The Bank of England (BoE) has voted to hold interest rates today, as homeowners looking to renew deals were warned to seize on mortgage offers quickly.

Following three rises earlier this year, the BoE announced that the rate would stay at 4 per cent, with the next vote in early November.

But two MPC members voted to cut rates further this time around, indicating there may still be a chance for another drop in rates before the end of this year.

Among the factors which affect the BoE’s decision is UK inflation - which official figures yesterday showed held steady at 3.8% across August, despite food prices rising at a much faster rate.

Elsewhere, Jaguar Land Rover’s woes as a result of the cyberhack in their systems will continue into next month at least, while Microsoft have announced a £22bn investment into the UK in a “tech prosperity deal” and one of the co-founders at Ben & Jerry’s has quit.

Follow The Independent’s live coverage of the interest rates vote plus latest stock markets and business news here:

Key points

- Inflation remains at 3.8%, food inflation higher

- Nationwide the latest lender to offer £175 to switch banks

- Interest rates in charts: From zero to 5.25%

- CONFIRMED: Bank of England hold interest rates at 4%

- BoE confirms quantitative tightening decision on sale of government bonds

- Homeowners urged to move fast if they were planning a new mortgage deal

- All you need to know from today's BoE meeting

Bank of England wrap: All you need to know from today's votes

14:00 , Karl MatchettOK, let’s get everything lined up for those who missed the live event. Here’s a recap of what went down and what it means...

Interest rates: The vote was split 7-2, but a hold at 4% was the outcome.

Quantitative tightening: Another split, 7-1-1, but ultimately the bank will slow down its rate of selling bonds.

What it means for...

Savers: Rates should hold above 4.5% for now in the best cases. Make sure your account offers above 4% at least, as that’s where inflation is/will be.

Mortgages: Don’t wait around if you need a new deal. The war between lenders is likely over for now and rates could tick back up a little more.

Businesses: As you were, in terms of borrowing costs - the BCC is demanding no further taxes with firms squeezed on all sides this year.

Interest rates live - Business and Money, 17 September

06:58 , Karl MatchettMorning all and welcome to our latest live blog across the business and finance worlds.

Today we’ll catch up on stock market matters, any further inflation reaction and the latest affecting workers at Jaguar Land Rover.

Our primary focus though is the 12 noon announcement from the Bank of England over interest rates.

Yesterday’s data confirmed UK inflation remained unchanged last month at 3.8 per cent, but consumers are still facing rising food and drink costs on some of the most popular everyday items like coffee and chocolate.

Food and drink price rises have accelerated for the fifth month in a row, in another hit to the poorest households, with the chancellor admitting that many people are “finding it tough”.

The Office for National Statistics (ONS) announced on Wednesday the rate of Consumer Prices Index (CPI) was 3.8 per cent in August, the same as July. This was the level that most economists had been expecting.

However, the rate of food and drink inflation rose to 5.1 per cent in August, from 4.9 per cent in July, as shoppers continued to face higher prices for items at the till.

Among food items, beef and veal has had the biggest annual rise in price, up by a quarter (24.9 per cent) over the past 12 months. Butter is next in line, up 18.9 per cent, while both chocolate and coffee have risen 15.4 per cent in the space of a year. More details on yesterday’s figures here.

Amazon announces above inflation pay rise for staff

07:16 , Karl MatchettOnline giant Amazon has announced an above inflation pay rise for its employees.

From the end of the month the minimum starting pay will rise by 5.9% to £14.30-an-hour or by 5.5% to £15.30-an-hour depending on location.

Annual salaries for frontline employees will start at a minimum of £29,744 and up to £31,824 depending on location.

The increase will affect tens of thousands of staff across the UK, said Amazon, adding that its minimum starting pay will have risen by 43% since 2022.

Interest rates: All the key details

07:24 , Karl MatchettToday’s big focus will be the Bank of England deciding on whether to cut interest rates or not. Here’s what you need to know:

When: At 12 noon we get their announcement

What: The nine MPC members vote to cut, hold or raise rates

Last time: In August rates were cut down to the current 4% level

This time: Experts predict no cut today - here’s the detail, reasons and what comes next.

Will interest rates go down tomorrow? Key factors and 2025 predictions

Starbucks employees suing firm over dress code change

07:42 , Karl MatchettStarbucks is facing a legal challenge from their own employees in the US, who say a new dress code came without reimbursements or garments.

A class action lawsuit is a possible route after the company switched up the dress code in an effort to create a “warmer” and more familiar brand.

One employee called the manner of the change “tone deaf” - more details here.

Major lenders joins the cash offer war in bid to win your current account

08:07 , Karl MatchettLloyds, Natwest, Nationwide.

All three have launched cash switch offers in the past few days, which means they will give you money if you move your current account to them.

The amounts are slightly different and so too are additional perks you get - make sure if you’re considering a switch you choose the one which gives you the best overall deal for your needs, not just the most money up front.

- Lloyds - £200.

- Natwest - £175.

- Nationwide - £175.

Lloyds also give you an extra annual perk like Disney plus or a coffee shop discount; with Natwest you can add an extra £36 across the year with one account type; Nationwide will share profits with their members (customers), often £100 a year recently.

Others like first direct, Co-op Bank and more are also putting £175 plus other perks on the table including access to much higher interest rate savings accounts - that’s 7 per cent in the case of first direct!

Make sure you choose carefully and always read terms to ensure you’re eligible.

Bank of England interest rates: Move your money now

08:22 , Karl MatchettWe’re expecting a vote to hold today from the BoE. That doesn’t transpire to consumers to do nothing themselves, however.

“With inflation staying stubbornly sticky, it’s unlikely that the Bank of England will be cutting rates today. But there are ways you can make sure your money is working for you, and not against you,” says Alastair Douglas, TotallyMoney CEO.

Here are his ways to make sure your money is in the right place...

For savers:

“If you’ve not moved your savings recently, it’s likely your bank will be paying you a below-inflation rate, meaning your cash will effectively be losing value. By shifting your money to a market-leading account, you could start earning up to 4.75 per cent.”

For homeowners:

“If your current deal is ending within the next six months, then it’s worth shopping around for a new offer sooner rather than later. If you don’t, then you’ll probably find yourself on your banks Standard Variable Rate – with the average currently at 7.5%. The average two-year fix is 4.75% - and while it’s likely to be more than you’re currently paying, your monthly payments will jump, but not as high. Some brokers will also let you lock in a new offer now, and then switch to a better deal if one becomes available before your one is up.”

For borrowers:

“Interest rates might not be dropping as quickly as we expected, but competition is heating up. Six banks are currently offering up to 34 months interest free on balance transfers, meaning borrowers can press pause on interest payments until July 2028, saving more than £1,700. So, if you’re carrying debt, make sure that the information on your credit report is correct and up to date, check your latest offers, and start saving money.”

Workers affected by Jaguar Land Rover cyberattack told ‘to sign up for universal credit’

08:40 , Karl MatchettThe workers’ union Unite is calling for the government to offer a furlough scheme for workers caught up in the Jaguar Land Rover (JLR) cyber attack after some in the supply chain were reportedly laid off or advised to sign up for universal credit.

The union said thousands of workers in the JLR supply chain should have a furlough scheme similar to the one announced this week to support staff at bus manufacturer Alexander Dennis.

JLR was hit by a cyberattack several weeks ago and after an initial shutdown, has recently stated it will be unable to resume production until at least 24 September, while suppliers have been warned that disruption could continue until November.

Staff have been told not to return to work while production lines are still affected.

Full details:

Workers affected by JLR cyberattack told ‘to sign up for universal credit’

Barclays offer switch bonus - on your cash ISA

09:00 , Karl MatchettPotentially one for somewhat older readers who have had more time to add to their savings, but along the same lines as the current account switch offers going around, Barclays has one for your cash ISA.

If you transfer to a Barclays cash ISA with a minimum of £25,000, from another ISA provider, you get between £100-£500 depending on your total pot.

Added to the fixed rates on offer of 3.7 per cent and 4.0 per cent depending on account type, Barclays say the cash bonus effectively lifts the rate to a market-competitive 4.5 per cent in a best-case scenario.

As always, check terms to see what you need to be eligible and that the fixed term deals suit your needs.

Next delivers profit boost, but cautions over ‘anaemic’ UK economic growth

09:20 , Karl MatchettNext has notched up a surge in half-year profits, but warned UK sales will be weighed on by “anaemic” economic growth and a faltering jobs market as the Government’s tax hike takes its toll.

The fashion and homewares group reported a 13.8% rise in underlying pre-tax profits to £515 million for the six months to the end of July as total full-price sales lifted 10.9%.

But it cautioned that UK sales growth will pull back sharply.

Chief executive Lord Simon Wolfson said: “The medium to long-term outlook for the UK economy does not look favourable.

“To be clear, we do not believe the UK economy is approaching a cliff edge.

“At best we expect anaemic growth.”

FTSE 100 rises ahead of Bank of England interest rate vote

09:27 , Karl MatchettWith the BoE expected to hold rates at 4% today, UK stocks have risen in early morning trading.

The FTSE 100 is up 0.23 per cent so far, though remains down for the week after a subdued couple of days.

Analytics firm RELX is the leader, up 2.75 per cent, while retailer Next is down 5.7 per cent after its profit release this morning, citing slowing or no growth to come.

Next remains up more than 19 per cent this year, however.

How much a young person in the UK needs to save in order to retire comfortably

10:00 , Karl MatchettToday’s young Britons would need to save more than £1 million to retire comfortably without depending on wages, new research suggests.

Due to the rising cost of living, coupled with longer life expectancies, 18- to 30-year-olds need £1,183,363 to stay financially independent until age 90 after retirement, according to a new study.

The analysis was conducted by investment and insurance company Shepherds Friendly, using average UK household spending rates, common debt, and a recommended six-month emergency fund.

The investigation also factored in 25 years of rising costs at 2.88 per cent annual inflation and a 5 per cent annual return on savings or investments, to reveal exactly how much would be needed today to enjoy 25 years of financial freedom in retirement.

Full story:

How much a young person in the UK needs to save in order to retire comfortably

BoE may adjust QT programme

10:31 , Karl MatchettOne of the questions the BoE will answer today, aside from interest rates, is on the matter of quantitive tightening programme.

In simple terms, this is the rate at which it’s selling bonds bought during periods when the government needed additional money, such as during the Covid pandemic.

However, selling at the rate it has been has contributed to lowering bond prices, which in turn pushes up bond yields - which for the government means “borrowing costs”.

In other words, the government has to pay back more money when the Bank is selling bonds at such a rate.

Therefore we may get an update on that today.

Holdings interest rates means repayments, mortgage rates and other costs might not go any higher - but it also means those already struggling with cost of living expenses and rampant inflation will get no relief.

That becomes a real consumer concern as winter and Christmas come closer, says Tamsin Powell, consumer finance expert at Creditspring.

“Although markets are predicting the Bank of England will hold rates, many households will continue to feel the strain of tight budgets. With unemployment at 4.7% and living costs remaining high, day-to-day budgets are under pressure, and borrowing – whether for loans or mortgages – is still expensive.

"Winter is just around the corner, and for many, Christmas will bring additional financial strain. Rising heating bills, combined with the 2% increase in the energy price cap from the 1st of October, mean millions of households will have less money to cover essentials and unexpected costs.

“While stable rates may prevent extra repayment pressure, they don’t provide relief for those already stretched.”

Cash ISAs continue to rise - expert advises investing instead

11:00 , Karl MatchettAn ongoing theme this: cash ISAs are in use more than ever, but so much money is in them that people could be investing instead to generate far better returns for the long term.

Around 5m people have between £10k and £20k in their cash ISA - it’s recommended for most people that having four months’ costs in a savings account is an ideal buffer. Beyond that, consider investing to help your reach your goals.

A total of around £360bn is thought to now be in cash ISAs.

Claire Trott, head of advice at St. James’s Place, said:

“Today’s HMRC figures are the latest indication that the UK population is over-saved and under-invested. While a cash buffer is important – and no doubt brings comfort to savers, promising safe, guaranteed returns - individuals who chose a cash ISA over a stocks and shares ISA could be missing out on hundreds of thousands of pounds over the long term.

“For individuals saving for long-term goals the cash ISA approach can be risky. As shown by our analysis, inflation can quickly and substantially erode the real value of cash savings.

“Ultimately, those wanting to reap the rewards of their finances over the long term need to be invested in the market. While short term fluctuations and market volatility may deter risk averse savers, history shows that staying invested over time has consistently offered far greater potential for growth, and protected wealth against inflation.

“For those nervous about investing without guidance, speaking to a financial adviser can be a great way to get started, and can provide confidence you’re making the best decisions over the long term.”

LISA reform on the agenda

11:20 , Karl MatchettContinuing with the data around ISAs, today’s figures show 87,250 people used their Lifetime ISA (LISA) to buy their first home in 2024-25 - that’s up 53.7% from the previous tax year, say money managers Nutmeg.

However, the rate of penalties for early withdrawal also increased across LISAs.

Claire Exley, head of financial advice and guidance at Nutmeg, says that should open debate once more to ensure savers aren’t punished due to increased housing costs and frozen thresholds.

“The Treasury received over £100 million from early LISA withdrawal penalties for the first time, a 35% increase from the previous tax year and the second year in a row it has risen.

“Whether it is rising house prices which have put properties beyond the LISA house price cap or a change in life circumstances that means people need the money in their LISA, more savers are handing over their savings to pay the exit penalty.

“While some friction to withdrawals helps consumers remain focused on goals, there should be a mechanism which ensures the Government gets back any bonus paid to LISA savers but does not excessively harm those who can no longer use a LISA or whose life circumstances change.

“While some are debating the future of the LISA, this data shows that it remains a well-loved and powerful tool for younger savers to accumulate wealth and get on the property ladder.”

Will interest rates go down today?

11:40 , Karl MatchettWe’re approaching time for the Bank of England’s interest rates vote announcement and reaction to that, so let’s have a quick check in on what to expect.

The base rate – currently at 4.0 per cent following cuts three times this year – impacts consumers and taxpayers through everything from their mortgages to savings.

Here’s what’s happening and what it will mean for you:

Will interest rates go down today? Key factors and 2025 predictions

Interest rates: From 0 to 5.25% - and back again?

11:50 , Karl MatchettHere’s the interest rates chart over the last 3.5 years from the Bank of England. Remember a time we were at 0.1%?!

Nobody really expects that to happen again any time soon, even if inflation stabilises and rates drop to a more neutral level.

But, also, we’re down some distance from the 2023/24 highs of 5.25 per cent, which caused real shocks for mortgage repayments and loans on variable rates.

Five cuts have happened since then, three this year.

A fourth today would be an extraordinary surprise - but perhaps, we could still see one in December.

.jpeg)

Bank of England to announce interest rates decision

11:56 , Karl MatchettJust a few minutes to go and then we’ll hear the latest.

Typically, what follows is a bit more discourse on wider economic policy, questions to some of the MPC members on their voting stance and some other aspects of the announcement.

We’ll bring you the consumer-focused element of that, plus reaction from lenders, industry experts and what it all means for you going forward.

CONFIRMED: Bank of England holds interest rates at 4%

12:02 , Karl MatchettThat’s confirmed - we remain at 4% as expected.

It’s a 7-2 split in voting from the MPC, with two members voting for another cut - that’s actually more than was predicted by most analysts.

Inflation is still an issue but the BoE say “there has been substantial disinflation over the past two and a half years” but they remain focused on returning to the 2% inflation target.

Move quickly if you're looking for fixed-rate mortgages - expert view

12:07 , Karl MatchettReaction pouring in already - we’ll bring you the best plus what the BoE itself says in reaction.

As anticipated, the first port of call for many will be over their mortgage repayments.

If you’re on a fixed-term deal nothing changes, but those on variable rates could have - and the many thousands preparing to get new deals across the rest of 2025 may have been hoping for more interest rate cuts.

Jasmin Ehlert, head of bank analytics at Raisin UK, says that’s not happening any time soon - so move quick before banks push up their terms even higher.

“Today’s decision by the Bank of England to hold the base rate at 4.00% reflects the difficult balancing act it faces,” she said.

“For households, this means mortgage and loan costs will not fall straight away, though lenders may start to sharpen their offers if economic pressures build and rate expectations shift. Anyone considering a fixed-rate mortgage should be ready to move quickly when a competitive deal becomes available.”

Savers should be boosted as rates hold at 4%

12:17 , Karl MatchettOn the flip side to mortgages, as ever, are savings.

When interest rates remain higher you can get a better rate on your cash - and it’s important you seek the best returns possible right now, with inflation running close to 4%.

“Inflation is a ‘Jekyll and Hyde’ character - while it may be good news for borrowers, as it erodes the value of their debts, it has detrimental implications for savers, investors and for retirees, chipping away at the value of future income payments and eroding the worth of their original capital pot,” explained Maike Currie, VP Personal Finance at PensionBee.

There are still plenty of places you can get above 4% on your money, so make sure you move your savings if needed.

QT decision made over sale of government bonds

12:23 , Karl MatchettOne key issue which the BoE has given information on today is that of quantitative tightening.

In a quick nutshell, the bank buys government bonds during spells when required, then sells them again afterwards - but had faced criticism recently due to the pace of sales, which pushed prices down and yields (government borrowing costs) up.

Ultimately, it has voted to reduce the rate of sale of them for the coming 12 months.

More on that to come - the vote to do so was split.

So, a bit more detail on the QT programme.

The reason why it’s of relevance now in particular is because we have a big old Budget coming up in two months and Rachel Reeves needs to find a lot of money.

Mostly that can be by taxes and so on, but another way the Treasury can “make” money is by reducing the payments they have to make.

Such as, of course, on the cost of it borrowing money.

Like us taking out a loan and paying interest - but in this case, it’s the bond yield we’re talking about.

Lowering the pace of sales could help lower the yield and thus give more headroom to the chancellor.

Brad Holland, director of investment strategy at Nutmeg, says it’s debatable whether the decision will be a winning one at this point.

“While a rates hold had been priced in, there have been growing calls in recent weeks for the Bank of England to scale back its programme of quantitative tightening,” he said.

“This matters because the bond curve on long-dated Gilts (UK govt bonds) steepened over the summer and there are growing fears that further bond sales from the Bank could increase losses and trigger a further steepening of the curve.

“For the Treasury, this would create an additional headache ahead of the Budget as any steepening of the curve has an impact on government borrowing. These concerns have clearly motivated policymakers to re-examine its programme of bond sales as part of its annual assessment and slowdown sales.

“Whether this proves to be a silver lining for the Treasury or not, we will need to wait and see if this loosening shifts the scales and leads to a decline in gilt yields. The jury is out for now.”

Conservatives deride 'reckless' Labour for high interest rates

12:38 , Karl MatchettAs is to be expected, the political discourse has begun with typical point-scoring.

Here at Independent Money we’re more concerned with telling you how these decisions affect you day to day than with the blame-gaming, but for completeness...

Sir Mel Stride MP, shadow chancellor, said:

“The fact interest rates are not coming down faster is a result of Labour’s reckless decisions which have pushed up inflation.

“The Prime Minister and Chancellor are distracted by scandal and working people are paying the price.

“There is deep nervousness about the drumbeat of bad economic news: inflation doubled, growth flatlining, and 150,000 jobs lost since the Budget.

“Only the Conservatives, under new leadership, will deliver a stronger economy.”

Bank of England should have stopped all gilt sales - IPPR

12:45 , Karl MatchettMost experts seem to be wavering between nodding approval at the BoE slowing QT rates, and marginal frustration at it not going further.

The Institute For Public Policy Research (IPPR) suggests that the Bank could have stopped sales altogether.

“The Bank was right to slow the unwinding of its economic support programme – quantitative tightening. It has added unnecessary pressure on gilt yields at a time of global pressures. The Bank should have in fact gone further and fully stopped active gilt sales, as these are not needed for its monetary policy strategy,” said the IPPR’s Carsten Jung, who is in fact a former BoE economist.

“Meanwhile, the expected inflation bump over the summer is projected to ease and the Bank of England should more strongly signal how it intends to lower rates over the coming months, given a range of factors pointing to weaker demand.”

Small firms face 'swamp of rising business costs', warns BCC

12:53 , Karl MatchettThe British Chambers of Commerce (BCC) has warned that higher interest rates mean greater cost pressures for businesses - and says the government has to break the cycle with the Budget.

“A further hold aligns with the BCC’s latest forecast, which expects no further cuts this year,” said David Bharier, head of research.

“Global factors such as tariffs, conflicts, and fragile supply chains, alongside domestic pressures – higher taxes and uncertainty ahead of the Budget – are clouding the outlook.

“SMEs are wading through a swamp of rising business costs which is impacting on confidence, investment and recruitment. Our latest survey shows that 73% cite labour costs as the top pressure, driven by the increase to employer NICs.

“Breaking this cycle depends on boosting growth, exports and productivity – not further burdens on firms. The Chancellor will need to use the November Budget to support business investment and confidence, not undermine it with new taxes.”

Interest rates: When will the next cut be?

13:01 , Karl MatchettThe remaining 2025 meetings of the BoE’s MPC are:

- 6 November

- 18 December

Many experts are suggesting we won’t get a rate cut below 4% before the year is out - but not everybody agrees.

And the bigger point to that is, economic data will determine whether we see one - and that can change very quickly.

Job market data, unemployment rates, wage growth, tariffs impact, inflation and of course - in the case of the December meet - the Budget will all impact each other in different ways to determine when the next cut comes (or rise, indeed).

Here’s what the experts are saying today...

Ed Monk, pensions and investment specialist at Fidelity International:

"The pathway to lower rates in the UK appears to be getting narrower, with rates held today and just one more rate cut now being priced in before 2027.

“The gilt market is indicating that no further rate cuts are likely this year, with the MPC meeting in March 2026 currently looking most likely to bring the next reduction.”

Peter Stimson, director of mortgages at MPowered:

“With two members of the committee voting for an immediate rate cut, the prospect of a cut in November is still firmly on the table. But nevertheless the Bank is allowing itself plenty of wriggle room, and it’s more than possible that we won’t see another base rate cut until 2026.

“The mortgage swaps market, which is used by mortgage lenders to determine the fixed interest rates they offer to borrowers, still suggests there will be two more base rate cuts in total, albeit with the timescale stretching into the new year.”

Rob Morgan, Chief Investment Analyst at Charles Stanley:

“While core goods inflation may be peaking, services could remain sticky due to elevated employment costs. This could keep overall CPI high, even as other components stabilise. Food prices also represent a major worry and could continue to drive consumer expectations.

“The Autumn Budget adds a further layer of complexity. Until there’s clarity on the Chancellor’s fiscal plans, the MPC may be reluctant to ease further. That makes a November rate cut unlikely. December’s meeting could be more finely balanced, depending on incoming inflation data and the Budget’s implications, but it’s likely the next rate cut won’t arrive until 2026.”

We’ve heard about homeowners looking to renew their deals - what about first time buyers?

Property prices keep increasing for the most part and while interest rates are well above the nominal levels we saw post-Covid, they are also far lower than a couple of years back.

“First-time buyers can take comfort that mortgage rates are in a much better place than they were two years ago, when the average two-year fix hit 6.7* versus 4.96% today,” explained Alice Haine, personal finance analyst at Bestinvest.

“The cohort of borrowers most likely to be dismayed by today’s BoE decision are homeowners with large mortgages still cruising on ultra-low fixed rates.

“Many five-year deals, secured before interest rates began their rapid ascent in late 2021, are now expiring so household budgets may need an overhaul to accommodate the upcoming jump in repayments.”

Deutsche Bank predict December cut - and two more next year

13:30 , Karl MatchettDeutsche Bank’s chief UK economist, Sanjay Raja, has dived into the numbers and reasons beyond the votes on interest rates and QT.

There are a few findings worth discussing, he says - including a suggestion that a late-year interest rate cut is still on the table.

“With a 7-2 vote tally, one thing is clear: the MPC remains fractured,” he said.

“The MPC also reiterated that monetary policy was not on a pre-set path – and the MPC ‘would remain responsive to the accumulation of evidence’. Put simply, a Q4-25 rate cut remains very much on the table with the MPC doing little to shift market expectations one way or another.

“We continue to see one more rate cut to end the year (December). And we continue to think that Bank Rate will settle closer to 3.25% ahead of next summer.”

That’s three cuts between now and next summer - considerably higher level of reductions than other analysts are forecasting at this time.

Taxes still coming in Budget regardless of BoE's QT efforts

13:45 , Karl MatchettLaith Khalaf, head of investment analysis at AJ Bell, says that tax rises are still going to be needed in the Budget.

Rachel Reeves will doubtless benefit a little from the drop in quantitative tightening but the gaps in public finances are too big for that alone to impact, our expert says.

“The Bank seems confident QT is not having a big effect on the present state of the gilt market, which does look to be highly correlated with overseas developments. The good news for Rachel Reeves is that 30-year bond yields have moved down over the course of this month, from a peak of almost 5.7% to just over 5.4% now.

“There is now just one more interest rate decision before the November Budget, and Rachel Reeves would dearly love to see some more dovish vibes coming from the Bank of England to relieve some pressure on the public finances.

“Tax rises rather than inflation controls will almost certainly be the main thrust of the Budget in November, like it or not.”

Vote in our Independent Money poll

14:20 , The IndependentEvery Tuesday, our Independent Money newsletter lands in inboxes with expert insight and practical advice on the financial issues that matter most – from the cost of living crisis to smart saving strategies and key economic trends.

You can vote in this week’s poll right here – for analysis of the results and more expert commentary, make sure you’re signed up to the Independent Money newsletter.

Not subscribed yet? It’s free and easy to join – just head to our newsletter preference centre, press the ‘+’ button next to Independent Money, and enter your email address.

US stocks rise after interest rates cut

14:43 , Karl MatchettOk so the BoE might not have cut rates today - but Stateside, the Fed did.

The 25bps cut has seen stocks rise in the US as a result, with the S&P 500 up 0.3 per cent so far, shortly after opening.

Tech stocks have risen more, the Nasdaq up 0.6 per cent.

Among them, the world’s biggest firm Nvidia is up 1.8 per cent or so in early trading.

Brits missing out on £24bn in unclaimed benefit they are owed

15:00 , Karl MatchettMillions of households are missing out on vital support they are entitled to, as new research reveals the massive scale of benefits going unclaimed.

More than £24 billion will go unclaimed in 2025-2026, the report from Policy in Practice finds, with universal credit making up nearly half at £11.1 billion, followed by council tax support at £3.3 billion and carer’s allowance at £2.4 billion.

Spread between the seven million households estimated to be missing out, this would be an average yearly boost of £3,428.

The amount of unclaimed support increased by £2.7 billion from last year’s figure, excluding a few benefits to account for modelling changes.

CHECK YOURS:

Unclaimed benefits reach new high with households missing out on £24 billion

UK and European stocks rise, bitcoin up to $117k

15:20 , Karl MatchettPending any late afternoon drops - which happened a few times last week - it has been a relatively consistent day in the FTSE 100.

The index remains up 0.3 per cent overall, with data analytics company RELX still the intra-day leader up 3.3%.

Halma, Experian and Polar Capital are the other firms up more than 2% today.

In Europe, France’s CAC 40 and Germany’s DAX are both up around one per cent, while bitcoin is also up more than 1 per cent over the past day, at around $117,600 now.

Over in the US tech stocks continue to surge higher - the Nasdaq is up 1.06 per cent so far.

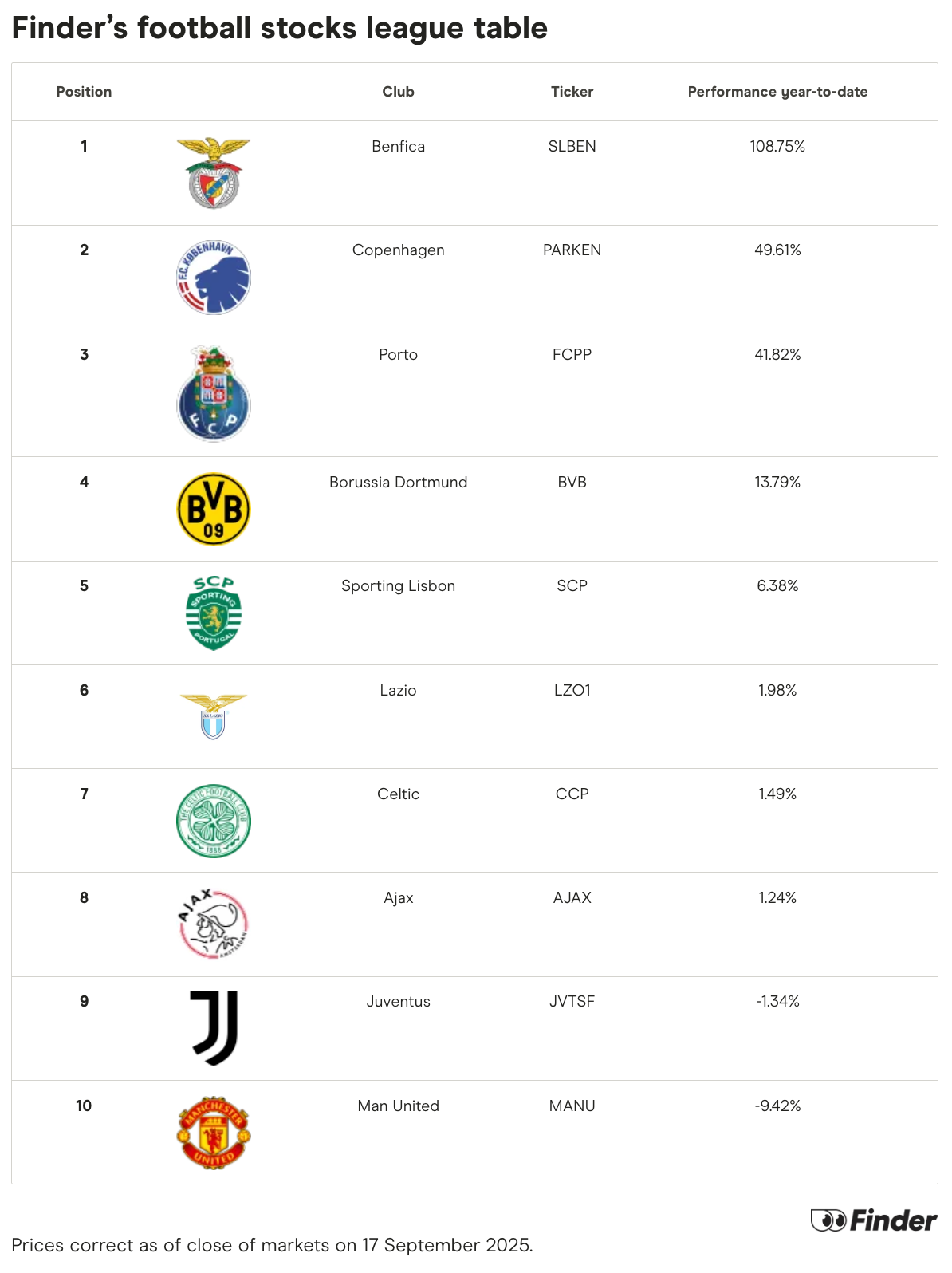

Football clubs' stock market table: Man United don't do well here, either

15:40 , Karl MatchettNiche, but related to that check-in on the stock markets - how many of you invest in some of Europe’s top football clubs?

The folk at comparison site Finder have run an analysis on which publicly-listed teams have performed best in share price terms over the course of 2025.

And - quite like in the Premier League - it’s not good news for Manchester United, who rank bottom of the tracked clubs.

The Premier League side have lost almost a tenth (-9.4%) of their value since the start of the year - contrasting with Benfica, whose share price has more than doubled (+108%).

Finder’s George Sweeney said: “It’s interesting to see that poor performance on-field can sometimes translate into below par results financially, but not always. It begs an interesting question, are the teams not living up to their fans’ expectations because of unsteady finances, or vice versa?

“It appears that decent performances and the position of league finishes doesn’t always translate to positive share price performance, but it certainly helps. Like with any investment, the stock price of football clubs will move based on the underlying financials and strength of the club.”

Workers affected by Jaguar Land Rover cyberattack told ‘to sign up for universal credit’

16:00 , Karl MatchettThe workers’ union Unite is calling for the government to offer a furlough scheme for workers caught up in the Jaguar Land Rover (JLR) cyber attack after some in the supply chain were reportedly laid off or advised to sign up for universal credit.

The union said thousands of workers in the JLR supply chain should have a furlough scheme similar to the one announced this week to support staff at bus manufacturer Alexander Dennis.

JLR was hit by a cyberattack several weeks ago and after an initial shutdown, has recently stated it will be unable to resume production until at least 24 September, while suppliers have been warned that disruption could continue until November.

Staff have been told not to return to work while production lines are still affected.

Full story:

Workers affected by JLR cyberattack told ‘to sign up for universal credit’

Nationwide give boost to homeowners with surprise mortgage rate cuts

16:15 , Karl MatchettUnexpected boost now for those seeking out better mortgage terms - one lender is cutting rates on some products.

Nationwide are bringing their lowest rate down as of tomorrow (Friday), which will now be 3.8%.

Maybe mortgage wars aren’t over after all...

“Nationwide will be cutting rates by up to 0.18 percentage points on selected two, three and five-year fixed rate products across its mortgage range, with its lowest rate now at 3.80%. The new rates will be effective from tomorrow, Friday 19 September and apply to new mortgage applications made from this date,” read a statement.

“The rate cuts will further support first-time buyers as well as those looking to move to a new home.”

Business and Money - 18 September

16:19 , Karl MatchettThat’s it for us today - it has been a busy one with interest rates, QT, stock market movements and more.

We’ll be back tomorrow with the latest business and finance news for you - see you all then.