With a market cap of $18.8 billion, International Flavors & Fragrances Inc. (IFF) is a global leader in high-value ingredients and solutions serving the food and beverage, health and wellness, home and personal care, and pharmaceutical markets. Operating through four main business units: Nourish; Scent; Health & Biosciences;, and Pharma Solutions, IFF delivers innovative, biotechnology-driven products across a broad range of applications worldwide.

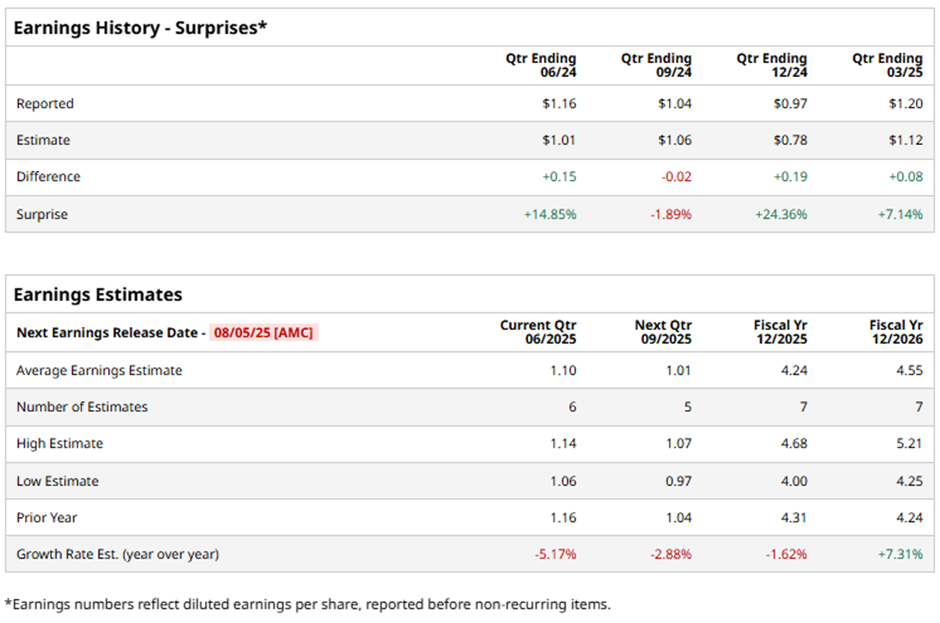

The New York-based company is slated to announce its fiscal Q2 2025 earnings results after the market closes on Tuesday, Aug. 5. Ahead of this event, analysts expect IFF to report an adjusted EPS of $1.10, a 5.2% decline from $1.16 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the ingredients producer to report adjusted EPS of $4.24, marking a decrease of 1.6% from $4.31 in fiscal 2024. However, adjusted EPS is anticipated to grow 7.3% year-over-year to $4.55 in fiscal 2026.

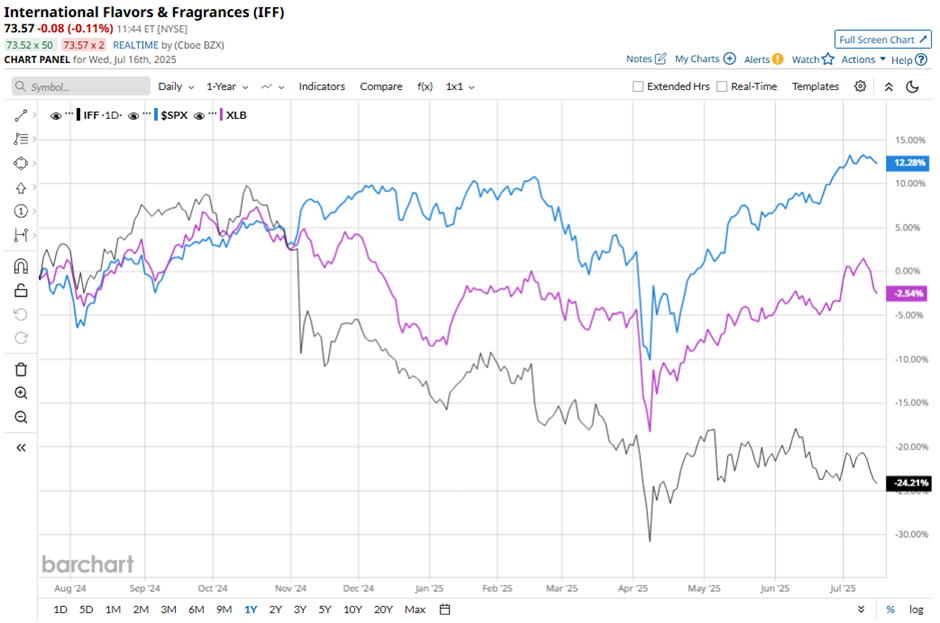

Over the past 52 weeks, shares of IFF have dropped 24.8%, underperforming the broader S&P 500 Index's ($SPX) 10.3% gain and the Materials Select Sector SPDR Fund's (XLB) 3.5% decline over the same time frame.

Despite beating Q1 2025 estimates with adjusted EPS of $1.20 and revenue of $2.8 billion on May 6, IFF shares fell 7.1% the next day. The company reported a steep GAAP loss of $3.98 per share due to one-time items, and Food Ingredients, a key unit of the newly split Nourish segment, saw a 7% sales decline. Additionally, the Health & Biosciences segment delivered flat EBITDA at $138 million, missing the expectation, and the Scent segment saw a 14.3% drop in EBITDA.

Analysts' consensus view on IFF stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, 13 suggest a "Strong Buy," two give a "Moderate Buy," three recommend a "Hold," and one has a "Strong Sell" rating. As of writing, the stock is trading below the average analyst price target of $89.53.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.