The Bank of England's governor has warned that rising food prices could push up inflation to 4 per cent, after another cut to interest rates.

The Monetary Policy Committee voted 5-4 for a drop of 0.25 of a percentage point, despite concerns over soaring inflation and US president Donald Trump’s tariffs.

The cut will be seen as a positive for chancellor Rachel Reeves as the government seeks to boost economic growth.

Andrew Bailey said: “I still think the path is downward for interest rates. But there is genuine uncertainty about the course of that direction...

“Higher food inflation has contributed to overall inflation – we expect this to be about 4 per cent in September.”

But Mr Bailey said he expected food inflation to rise until Christmas.

He said the rate cut was a “finely balanced decision” after committee members were forced to hold a second vote after failing to reach a majority the first time.

The cut will be a boost to homeowners, but savers will be hit by lower interest on their cash.

Follow The Independent’s live coverage of the latest stock market and business news here:

Key points

- Reeves urged to raise taxes to cover £50bn fiscal hole

- FTSE 100 falls on opening as Trump tariffs come into effect

- How do interest rates affect your mortgages and savings?

- BREAKING: Bank of England cuts interest rates to 4%

- Two votes required to ensure rates were cut after initial 4-4-1 split

Fact check: Bank holds rates four times under Labour

18:52 , Jane Dalton

Fact check: Bank has held rates four out of nine times since Labour took power

Experts cautious over predicting further cuts

18:28 , Jane DaltonSome economists said the more cautious tone coming from the central bank could make further interest rate cuts this year less likely.

The pound strengthened after today’s decision, indicating that traders welcomed the potential for UK borrowing costs to remain higher for longer.

Sandra Horsfield, an economist at Investec, said she was expecting another 0.25 percentage-point cut in November, followed by further reductions in 2026 until the base rate reaches 3% next summer.

"However, our confidence in this view has diminished," she said.

Inflation peak higher than previously forecasted

17:55 , Jane DaltonInflation is expected to accelerate in the coming months, putting more pressure on household budgets.

Consumer price index (CPI) inflation is now on track to peak at 4% in September, surpassing previous guidance that it would peak at 3.5%.

The increased cost of living is largely being driven by higher energy and food prices, according to the Bank.

Food prices have jumped in recent months - with the cost of chocolate, coffee and beef all accelerating.

Inflation will remain higher than previously expected for the next two years - but drop below the Bank's 2% target rate by 2027.

Accountants cast doubt on more rate cuts this year

17:25 , Jane DaltonSuren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said: "The close vote split in favour of loosening policy suggests that policymakers are struggling to balance supporting a weakening economy with keeping a lid on rising inflation, inevitably casting doubt on further rate cuts this year.

"August's policy loosening is likely [to be] the beginning of the end of this rate-cutting cycle, with the bank's forecasts of higher inflation likely to push policymakers to press the pause button on interest rate cuts sooner rather than later."

One more rate cut this year predicted

16:50 , Jane DaltonAndrew Montlake, chief executive of Coreco mortgage brokers, said: "It now seems there is maybe just room for one more cut before the end of the year if inflation starts to play ball, and while you may see two- and five-year fixes reach around 3.5%, it is unlikely to fall much further.

"The last quarter of the year is set to be a busy time in the mortgage market as lenders battle for business in a competitive environment and borrowers take advantage of a buyers’ market while it is still around."

David Hollingworth, associate director at L&C Mortgages, said: "The good news for fixed-rate borrowers coming to the end of a deal is that rates have been falling.

"That's because today's cut was so widely expected that it's already allowed lenders the chance to improve their rates although it means we are unlikely to see fixes plummet further because of today's cut."

.jpeg?trim=0%2C0%2C0%2C0)

Home loans for some borrowers to fall by nearly £14 monthly

16:20 , Jane DaltonMortgage-holders on a standard variable rate (SVR) deal could have their monthly payments reduced by £13.87 on average, adding up to an annual saving of £166.44 - provided the lender passes on the base rate cut in full.

Borrowers often end up on an SVR when their initial deal ends and the rate is set by individual lenders but often follows movements in the base rate.

Effect of householders may be gradual, says expert

15:50 , Jane DaltonDean Butler, of Standard Life, said: “For borrowers, particularly those on variable rate mortgages or nearing the end of fixed-term deals, this move offers some relief.

“However, with household budgets still under strain from high living costs, the impact may be gradual rather than immediate.

“The path ahead remains uncertain, and further rate cuts in 2025 are not guaranteed.

“Savers face a more complex picture. Retail cash rates may begin to fall and with inflation still elevated, real returns on cash savings risk being eroded.

“Maintaining accessible cash for short-term needs remains sensible, but it’s increasingly important to consider long-term strategies.”

Tracker loan holders to save £29 a month

15:25 , Jane DaltonNearly £29 will be shaved off the monthly repayments of an average homeowner on a tracker mortgage, according to industry figures.

Banking and finance industry body UK Finance calculated that the reduction in the base rate, from 4.25% to 4%, will mean the typical mortgage holder on a deal that directly tracks the base rate will pay £28.97 per month less, based on the average balance outstanding.

Over a year, this adds up to a reduction of nearly £350 (£347.64).

Call for action to bring down cost of living

15:05 , Jane DaltonAshwin Kumar, director of research and policy at the Institute for Public Policy Research, said: “With growth reducing in the past couple of months, fewer employees paying taxes and Trump’s tariffs increasing global trade frictions, the Bank of England’s rate cut from 4.25 to 4 per cent is welcome but not enough.

“The Bank has kept rates too high for too long. Inflation is expected to return to target, with risks to the economy and global growth over the next few years warranting a larger cut of 0.5 per cent.

"The government has other options to ease pressures on households immediately - even as price increases are set to slow, essential costs remain high, and further action is needed to bring down the cost of living.

"One way to deliver swift support is by rebalancing energy bills: lowering electricity prices, helping with energy debts, and ensuring that households access the cheapest energy prices on offer."

Chambers of Commerce back rate cut

14:45 , Jane DaltonDavid Bharier of the British Chambers of Commerce said the Bank is right to act to “mitigate the risk of a deeper downturn”.

“SMEs in particular have been under sustained pressure from cumulative cost increases and external shocks.

“The impact of April’s national insurance rise is now tangible, with firms reporting reduced investment and recruitment plans.

“Rate cuts alone are only part of the solution. To restore business confidence, firms will need to see a roadmap to lower their cost burden, further improvements to ease trade friction, and greater investment in AI and infrastructure.”

Explained: How lower interest rate pushes up inflation

14:25 , Jane DaltonAccording to the Bank of England, lower interest rates mean it is cheaper to borrow money and there is less incentive to save.

This encourages people to spend and so increases the rate of inflation.

Blow for Reeves as Bank predicts Christmas dinner misery for millions

14:12 , Kate DevlinThere is no such thing as a free lunch, or, in this case, a free Christmas dinner.

Even as he unveiled an interest rate cut that will be hailed as good news for millions of mortgage-payers, the governor of the Bank of England warned that the institution forecasts inflation will continue to rise, especially food inflation.

While inflation overall is predicted to peak at 4 per cent in September, food inflation will continue to rise to 5.5 per cent between now and Christmas.

The figures will also come as a blow to the chancellor – just days after she was warned she faces a £50bn black hole in the government’s finances.

Guinness is helping Wetherspoons thrive — so why is its own parent company struggling?

14:00 , Karl MatchettAnalysis: Guinness maker Diageo has been on a downward curve for three years. Now a new CEO faces a big turnaround task, writes Karl Matchett

Guinness is helping Wetherspoons thrive — so why isn’t its own parent company?

Ombudsman receives fewer complaints about scams and ‘unaffordable’ lending

13:30 , Karl MatchettThe number of complaints about financial firms where the ombudsman was called on to step in has fallen to its lowest level in more than a year, with fewer gripes recorded about issues such as perceived unaffordable lending and fraud.

The Financial Ombudsman Service (FOS) said the fall in case numbers has been particularly significant across certain issues.

Between April and June, it received 10,000 new cases related to perceived irresponsible and unaffordable lending – less than half of the 21,600 complaints received a year earlier.

Similarly, the most complained-about issue it is currently seeing – motor finance commission – also saw a drop in complaints, from 36,000 cases between January and March to 21,500 cases processed between April and June.

More detail from PA:

Ombudsman receives fewer complaints about scams and ‘unaffordable’ lending

Bailey says path of rates uncertain

13:14 , Jane DaltonBank governor Andrew Bailey said: “There are different camps who think where the neutral rate would be.

“I still think the path is downward for interest rates. But there is genuine uncertainty about the course of that direction.

“The path has become more uncertain because of what we’re seeing: we’re seeing an upside risk with inflation, but we’ve got a downside risk with the weaker labour market story. We’re balancing that.

“I certainly haven’t changed my view on the direction of the path, it’s more a question of what time it takes.

“Higher food inflation has contributed to overall inflation - we expect this to be about 4% in September. There are good reasons to think this rise in headline inflation will not persist,” he said.

Money expert urges savers to seek out best deal: 'Lots of fantastic options out there'

13:05 , Karl MatchettJohn Dentry, of the UK’s Current Account Switch Service, has underlined the need for people to take stock of their financial situation and ensure their cash is in an account giving them as high a rate of interest as possible, even after that limit was lowered today.

“The Bank of England is cautiously trying to encourage economic growth. High levels of inflation have certainly complicated the picture, but reviving the economy is clearly a priority this time round,” he said.

“While these moments are big for the market, for consumers, its important to remember that the Banks are filled with plenty of smart analysts predicting what might happen to the base rate. This means they usually ‘price-in’ a cut before it happens, which is why you’ve likely seen mortgage and savings rates gradually fall throughout the year.

“A lot of people only look at their bank account options when rates are going upwards. Now that they’re coming down, it’s just as important to ensure your bank fits your financial priorities.

“There are lots of fantastic options out there, so make sure you’re constantly reassessing your provider and finding the perfect home for your cash.”

No change to view on economic prospects despite raised GDP estimates

12:56 , Karl MatchettOn raised GDP expectations, Andrew Bailey explains there’s no major update in overall Bank of England view on the UK’s economic prospects, but that figures pushed higher simply reflects data received over the past few months.

“That’s all on data releases we’ve had. There really isn’t much of a change in our GDP profile - the change is to capture data rather than a change in view, it’s just incorporating changes which aren’t very big,” he said.

“It’s a very small change in the forecast compared to previously,” adds fellow MPC member Clare Lombardelli.

BoE: Still a downward path for interest rates

12:49 , Karl MatchettAndrew Bailey says there’s more uncertainty over where interest rates go from here, but he still believes it will ultimately be downwards.

“There are different camps who think where the neutral rate would be. I still think the path is downward for interest rates. But there is genuine uncertainty about the course of that direction,” he says.

“The path has become more uncertain because of what we’re seeing: we’re seeing an upside risk with inflation, but we’ve got a downside risk with the weaker labour market story. We’re balancing that.

“I certainly haven’t changed my view on the direction of the path, it’s more a question of what time it takes.

“My vote was not motivated by concerns over risks for a recession.”

Bank of England took two votes to cut rates today

12:45 , Karl MatchettThe Bank of England report shows that two votes were needed today to cut the interest rates.

The MPC has nine members; initially four voted in favour of a cut: Andrew Bailey, Sarah Breeden, Swati Dhingra and Dave Ramsden.

Four members - Megan Greene, Clare Lombardelli, Catherine L Mann and Huw Pill - then preferred to maintain the Bank Rate at 4.25%.

And one member (Alan Taylor) preferred to reduce Bank Rate by 0.5 percentage points, to 3.75%.

The second vote therefore was required, with Mr Taylor then opting for a 0.25 percentage points cut and a 5-4 swing to do so.

Bank of England: Late 2027 the projection for controlled inflation

12:40 , Karl MatchettMr Bailey continues: “Inflation returns to 2% in September 2027 in our main projection and remains there thereafter.”

However, the governor highlights risks including global trade tariffs which can impact this - and even warns of the potential to fall below the 2% target.

“Economic growth is subdued and consumption growth may take longer to pick up - that can lead to inflation falling below 2% in the months ahead.

“We will do what it takes to return inflation to 2 per cent target. Based on the outlook, a gradual and careful approach remains appropriate.”

Andrew Bailey: Good reasons to think inflation will not persist

12:36 , Karl MatchettAndrew Bailey, the Bank of England governor, is describing what comes next in the UK economy.

“Higher food inflation has contributed to overall inflation - we expect this to be about 4% in September. There are good reasons to think this rise in headline inflation will not persist,” he says.

“There has been progress on services disinflation. Pay growth, a key component of cost pressures in the UK economy, has declined recently.”

A chart is shown with decreasing private sector regular pay growth, with the expectation that eases further later this year - average pay rises are expected at 3.5-4% on average.

Interest rate cuts: Savings and bills impact

12:29 , Karl MatchettNow, just before the Bank of England press conference, on how interest rates impacts your savings and bills.

For your money in bank accounts, always make sure your savings are in a proper savings account, preferably an easy-access one for “immediate” money you might need which pays as high a rate of interest as possible. Shop around for one if you haven’t already - don’t leave money earning zero interest as inflation means you actually lose out over time.

However, do note that easy access savings accounts are usually variable rates, so they are likely to decrease in line with this BoE interest rate cut.

If your cash is in a fixed term deal or bond account, it won’t impact - you’ll get the same rate you signed up to. If you have a “regular saver” type account, that also shouldn’t change if it’s one with a guaranteed rate, typically allowing you to save a set amount for one year or similar.

For bill repayments on interest, such as credit cards or loans, always check your specific deal to see if rates are variable or based on the variable rate - but ideally pay off credit cards first as they are usually far more costly ways to borrow money.

Interest rate cuts: Mortgages impact

12:25 , Karl MatchettRight, quickfire reminder of impact.

First of all concerning mortgages. The interest rate change will only directly affect you if you are on a certain type of product. If you have a fixed deal, like a two-year or five-year term, your interest rate remains the same until you change it for a new one.

It also won’t directly affect the mortgage market immediately in terms of what rates are on offer - the banks and building societies use swap rates (basically future predictions of what the interest rate will do) to set their products.

However, if you’re in the process of applying for a mortgage, today could well affect you.

Charles Roe, director of mortgages at UK Finance, explains:

“Today's rate cut by the Bank of England takes us back to where we were just over two years ago when rates were last at 4 per cent. While most mortgage holders are on fixed-rate deals, the cut will be welcomed by those on tracker or variable rate mortgages. This rate reduction should also help new mortgage applicants, as affordability and overall borrowing costs could improve.”

Conservatives accuse Labour of pushing up inflation

12:20 , Kate DevlinDespite interest rates coming down, shadow chancellor Sir Mel Stride has pointed the finger at Labour for recent inflation increases.

Mr Stride said: “Rachel Reeves claims credit for interest rate cuts - but rates are coming down to support the weak economy she has created. Inflation has almost doubled on her watch and unemployment is rising.

“Interest rates should be falling faster, but Labour’s Jobs Tax and reckless borrowing have pushed inflation well above target.

“With economists warning Labour have created a £50 billion black hole and the Chancellor refusing to rule out further harmful tax rises, Labour are showing they don’t understand the economy.”

Chancellor Rachel Reeves welcomes interest rate cut

12:17 , Kate DevlinChancellor Rachel Reeves said the fifth interest rate cut since last year's election “is welcome news, helping bring down the cost of mortgages and loans for families and businesses.”

Ms Reeves added: “The stability we have brought to the public finances through our Plan for Change has helped make this possible and helped us become the fastest growing economy in the G7 in the first quarter of this year.

“We’re locking in this growth in the long run by investing over £113 billion in infrastructure, securing three major trade deals and embracing the technologies of the future – to drive up wages and improve living standards across the UK.”

'Struggling households are unlikely to feel much let-up' from rate cut

12:12 , Karl MatchettWhile interest rates dropping will be a positive for repayments, a leading finance charity has explained it is still imperative that those needing support due to the cost of living crisis are unlikely to see much benefit.

That’s due to food inflation in particular continuing to surge, with unemployment also rising recently.

Steve Vaid, CEO at Money Advice Trust, the charity that runs National Debtline, said:

“The cut to interest rates will help people on tracker mortgages, and those looking to buy or remortgage. But for many struggling households, the bigger – and more worrying – picture is in the backdrop of this cut. Inflation, driven by increases in food prices, is directly hitting people’s pockets, being felt in the weekly shop and stretching some people’s budgets to breaking point.

“With significant uncertainty in the economy, and unemployment on the rise, struggling households are unlikely to feel much let-up as a result of this cut.

“However, there is help out there. I’d encourage anyone worried about their finances to speak to a debt advice charity, like National Debtline, as early as possible. You can also contact your lender. While it can feel difficult, they are required to offer you support if you’re struggling.”

Bank of England: 'Inflation has increased but will fall back'

12:07 , Karl MatchettExplaining its decision to cut interest rates today, the BoE says that although inflation has increased this year “as expected”, they fully anticipate that starting to fall again.

The government-set target rate of inflation is 2 per cent - this has recently been achieved in the Eurozone, but the UK’s level is still at 3.6 per cent according to latest data.

A statement on the matter from the BoE explained inflation will keep rising for now, but will then fall back into next year:

“Inflation has fallen back significantly since its peak of over 11% in 2022. Inflation has increased again recently, but by a much smaller amount. It is likely to rise to around 4% in the next few months, partly because of higher food prices. We expect it to start falling back towards our 2% target after that.

“There has been uncertainty from global developments, including because of changes in global trade policies. While recent trade agreements mean there is less uncertainty than earlier in the year, we continue to watch closely what this could mean for UK inflation.

“We need to be confident that inflation will remain low and stable in a lasting way. We will judge how far and how fast we can cut interest rates to achieve this.”

CONFIRMED: Bank of England cut interest rate to 4%

12:00 , Karl MatchettThe Bank of England has confirmed a cut to interest rates, down to 4% - the lowest level since March 2023.

While the outcome was expected, analysis will focus more on the split of votes and the BoE’s predictions for economic growth, inflation and the UK jobs market in the coming months.

It marks a third interest rate cut of the year by the Monetary Policy Committee, and a fifth since rates started coming down again in August of last year, from a high point of 5.25%.

Bank of England interest rate announcement imminent

11:54 , Karl MatchettHere’s how the next hour or so will pan out:

At noon we’ll get the decision, we’ll get plenty of expert comment and the interest rate change (assuming predictions are right) will take effect.

Then at 12:30 we get a press conference at the BoE where the voting members will explain upcoming economic expectations and more.

No doubt a lot of political reaction and public expectation to follow this afternoon too.

Interest rates chart: The fall and rise in the UK

11:47 , Karl MatchettHere’s a more graphic representation of just how high interest rates rose as inflation spiralled under the last government - and how rates are still only slowly coming back down under this one.

For over a decade, borrowing money was super cheap, very nearly free.

Anyone with repayments to make between 2020 and 2023 got a bit of a shock to the system if their deal was tracking the base rate, that’s for sure.

But we are, as the right side of the chart shows, on a steady path downwards in the past year or so. “Gradual and careful,” the BoE calls it.

Plenty say that even this is too fast though, with inflation having been rising once more of late.

.jpeg)

Supermarket wars continue with new cheapest store

11:40 , Karl MatchettThe UK has a new cheapest supermarket, if you’ve not already heard - Aldi lost the title for the first time in two years.

You can read more about that here including how loyalty cards impact (or don’t!), and you can vote in our poll below to tell us where you shop too!

Households still cautious over future tax burdens - expert

11:30 , Karl MatchettAside from being a negative for savers, most households will generally see an interest rate cut as a positive.

However, the savings it makes them on bills and borrowing may not feed through to spending immediately, says one expert - because of fears about what lies ahead.

That’s particularly prevalent given talk of more taxes in the Budget this autumn.

“Investors are primed for an interest rate cut from the Bank of England later today, given the highly sluggish nature of the economy, and the rising unemployment rate,” said Susannah Streeter, head of money and markets, Hargreaves Lansdown.

“There will be hopes that if loans become cheaper, it will help boost consumer and business confidence but there’s a long way to go. In the meantime, speculation over potential tax rises in the Autumn Budget may keep households and companies cautious, given the uncertainty over where extra burdens may land.

“There will be a lot of focus on the voting split on the Monetary Policy Committee, given that the views are highly unlikely to be unanimous, and the leaning of members could help indicate the speed of future rate cuts.”

Interest rates and mortgages: Saving money, or overpay the difference?

11:20 , Karl MatchettIf you’re on a tracker mortgage rate (or if you’re soon to negotiate down a deal from a couple of years ago) then an interest rate cut today could be to your benefit, saving a bit of outgoing money.

However, if you still put that into paying off your property (if your terms allow - always check!) then it can save you way more in the long run.

Jinesh Vohra, CEO of mortgage app Sprive, said: “Around one in five (17 per cent) mortgage holders are currently on variable rate mortgages, and if the Bank of England cuts the base rate today, their mortgage rate will drop as a result.

“For example, someone with a £150,000 mortgage at 4.25% over 25 years currently pays around £812 a month.

If the rate is cut by 0.25%, their monthly payment would fall to £791 — a saving of £21 a month, or £252 a year.

“While it might be tempting to enjoy that saving, those who can afford to should consider maintaining their current payment level and using the £21 saving to overpay their mortgage instead. Doing so could save them £4,280 in interest and help clear their mortgage 1 year and 1 month earlier.

“Overpaying is one of the most powerful ways to become mortgage-free faster. Even small, regular overpayments can knock years off the term and save thousands in interest — helping mortgage holders reach financial freedom sooner, without stretching their budget.”

Companies latest: Deliveroo, WPP, InterContinental

11:07 , Karl MatchettHere’s a quick wrap of the latest companies announcements and financials this morning:

Deliveroo saw sales increase in the first half of the year with more people ordering takeaways, but the company swung to a loss even so. It is set for a takeover by DoorDash later this year in a £2.9bn deal.

Advertising firm WPP has cut 7,000 jobs and saw profits drop from £338m a year ago to £98m this year as a tough year continues. Shares were down 2.7 per cent this morning and have dropped by more than half this year.

And Holiday Inn’s owner, InterContinental Hotels, said a key metric in revenue per available room has slowed - but overall pre-tax profits rose 13 per cent from last year.

Mortgage market facing a reckoning as super-cheap deals come to an end

10:40 , Karl MatchettAside from the questions of inflation and economic growth, there’s one additional big reason why lots of people hope for interest rate cuts, now and in the coming months.

Many thousands of homeowners are set to see their five-year fixed term mortgage deals expire in the second half of 2025 - and given interest rates were 0.1 per cent for most of 2020, it’s fair to say the increased payments they face will be a big shock to the system.

One mortgage broker suggests the fall-out will dampen down house prices and many need to reassess their financial positions.

Ranald Mitchell, from Charwin Mortgages, said: “For many borrowers, 2025 will prove the hangover after the house party. Millions are waking up to find their cheap-as-chips pandemic mortgage deals have vanished, replaced with monthly payments that bite.

"For five-year fixers coming off sub-2% rates, some are facing £300–£500 extra a month. It’s not just a shock, it’s a financial slap. This won’t crash the market, but it will chill it. Potential movers may pause and reflect on their new monthly financials. The days of borrowing big and breezing through affordability checks are over.”

FTSE 100 an outlier as global stock markets rise

10:20 , Karl MatchettAcross most global markets, shares were on the up overnight and today despite those tariffs coming into effect - the UK’s FTSE 100 is very much an outlier there, as AJ Bell’s Danni Hewson explains.

“The FTSE 100 is struggling to make meaningful progress this week, running to stand still as investors weigh the latest economic, geopolitical and corporate developments,” says Ms Hewson.

“Not helping today was several heavyweight names trading without the rights to their dividend. This held the index back despite gains on Wall Street and across Asia. Investors are largely greeting widespread tariffs taking effect with a shrug.

“The exception again was India, with the Trump administration ordering a big increase in tariffs to punish the country for buying and selling Russian oil.”

UK not facing threat of stagflation - bank expert

10:00 , Karl MatchettWith economic growth still a struggle to find, you may hear the term “stagflation” being used.

That shouldn’t the case, says one industry expert - it’s not the situation the UK faces right now.

Will Hobbs, from Barclays private bank and wealth management, said current indicators do not suggest the UK is any more at risk of that than previously.

“Given the current margins for error in the UK’s economic dataset, it remains possible to tell almost any story you want on the UK’s economic outlook. Our optimistic [view] rests in part [with] household balance sheet and rising real incomes, both of which provide a buffer against broader uncertainty.

“Of course, there are multiple factors to consider. We, like the consensus, expect the Bank of England to cut rates, likely following a fairly even vote split.

“We would resist overuse of the term ‘stagflation’ to describe the UK’s position. The misery indices (unemployment plus inflation), looks unremarkable today relative to the experience of the last century.”

How interest rates impact on your money, savings and bills

09:40 , Karl MatchettIf you have money in a savings account, it’s the other side of the see-saw to mortgages: rates going down mean you’ll earn less interest.

As there’s still a bit of a fierce battle raging among banks and building societies for customers, it’s still possible to get good deals if you are happy to lock in money for a fixed period of time or contribute regular amounts, with several offering around 4.5 per cent or even more.

There are always terms and conditions to be met, so ensure it suits your circumstances, but the opportunity remains there to save and earn money at a better rate than inflation, which currently sits around 3.5 per cent.

Do be aware of the amount of interest you can earn without being taxed, though. If your savings account interest rate isn’t fixed, banks can always change the rate you get up or down.

A tax-efficient way of saving is to use a Cash ISA, where everyone has a £20,000 personal allowance each year.

Credit card repayments and bank or car loans are of course also affected by interest rates, as the amount they all charge for borrowing will be altered.

For credit card users, it’s always ideal to pay off the full amount each month if you are able to, to avoid interest being charged at all - depending on your circumstance and the account type, they can be one of the more costly ways to borrow.

For more info see here.

What do interest rate cuts mean for mortgages?

09:20 , Karl MatchettBroadly speaking, as increasing interest rates over the last few years have meant mortgage repayments going up, then the reverse should also hold true: lower rates, lower repayments. However, there are several important things to note.

Firstly, that it’s only the interest on the repayments which should change — your capital repayments will naturally decrease the more you pay off your mortgage. Secondly, the base rate isn’t the rate you are necessarily charged by your bank or lender for the mortgage — they’ll base theirs off the BoE rate but it doesn’t have to be the same.

More than half a million people do, however, have a mortgage which tracks the BoE interest rate and those will see an immediate change. Far more have fixed term deals which expire each year and need renegotiating.

Additionally, if you’ve got a fixed term on a mortgage plan, you won’t see a change in any case until that comes to an end.

New mortgage products tend to be based on swap rates - future expectations of interest rates movements rather than the current Bank Rate, as it’s officially known.

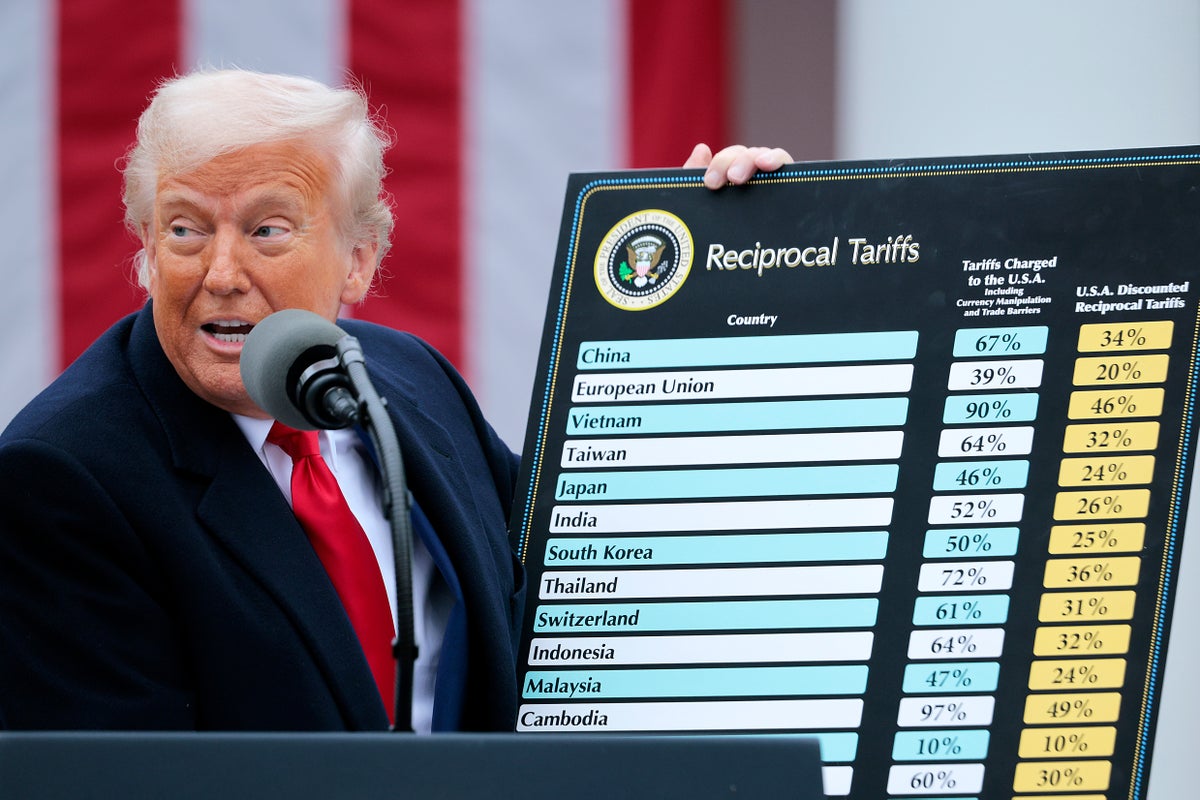

Trump’s new import tariffs now in force against scores of countries

09:00 , Karl MatchettNew tariff rates on U.S. imports, initiated under President Donald Trump's administration, came into effect on Thursday, marking a significant development in his reshaping of global trade.

These measures include potential tariffs of up to 200% on pharmaceutical imports and a 100% import tax on computer chips.

Most U.S. imports of copper, steel, and aluminium are now subject to a 50% duty.

Significant uncertainty persists, with no agreement yet reached on tariffs for products from China.

India also faces a potential 50% tariff, as the U.S. pressures the nation to cease oil purchases from Russia.

Full details here from Elaine Kurtenbach:

Trump’s new import tariffs now in force against scores of countries

Bank of England's forward guidance key after rate vote - expert

08:40 , Karl MatchettGeorge Vessey, lead macro strategist at Convera, is expecting another three-way split in the MPC voting.

But the more interesting element of the BoE’s explanation might be their guidance for what comes next, he says.

Economic growth still isn’t great, and that - plus jobs data - weighs against inflation.

“The BoE is expected to cut rates to 4.00 per cent today. However, given the mixed signals from recent economic data, we anticipate a three-way vote split, with two members favouring no change and two advocating for a more aggressive 50bps cut.

“There has not been a single unanimous vote in this cycle and this divergence reflects the tension between persistent inflation concerns and signs of economic slack.

“With the cut largely priced in, attention shifts to the committee’s forward guidance specifically, whether it will reaffirm its pattern of quarterly reductions or hint at a change in pace. The key uncertainty hanging over this meeting is the risk of a deeper deterioration in the labour market. So far, the evidence points to a gradual weakening rather than a sudden downturn. At the same time, inflation remains persistently high, especially in the services sector, adding another layer of complexity to the policy outlook.

“Overall, we expect the August forecasts to closely mirror May’s Monetary Policy Report, with only modest adjustments: inflation steady, GDP slightly higher on reduced tariff drag, and softer labour market projections.”

FTSE 100 falls after opening as Trump tariffs come into effect

08:20 , Karl MatchettPresident Trump gave a one-week delay to his new tariff rates coming into force last week but that day has now arrived and with it comes a morning slump in the stock markets.

US stocks moved last night and Asian markets also have remained mostly strong overnight, with rises in the Shanghai, Japan’s Nikkei 225, the KOSPI in Korea and Vietnam’s VN30 - an outsized performer itself of late.

This morning however the FTSE 100 has dropped 0.2 per cent in early trading, with Germany’s DAX flat and the Euro Stoxx 50 index up 0.3 per cent.

Interest rates decision: All the key details - PINNED POST

08:02 , Karl MatchettOK here’s what you need to know in a flashcard:

What time: 12 noon

Who votes: The nine MPC members of the Bank of England

What’s predicted: A 25 basis points cut, which means 0.25 percentage points off the current interest rate of 4.25 per cent, giving a new rate of 4.00 per cent

How many votes are needed: A majority, so five. A 5-4 split happened in May for example, with some voting for a double cut

When will a cut come into force: Immediately, if voted for

Reform gambling laws to cover child poverty cost, says think tank

07:48 , Karl MatchettGordon Brown has urged ministers to hike taxes on online casinos and slot machines to cover the cost of lifting children out of poverty.

Reforms to gambling taxes could generate the £3.2 billion needed to scrap the two-child limit and benefit cap, the Institute for Public Policy Research (IPPR) said.

The think tank’s latest research said axing the policies could lift half a million children out of poverty and “reverse years of rising hardship for low-income families”.

More here.

Rachel Reeves faces ‘impossible trilemma’ and must raise taxes

07:30 , Karl MatchettRachel Reeves faces an “impossible trilemma” ahead of the autumn budget and must raise taxes or tear up her flagship borrowing rules to fill a £50bn black hole left by Labour U-turns, higher borrowing and sluggish economic growth, top economists have warned.

The National Institute of Economic and Social Research (NIESR) – a leading economic think tank – said the chancellor could also look at spending cuts in the autumn Budget as a way to raise the money needed by 2029-30 to remedy a £41.2bn shortfall on her borrowing targets, set out by her self-imposed “stability rule”.

In order to restore the £9.9bn buffer the government has maintained since last year’s Budget, the chancellor must therefore raise a total of £51.1bn.

Millie Cooke and Kate Devlin have the detail:

Reeves warned she must raise taxes or cut spending to plug £50bn black hole

What affects decisions over interest rates?

07:17 , Karl MatchettThe MPC have a lot to weigh up before deciding whether to hold, cut or raise interest rates at any given point.

Right now, members will be considering domestic inflation as a primary factor, for sure, but also economic growth and business investment prospects, and job vacancies and unemployment.

Cutting rates are one way to stimulate economic growth by lowering borrowing costs, which can bring more business investments and hiring, more jobs, more spending power.

That’s more what the UK seems to need at present.

Will interest rates be cut today?

07:07 , Karl MatchettThe Bank of England’s (BoE) next meeting to determine interest rates is on Thursday 7 August, and all eyes will be on the Monetary Policy Committee (MPC) and whether its members opt to continue lowering rates.

The base rate - currently at 4.25 per cent following cuts in February and May - impacts consumers and taxpayers through everything from their mortgages to savings, so what do experts foresee both next week and beyond?

Will interest rates be cut tomorrow? Key factors and 2025 predictions

Interest rates and latest business news

06:58 , Karl MatchettMorning all and welcome to The Independent’s live business coverage.

Today’s main focus will be the Bank of England’s meeting later on and the MPC’s decision over interest rates.

Elsewhere we’ll keep you posted as always on the latest company news, stock market updates and everything else that affects your money matters.