The Bank of England has voted to hold interest rates at 4.25 per cent, as they attempt to balance higher inflation and the need to stimulate economic growth.

Rates have been declining since hitting a high of 5.25 per cent, with the most recent cut coming in May, but a series of factors have meant back-to-back cuts were improbable. Along with inflation still remaining at 3.4 per cent last month, the prospect of rising oil prices and wider economic uncertainty through trade tariffs meant the Monetary Policy Committee voted 6-3 in favour of holding rates this time around.

While the immediate impact of maintaining interest rates means savers will benefit from higher returns on their money for longer, those with mortgages or other debt are left to wait to benefit from lower repayments.

The Independent brings you the latest reaction to the interest rates decision along with business news and stock market updates on Thursday.

Interest rates and live business news

- Federal Reserve opted to hold US interest rates last night

- FTS lower after Asian stocks fall overnight

- Amazon tells staff AI will take some of their jobs

- Global interest rate decisions ahead of BoE meeting

- CONFIRMED: Bank of England holds interest rates at 4.25 per cent

Business news live

16:35 , Karl MatchettThat’s it from us today, we’ll be back as usual tomorrow morning from early on.

No major economic data to worry about for one day at least...we’ll see what the geopolitics throws our way though, and the US stock markets will be back open too.

See you then!

Business news live - Thursday

Wednesday 18 June 2025 15:48 , Karl MatchettGood morning and welcome to The Independent’s live business news coverage for Thursday.

As usual we’ll bring you all the stock market reaction to the day and the big lines from the world of UK plc and beyond.

Our primary focus leading toward lunchtime, however, is the Bank of England’s meeting on interest rates.

Interest rates - live

07:04 , Karl MatchettThe Bank of England’s MPC will be meeting and announcing their interest rates decision at 12 noon today.

The expectation is that they hold firm at 4.25 per cent, but there’s at least some case to be made for guidance on what comes next.

Oil prices rising and inflation sticking higher than expected are both reasons to keep the rate high - or even to raise it to 4.5 per cent again, in the eyes of some.

But slowing wage growth, unemployment rising and the economy all but flatlining are all key issues that the BoE must balance out as to when they can cut interest rates once more.

Business news live - Thursday

07:20 , Karl MatchettAll eyes will be on the Monetary Policy Committee (MPC) and whether its members opt to continue lowering rates.

The base rate - currently at 4.25 per cent following cuts in February and May - impacts consumers and taxpayers through everything from their mortgages to savings, so what do experts foresee both next week and beyond?

Will interest rates be cut tomorrow? Key factors and 2025 predictions

Interest rates - live

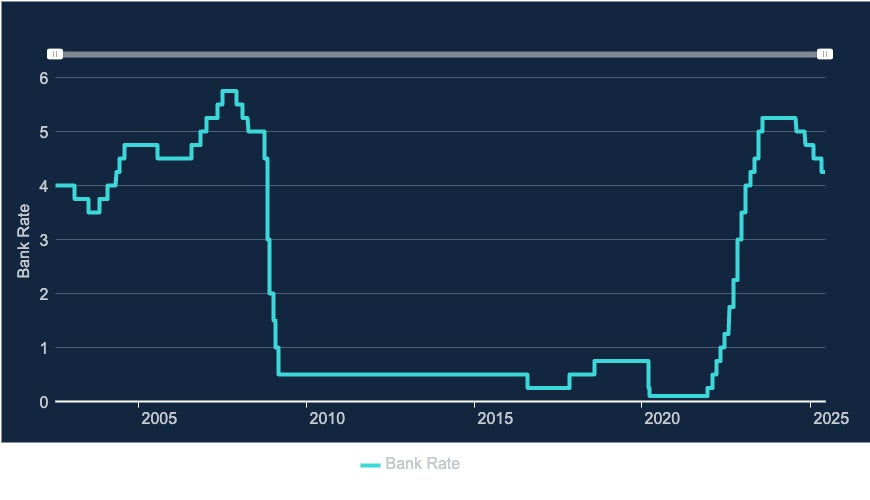

07:33 , Karl MatchettHere’s a chart of how the interest rate has changed over the past few years.

The post-financial crash years were extremely low - cheap money for all, basically.

But a huge rise in inflation - through energy costs and more - from 2022 saw the rate pushed as high as 5.25 per cent, before now slowly decreasing again.

UK inflation rate holds as air fares and fuel prices decrease – but risk remains

07:42 , Karl MatchettIf you missed it yesterday: UK inflation has held at a higher than expected rate after air fares and motor fuel dropped in price.

The Office for National Statistics said that its key measure of inflation, the consumer prices index, was 3.4 per cent in May - having also been 3.4 per cent after revised figures in April, its highest level for more than a year.

Inflation in the UK had been dropping, having reached a high of 11.1 per cent in October 2022. A rise for April was expected due to raised labour costs, rising energy bills and changes to social housing costs, among other factors. But the leap was above the expected figure and led Chancellor Rachel Reeves to acknowledge disappointment at the rise.

A drop in some areas for May will therefore be taken as a limited positive, though inflation remains some distance above the Bank of England’s government-mandated 2 per cent target.

While fuel dropped for May, food prices increased to the highest rate in 12 months, while household goods also went up.

UK inflation rate holds as air fares and fuel prices decrease – but risk remains

Vodafone appoint CFO from Microsoft

07:54 , Karl MatchettVodafone have been on a turnaround plan which shows signs of working in several areas, with debt reduced, growth in Africa and the UK merger with Three now complete.

They have now announced Pilar Lopez will be their new CFO, incoming from Microsoft where she is COO for Western Europe, having previously worked at Spanish telecomms company Telefonica.

Additionally, she sits as a non-executive director at Inditex, the firm which owns Zara, Massimo Dutti, Stradivarius and the like.

Ms Lopez will replace Luka Mucic, who is heading to a German DAX-listed company in November.

Stock market watch: Asia falls overnight

08:06 , Karl MatchettAfter US stocks finished pretty much flat yesterday, shares in Asia dropped considerably overnight.

The Shanghai Composite (-0.8 per cent), the Nikkei 225 (-1.0pc) and the Hang Seng (-2.0pc) all suffered outflows.

Early futures are all showing broader drops for the US markets ahead of trading later today, with the Nasdaq 0.4pc down and the S&P 500 down by a third of a per cent in pre-trading.

Fed hold US interest rates steady

08:15 , Karl MatchettWhile the BoE’s decision lies ahead, last night the US decision-maker, the Federal Reserve, made their own call and opted to sit tight.

After the Fed held interest rates to 4.25-4.50 per cent, Quilter’s investment strategist Lindsay James explained the factors at stake and why it’s set to irk President Trump.

“Amidst the geopolitical and economic chaos, the Federal Reserve has opted to keep its foot off the pedal and continue to hold rates. The move - or lack thereof - seemed inevitable given President Trump’s tariffs are still yet to be finalised but look likely to weigh further on the economy in the coming months, particularly as the 90 day pause nears its end, and the turmoil in the Middle East remains unpredictable.

“In the March release of the policy makers' dot plot, two more rate cuts were anticipated this year. Now, while the median remains the same for 2025, it seems progress towards lower interest rates could slow even more as policy makers were split over whether there would be no cuts or even as many as three. The Fed's ‘slow and steady’ approach could spark further tension with Donald Trump, whose pressure to cut rates has had little effect.”

FTSE 100 opens down

08:33 , Karl MatchettConsidering domestic inflation data, overall investor caution and everything going on with Iran, the US and beyond, perhaps not surprising the FTSE is down this morning.

The 100 is down 0.4 per cent in early trading, with the 250 down 0.72 per cent.

In Europe it’s a similar story:

German DAX: -0.6 per cent

French CAC 40: -0.65 per cent

Euronext 100: -0.5 per cent.

Swiss central bank warns of uncertain global economy

08:40 , Karl MatchettThe Swiss National Bank has highlighted major risks to the global economic outlook, including high public debt, geopolitical tensions and a stretched US stock market.

“Several risk factors could amplify the impact of potential negative shocks on global economic and financial conditions,” the SNB said in its 2025 Financial Stability Report.

The central bank has urged higher regulatory systems and backed proposals by the Swiss government to prevent future banking crises.

UK interest rates vs inflation

08:58 , Karl MatchettTime for a quick look ahead - the Bank of England will be announcing in about three hours their latest interest rates plan, so here’s how factors come together to make that call.

Inflation remained higher than expected for May when data came out yesterday.

The aim is for a 2 per cent inflation rate, and we’re way above that for now, which is a push for the BoE to keep interest rates higher.

Higher interest rates are an incentive for businesses to make fewer investments in projects or hiring, which in turn lowers wage growth or jobs, which means less spending power for people, lower demand and thus helps to stem price rises...which is, basically, inflation.

However - the government really want a growing economy, and for that businesses need lower interest rates to encourage them to produce, spend and hire more.

That’s a big ongoing battle right now.

But slowing wage growth, rising unemployment rate, the potential for the price of oil to surge due to the situation in Iran right now and other geopolitical forces are all also pulling and pushing inflationary or deflationary forces all the time.

The BoE must balance all this, and decide the course of action to take every few weeks - including today.

Waitrose announces new supermarket plans and store upgrades in huge expansion

09:20 , Karl MatchettWaitrose is set to open its first full-size supermarket in seven years as part of a multi-million-pound expansion plan.

The new 30,000 square foot store, located in Brabazon, a new town in North Bristol, is anticipated to open its doors in 2027.

The move follows a multi-million-pound agreement by parent company the John Lewis Partnership, signalling a renewed focus on larger retail formats.

Developed in partnership with YTL Developments, the new supermarket is expected to create approximately 150 jobs in the area.

Full details:

Business news latest - quick hits

09:37 , Karl Matchett- Mike Ashley has pulled out of an approach to buy Revolution Beauty, a week after announcing the consideration of an all-cash bid. Ashley’s company Frasers are the biggest shareholder in Boohoo (now Debenhams), which in turn is the biggest shareholder in Revolution.

- The Telegraph are reporting Shein facing an investigation over dodged taxes in the UK.

- And the boss of OpenAI has accused Meta of trying to buy top staff with $100m signing on bonuses.

Oil prices continue to rise ahead of interest rates call

10:04 , Karl MatchettA key consideration for the Bank of England ahead of today’s interest rates announcement will be oil prices.

Figures yesterday showed lower fuel and air fares were among the factors leading to very marginal lower overall inflation, but since May the price of oil has risen significantly.

Israel-Iran tensions and the prospect of the possible closure of a key shipping route has seen Brent Crude rise to almost $77 - it’s up 0.23 per cent today, with Crude Oil also up 0.59 per cent to $75.58.

Over the last two months those prices have been around the low-to-mid 60s.

Higher oil prices tend to lead to higher inflation down the line.

AIM at 30 - with more to come?

10:15 , Karl MatchettAs AIM turns 30, Nicholas Hyett, investment manager at Wealth Club, has some thoughts over reasons to be positive about its future:

- Increasing listed companies in the coming years

- Inheritance tax benefits (for now)

- The end of US exceptionalism

- Valuations suggestion potential 40% gains over the next few years

- The fact departures should broadly be welcomed

While AIM has its detractors and certainly has seen many businesses leave and not be replaced, Mr Hyett points to the positives.

“One of the reasons AIM, and the UK more generally, has struggled is that valuations for UK listed companies are so much lower than in the US,” he said.

“That could be changing, recent months have seen the value of US companies fall slightly versus the rest of the world – suddenly the UK isn’t a bargain basement anymore. Companies staying around longer means more opportunity for UK investors to benefit from their growth.

“AIM’s IHT benefits have been a major source of discussion, and yes they’ve been halved in the last 12 months. Nonetheless, as things stand, AIM shares remain the only way to reduce the inheritance tax due on your ISA – often someone’s largest asset outside their home and pensions and potentially a source of a lot of death duties.”

Pound climbs against dollar ahead of interest rates call

10:24 , Karl MatchettIvo Mertens, Chief Economist at iBanFirst, has detailed currency movements ahead of the Bank of England’s interest rate decision.

The US dollar continues to weaken and wider geopolitical influences could impact going forward.

“As the Bank of England meet once again to make a rates decision, the euro continues its rise against a dollar weakened by trade and geopolitical uncertainties, and general investor anxiety as Trump’s 90-day truce draws closer,” he said.

“EUR/USD has extended its rally, recently hitting a new high at 1.1632, while GBP/USD climbed to 1.3634.

“While markets expect a status quo from the Bank of England, the hawkish stance taken by the ECB could continue to support the single currency. Although rising energy prices linked to the Israel-Iran conflict and U.S. immigration policy could influence inflation and rate expectations.

“If markets start to factor in these dynamics, it could lead to a rebound in U.S. interest rates. In that context, only a spike in inflation or a flare-up in geopolitical tensions that triggers safe-haven flows may support the dollar in the medium term. For now, however, the downward trend for the greenback appears firmly in place.”

Interest rates affect many things for many of us, primarily when it comes to savings and mortgages.

Harriet Guevara, chief savings officer at Nottingham Building Society, explains why whatever happens today, it’s important to periodically check in on your overall financial situation and make sure your products are the right ones for your needs.

“Whether or not the base rate moves this week, we do expect further cuts by the end of the year. Therefore, this remains an important moment for savers to review their options."

“Cash ISAs remain a powerful tool, especially with rates still relatively strong on both easy access and fixed-rate options. And with speculation that future rule changes may reduce how much of your £20,000 annual ISA allowance can be held in cash, it makes sense to take advantage of the current structure while you still can.

“On the mortgage side, it’s worth remembering that base rate decisions also shape the cost of borrowing. While we may not see movement this month, future cuts could bring opportunities for borrowers, especially for those coming off fixed deals, to explore more affordable options later this year.

“In the meantime, it’s important to stay informed, review your products regularly, and be ready to act when the time is right.

“Whether it’s for short-term savings or long-term plans, reviewing your accounts now and considering a Cash ISA could help maximise returns before rates start to fall, and before any potential restrictions on tax-free cash saving are introduced.”

To that, we’ll add: you should also consider an investment ISA, if you don’t already have one and are in a position to add even a small amount a month to it.

Over the long term, investing can produce greater returns than just cash savings - but you should always have a cash pile accessible too.

Amazon tells 1.5m staff that AI will replace ‘some of their jobs’ — but won’t say how many

10:48 , Karl MatchettAmazon bosses have told staff that some employees will lose their jobs over the coming years as they step up the use of Artificial Intelligence.

The company employs around 1.5m people around the world, with more than 60,000 estimated to be working in the UK.

A memo from chief executive Andy Jassy to staff did not clarify the number of roles which would be handed over to AI control, but said there would be an inevitable change over what work would be carried out by people and what could be left to agentic AI.

More here:

Amazon tells staff that AI will replace ‘some of their jobs’ — but won’t say how many

Could interest rates be put back up?

11:03 , Karl MatchettWe’ve already explored how the expectation is for interest rates to be held today and cut in future.

But much of that is based on what was happening over the past few months, not the escalations we’ve seen this month.

Could they in fact go back up? Maybe not today - but don’t rule it out in future.

“Central banks are in a ‘wait and see’ mood with regards to interest rates, despite broad concerns about a weaker economic outlook,” says Russ Mould, investment director at AJ Bell.

“The Fed kept US rates unchanged at its meeting yesterday and the Bank of England is expected to do the same with UK rates later today.

“[Investor] markets have plenty of other things to focus on, namely the Middle East conflict which shows no sign of easing.

“Oil prices have shot up in recent days and any disruptions to Middle East supplies could put them even higher and stoke inflation.

“Remember that central banks fight inflation by putting up interest rates, not cutting them, which muddies the water in terms of trying to second guess what will happen next to borrowing costs. Rates staying higher for longer is bad news for investors and so the more intense the Middle East conflict gets, the greater the potential for increased market volatility.”

FTSE latest news - live

11:17 , Karl MatchettWorth a check-in on the markets ahead of the interest rate decision - and it remains a day fully in the red, across London’s markets and onto the continent.

- FTSE 100 down 0.22 per cent

- FTSE 250 down 0.64 per cent

- AIM down 0.26 per cent

- France’s CAC 40 down 0.61 per cent

- Germany’s DAX down 0.33 per cent

- Euronext 100 down 0.5 per cent

Until there’s more clarity over tariffs, the US involvement with Iran, oil prices and one or two other factors, this might be the direction of travel for a while.

Interest rates changes impacting mortgages

11:30 , Karl MatchettUK Finance data shows over a million people are on tracker mortgages or standard variable rate mortgages at present - either band could be affected by a change in interest rates.

Some homeowners may have been waiting to see if rates come down further before committing to a new fixed rate term, with analysis showing 1.6m fixed rate mortgages are due to end during 2025.

Workings show a 0.25pc reduction to the base rate could equate to around £28.97 a month lower repayments based on those on an average tracker product, or £13.87 for those on SVR deals.

Interest rates: Global changes

11:43 , Karl MatchettIt’s not just the Bank of England with this decision today over to cut, hold or raise interest rates. Here’s what has happened around the rest of the world of late:

- The US Fed opted to hold at 4.25-4.50 per cent last night

- Norways’s central bank today took a surprise cut for the first time in five years, to 4.25 per cent

- Taiwan have opted to hold at 2 per cent

- The Swiss national bank cut a quarter point to zero in an expected move as inflation falls

- Earlier this month, the European Central Bank cut interest rates on the deposit facility, main refinancing operations and marginal lending facility to 2.0pc, 2.15pc and 2.40pc respectively

Bank of England set to decide on interest rates

11:52 , Karl MatchettThe MPC’s meeting is due from 12 noon and we should hear right away about the latest interest rates call.

As a reminder, we’re currently at 4.25 per cent base rate.

The last cut came in May and we’re expecting a hold decision this time around.

Bank of England votes to hold interest rates at 4.25 per cent

12:01 , Karl MatchettInterest rates have been held at 4.25pc, the Bank of England has now announced.

This means a continuation of the recent trend of voting to cut rates at every other meeting since rates began to lower last year, from a peak of 5.25pc.

Interest rates held - but check your own account regardless

12:05 , Karl Matchett“Cautious” movement forward, is the message, amid a decision to stay with today’s 4.25 per cent rate.

John Dentry, of the Current Account Switch Service (CASS) said expectations remain that cuts will follow later this year - but reminded savers to check their individual products to ensure their own bank haven’t cut rates and they are still getting the best value for their money.

Make sure to see if others may suit you, if your own bank isn’t giving a great rate right now.

“Today’s base rate decision tells the market that the Bank is moving forward cautiously amid a turbulent economic environment. It’s predicted that this approach will continue with a few minor rate cuts later this year,” Mr Dentry said.

“Consumers must remember that it is not the base rate which dictates your interest rates, but your bank. The banks usually won’t align their rate drops with the Bank of England, so even though the base rate hasn’t changed, your own, personal rate could potentially do so.

“If you’re finding yourself earning less interest on your cash, remember there are plenty of other providers who might give you a deal that is a better fit for your financial priorities. Switching banks is an important way to put the power back in your own hands – make sure you consider using it.”

When is the next interest rates announcement?

12:08 , Karl MatchettMortgage owners in particular might already be looking ahead and wondering when the next date is for a potential interest rates cut.

In that case, look no further: 7 August is the date for your diary.

Three MPC members voted for June interest rates cut

12:12 , Karl MatchettThe Bank of England has confirmed its MPC members voted by a majority of 6–3 to maintain Bank Rate at 4.25 per cent.

Three members preferred to reduce the base rate by 0.25 percentage points, to 4 per cent, it said.

The BoE has referenced “substantial disinflation over the past two years” but also pointed out the current level is likely to remain elevated for the rest of the year.

Wider economic uncertainty, including energy price rises, mean the intention remains to stay on the “gradual and careful” approach to cutting interest rates.

We’ve seen how the interest rate remaining higher will mean savers can still get a relatively good rate for their cash - as long as they ensure their bank is providing one, or they seek one elsewhere.

But for businesses, a higher interest rate means ongoing challenges, says James Burgess, insolvency expert at Atradius UK.

“While the decision to hold rates was widely expected, given above-target inflation at 3.4 per cent and high wage growth, it creates a challenging environment for UK companies,” he said.

“High borrowing costs and lingering tariff uncertainty continue to hamper investment and growth, particularly for SMEs. Businesses are still navigating elevated operating costs and cautious consumer spending.

“To navigate the uncertainty ahead, businesses should take proactive steps to protect their operations. Strengthening cash flow, reviewing supply chain resilience, and considering trade credit insurance can provide greater stability and peace of mind during what remains a challenging period.”

Tough decisions ahead for mortgage holders seeing fixed deals end

12:32 , Karl MatchettAs for mortgage holders and what they do next, it depends on when their fixed term deal expires - and maybe just as importantly, when it started, says Alice Haine, personal finance analyst at Bestinvest.

“Future rate cuts could certainly deliver respite for some mortgage borrowers. Anyone nearing the end of their fixed-rate term now has a tricky decision to make,” said Ms Haine.

“Should they secure another fixed-rate deal or take a punt on further interest rate cuts, which could mean a tracker might work out best over the longer term? With the gap between the average two-year fix and the average five-year fix narrowing to the lowest level since the inversion began in October 2022, choosing how long to lock in for is another decision that might require some careful thought.

“Mortgage rates have been edging down, but they remain higher than five years ago before the Bank of England began hiking interest rates and when rates were at ultra-low levels.

“First-time buyers may find the mortgage market more welcoming thanks to recent BoE rate cuts and an uptick in lenders relaxing their affordability stress test rules.

“For existing borrowers rolling off cheap, five and 10-year fixed-rate deals secured before the BoE began hiking rates, the financial hit from higher mortgage costs will hurt as they are likely to see a sizeable jump in their repayments.

“This is where a reputable independent mortgage broker can be worth their weight in gold, helping to source the right solution for a borrower’s unique needs.”

Inflation must come down for BoE to reduce rates

12:44 , Karl MatchettOther than oil and energy prices which is outside the UK’s hands to a large extent, reducing domestic inflation is key to lowering interest rates - and therefore to stimulating the economy.

Brad Holland, director of investment strategy at wealth manager, Nutmeg, pointed out a key area facing high inflation which needs to be tamed.

“Services inflation and wage growth continue to run hot, and external factors such as tariffs and global conflict have created too many ‘unknowns’. The Bank is showing caution,” Mr Holland said.

“For now, the question weighing on many people’s minds is: how long will it take for interest rates to fall further? It is believed by many that the ‘neutral rate’, where the UK economy can deliver price stability, lies around 3 per cent.

“But, we could be a long way away from this target with the market currently expecting the base rate to fall to 3.5 per cent by April 2026.

“Getting services inflation down to a more manageable level is crucial to lowering interest rates.”

Hold decision criticised by trade union Unite

12:51 , Karl MatchettTrade union Unite have spoken out against the decision to hold interest rates, saying it is punishing workers and enabling banks.

General secretary Sharon Graham said:

“The Bank of England’s decision is wrong. High interest rates are a weight on the backs of workers. They boost lenders’ profits, while pushing up mortgages and rents, and increase the strain on our struggling industries.”

Will we still see a rate cut in August?

12:57 , Karl MatchettExpectations until recently have been of a hold today and a cut in August.

Is that still the case?

Not necessarily, says Thomas Pugh, chief economist at tax and audit firm RSM UK.

“The most interesting part of today’s decision was the vote split with three members voting for a 25bp cut rather than the two we expected,” he said.

“The committee kept its “gradual and careful” language, again suggesting it is in no rush to cut rates more quickly than previously assumed.

“The big risk now is rising energy prices. At current levels, oil prices probably won’t require a change in thinking. But if they go to $85 or higher, inflation will probably breach the psychologically important level of 4%.

“Normally, we would expect the BoE to ‘look through’ energy driven inflation movements, but inflation expectations are close to record highs and are at risk of becoming unanchored. This makes the chances of the BoE responding by skipping a rate cut significantly higher than it previously would have been.”

Mortgage rates already 'priced in' with two more rates cuts

13:10 , Karl MatchettMortgage holders hoping for a big drop later this year shouldn’t hold their breath, barring some very different economic data coming through over the next few months.

The rates you see on mortgage products are based on swap rates - expectations of where the interest rates go - rather than the exact bank rate, and most banks have already taken that into account, says Frances Haque, chief economist at Santander UK.

“As expected, base rate has been held. Despite that, we have seen many lenders cutting mortgage lending rates in the last week – Santander included. Our forecasts suggest that we’re still likely to see two more base rate cuts over the coming year – most likely ending 2025 at 3.75 per cent.

“This is being ‘priced in’ to current mortgage rates.

“Aspiring homeowners and those already on the ladder could expect to see mortgage rates continue to hover between the top end of the threes or lower end of the fours. For this to change significantly we’d need to see changes in economic data – and as ever, that could see mortgage rates go up as well as down.”

What the latest interest rates mean for your mortgage, savings and bills

13:23 , Karl MatchettThe Bank of England (BoE) announced on Thursday its decision to hold the Bank Rate — what we might simply call the interest rate — at 4.25 per cent, following a cut to that level in May.

The Bank’s nine-person Monetary Policy Committee (MPC) voted by a majority of six-three to maintain rates at that level, with the dissenters voting for another quarter-point cut down to 4.0 per cent.

The committee underlined “the risks of inflation persistence” and “global uncertainty”, sticking to their mantra that a “gradual and careful approach” to cutting rates remained appropriate.

Here’s a brief rundown of what the current interest rate might mean for you:

What the latest interest rates mean for your mortgage, savings and bills

Markets predict 85% chance of August rate cut

13:44 , Karl MatchettThe markets are still pricing in a large chance of a cut in August, says Esther Watt, bond strategist at Evelyn Partners.

“The UK swap market is pricing is an 85 per cent chance of a cut at its next meeting in August and one further cut through to the end of 2025.

“Given [MPC member] Ramsden’s reputation as a bellwether on the committee, it will be interesting to see if weakening labour market data encourages more committee members to start look through inflation concerns, resulting in the pace of quarterly rate cuts picking up.”

How rising inflation impacts your mortgage and savings

14:02 , Karl MatchettInflation shot back up to 3.5 per cent in April, having been on a downward trajectory at the start of 2025, before a marginal decrease to 3.4 per cent in May.

In part as a result of this sticky inflation, the Bank of England (BoE)’s Monetary Policy Committee has voted to maintain interest rates at 4.25 per cent, following a cut in May.

As interest rates are one of the primary ways the BoE looks to control inflation, they are often linked to each other, and each one can have knock-on effects on several areas for people in the UK.

Here’s how inflations affect your savings, mortgage and more:

FTSE news latest

14:20 , Karl MatchettThe stock markets have been in the red all day today and on the London Stock Exchange that hasn’t been altered by the Bank of England’s interest rate decision, predicted as it was.

Melrose Industries is the biggest climber of the day, up 3.26 per cent to continue a positive month which has resulted in near-10 per cent gains all told.

Meanwhile, housebuilder Persimmon is the biggest faller, down 3.11 per cent on the day.

Morrisons ‘bounces back’ from cyber attack despite pressure on shoppers

14:39 , Karl MatchettMorrisons said it has “bounced back” from a cyber attack which disrupted its Christmas trading, as it posted stronger sales and profits for the latest quarter.

However, it came as the UK’s fifth-largest supermarket chain warned that rising inflation is driving “subdued” sentiment among shoppers.

On Thursday, the Bradford-based grocery business revealed that group sales grew by 4.2% to £3.9 billion for the 13 weeks to April 27, compared with the same quarter a year earlier.

Rami Baitieh, chief executive of Morrisons, said he was “pleased to report that Morrisons has bounced back strongly” from disruption linked to a cyber attack on its technology supplier Blue Yonder in November.

Morrisons ‘bounces back’ from cyber attack despite pressure on shoppers

Interest rates - live

15:23 , Karl MatchettHere’s a recap of the day’s events and how we arrived here:

- Bank of England vote to maintain interest rate at 4.25 per cent

- This follows May’s cut; 85% chance priced in of another cut to follow

- Next MPC meeting is in August

- Inflation marginally lower for May but still at 3.4%

Amazon tells 1.5m staff that AI will replace ‘some of their jobs’

15:40 , Karl MatchettAmazon bosses have told staff that some employees will lose their jobs over the coming years as they step up the use of Artificial Intelligence.

The company employs around 1.5m people around the world, with more than 60,000 estimated to be working in the UK.

A memo from chief executive Andy Jassy to staff did not clarify the number of roles which would be handed over to AI control, but said there would be an inevitable change over what work would be carried out by people and what could be left to agentic AI.

Amazon tells staff that AI will replace ‘some of their jobs’ — but won’t say how many

Savers issued warning after Bank of England holds base rate

16:00 , Karl MatchettSavers are being urged to proactively review their accounts and avoid the trap of low returns, after the Bank of England held its base rate steady at 4.25 per cent on Thursday.

Despite the general downward trend in average savings rates in recent weeks, Thursday did offer a ray of light for some, with certain providers unveiling new products.

Aim boss makes plea to boost market’s appeal after inheritance tax blow

16:20 , Karl MatchettThe boss of London’s junior stock market has called on the Government to help halt an exodus of companies listed in the City as he warned over the impact of its move to cut inheritance tax relief on Aim shares.

Marcus Stuttard, head of Aim and UK primary markets at the London Stock Exchange, urged the Government to reinstate “financial incentives” for Aim investors after last autumn’s Budget revealed plans to slash inheritance tax (IHT) relief on Aim-listed stock from 100% to 50% from April next year.

Aim has suffered a raft of firms quitting the market in recent years as part of a wider shift away from London towards overseas rivals and as firms are bought out by foreign competitors or taken private.

More than 60 firms – with a market cap of over £12 billion – have already announced plans to leave Aim in 2025 as they look to move to the main market, delist or are bought out.

Full story:

Aim boss makes plea to boost market’s appeal after inheritance tax blow