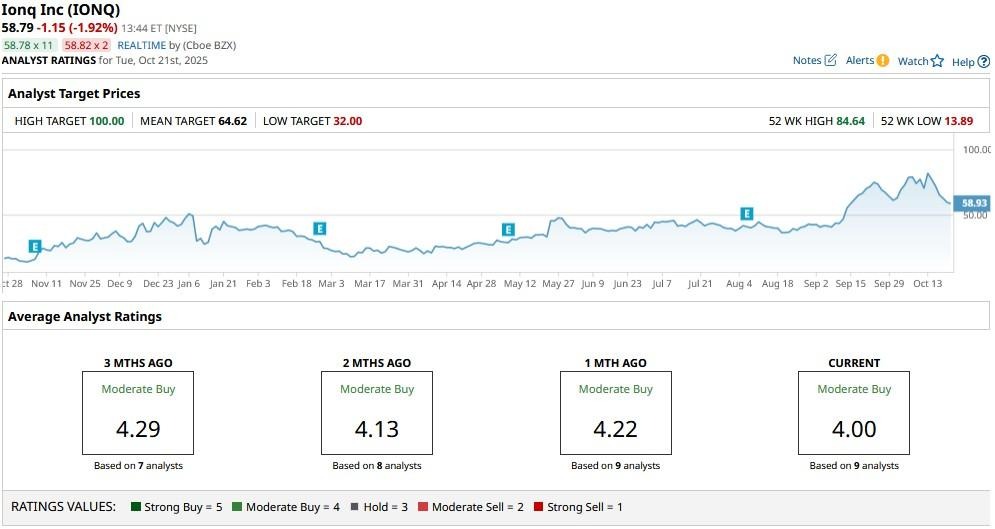

Wall Street Sees Massive Further Upside in IonQ

At a price-sales (P/S) multiple of more than 400x, IonQ shares aren’t inexpensive to own by any stretch of the imagination.

But the aforementioned reasons have Wall Street sticking with its consensus “Moderate Buy” rating on IONQ stock with price targets going as high as $100, indicating potential upside of another 65% from here.