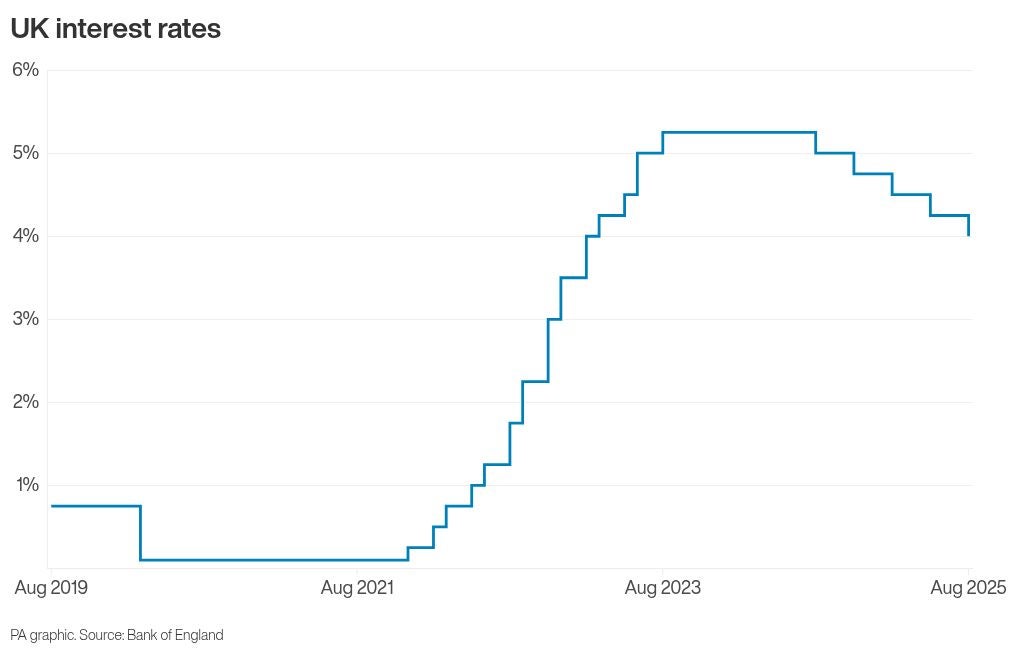

UK interest rates have been cut to their lowest level since March 2023, despite the Bank of England predicting a sharp rise in inflation amid accelerating food prices.

The central bank chose to reduce interest rates to 4% from 4.25%, pointing towards a recent fall in wage inflation and reduced uncertainty over the impact of US tariffs.

The cut came after the Bank’s nine-person rate-setting committee was forced to take a second vote for the first time in its history.

The Bank’s Monetary Policy Committee (MPC) initially saw four of its committee vote for the 0.25 percentage point reduction, four vote to keep rates at 4.25% and one, Alan Taylor, vote for a 0.5 percentage point cut.

Governor Andrew Bailey then led a second vote, when Mr Taylor gave his backing for a cut to 4%, providing a majority of five to four.

Mr Bailey said: “We’ve cut interest rates today, but it was a finely balanced decision.

“Interest rates are still on a downward path, but any future rate cuts will need to be made gradually and carefully.”

Lower interest rates will be welcomed by Chancellor Rachel Reeves, and the move is likely to reduce the Government debt payment costs.

It comes after warnings from the NIESR think tank that the Chancellor may need to find a further £40 billion through tax rises or spending cuts in her autumn Budget in order to balance the state finances.

Firms were already hit by significant tax and wage cost increases in April after Ms Reeves’ first Budget.

In its fresh report, the Bank of England warned that UK businesses said increased national insurance contribution payments and uncertainty caused by the tax rise have “weighed on growth”.

The Monetary Policy Committee voted by a majority of 5-4 to cut interest rates to 4%.

— Bank of England (@bankofengland) August 7, 2025

Find out more in our #MonetaryPolicyReport https://t.co/jtJlDzsgEC pic.twitter.com/chFJVqXZoo

Nevertheless, the Bank raised its economic growth forecast for this year, predicting that GDP (gross domestic product) will grow by 1.25% in 2025, up from its previous estimate of 1%.

It comes despite latest figures from the Office for National Statistics showing that the economy contracted in both April and May.

Bank officials indicated that the economy is still likely to have grown by 0.1% over the second quarter, and predicted this will pick up further through the year amid hopes that reduced interest rates will encourage spending.

Meanwhile, inflation is expected to accelerate in the coming months, putting more pressure on household budgets.

Consumer price index (CPI) inflation is now on track to peak at 4% in September, surpassing previous guidance that it would peak at 3.5%.

The increased cost of living is largely being driven by higher energy and food prices, according to the Bank.

Food prices have jumped in recent months, with the cost of beef, chocolate and coffee all accelerating.

The inflation reading for September could also be influential as it is typically used to decide how much benefits increase the following year and is also one aspect of the pension triple lock.

The triple lock means that pensions will rise by the highest of the September inflation reading, wage inflation for the month, or 2.5%.

Inflation will remain higher than previously expected for the next two years.

The Bank said inflation is now on track to drop down to the 2% target rate set by the Government in 2027.

On Thursday, the Bank also said it now had increased clarity over the potential impact of US President Donald Trump’s tariff regime compared with its previous report in May.

It said tariffs will now drag down UK economic growth by 0.2 percentage points, down from 0.3, after the Government’s trade agreement with the US.

Interest rates live: Mortgage boost as Bank cuts rate for third time this year

The Bank of England cuts its main interest rate to 4%, the lowest level since March 2023

Homelessness minister urged to resign after ‘hiking rent at London townhouse by £700’

O2, Three and iD Mobile most complained-about mobile providers – Ofcom

WPP reveals around 4,000 roles cut in past six months as profits tumble

Rachel Reeves should exempt defence pledge from budget rules, says Gordon Brown