/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Palantir (PLTR) remains in focus this morning after its artificial intelligence (AI) peer MongoDB (MDB) said its cloud-native platform Atlas grew 29% on a year-over-year basis in its fiscal Q2.

Investors are cheering the MDB announcement primarily because it signals continued demand for AI data infrastructure, a core competency for Denver-headquartered PLTR.

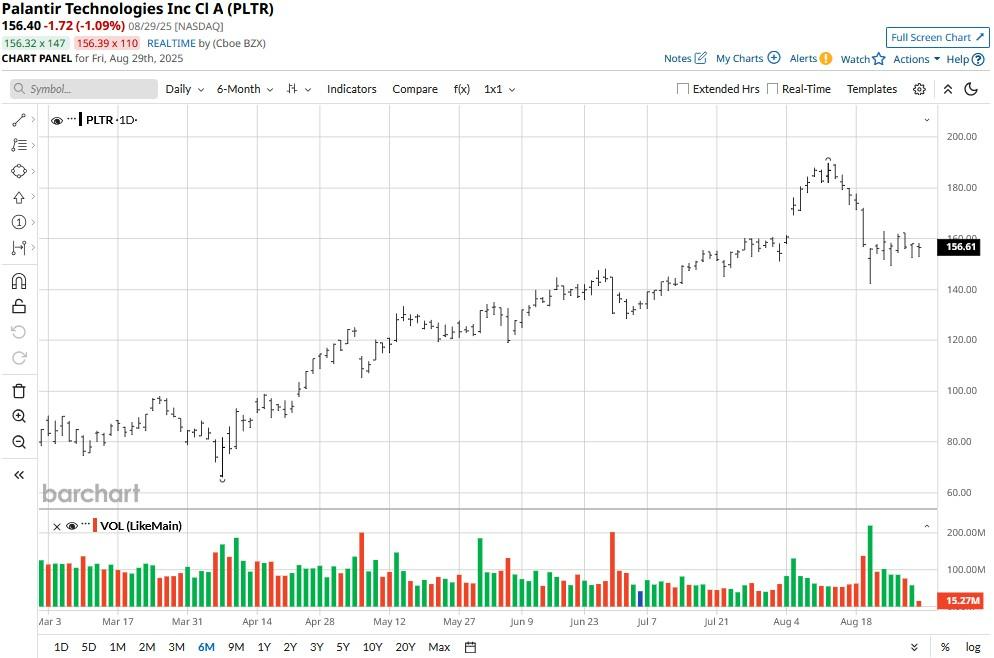

Valuation concerns triggered a significant pullback in Palantir stock this month. However, the data analytics specialist remains up more than 140% versus its April low.

Why MongoDB Earnings Bode Well for Palantir Stock

MongoDB recording exceptional growth in Atlas revenue indicates surging enterprise demand for scalable AI data infrastructure, a home ground for PLTR through platforms like Foundry and AIP.

MDB earnings validate the broader market appetite for AI-native solutions, suggesting Palantir’s offerings are well-positioned for accelerated adoption ahead.

As investors continue to reward names with real AI traction, MDB’s momentum acts as a bullish proxy for PLTR stock, reinforcing its relevance in mission-critical data environments.

Since Palantir’s commercial growth is already accelerating, MongoDB’s beat could foreshadow upside in PLTR’s next earnings cycle, making it a timely play on the AI infrastructure boom.

James Cakmak Recommends a Small Position in PLTR Shares

Despite an explosive rally in Palantir shares over the past four months, seasoned equity research analyst James Cakmak remains bullish on them as a core long-term holding.

Palantir is “a company that will permeate every single aspect of corporations around the world,” he told CNBC in a recent interview.

However, the market expert believes valuation is a legit concern for PLTR shares at the $160 level, which is why “you have to own it, but at smaller size than what it would have been, call it 6 months ago.”

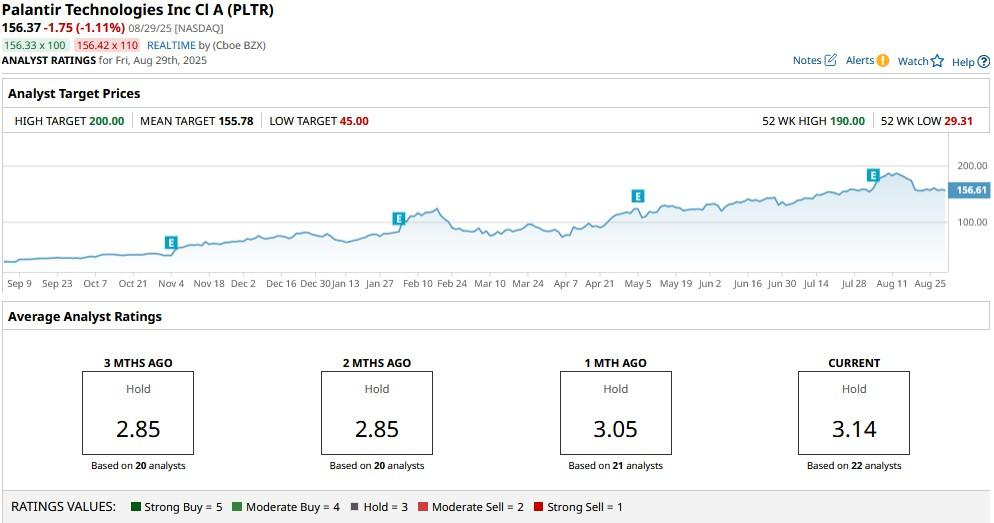

Wall Street Remains Cautious on Palantir Technologies

Wall Street analysts also recommend caution in initiating a position in Palantir shares at the current price.

According to Barchart, the consensus rating on PLTR stock currently sits at “Hold” only, with the mean target of roughly $156 indicating a lack of expected further upside from here.