Intel Corp. (NASDAQ:INTC) gained 4.48% in after-hours trading on Thursday after climbing 7.38% during the regular session, according to data from Benzinga Pro. The stock was seen trending among investors.

Government Talks Signal Major Shift For Intel

The surge and the investor interest come following reports about a potential government investment stemming from the latest meeting between President Donald Trump and Intel CEO Lip-Bu Tan. The stake, still undefined in size, has reportedly been aimed at boosting Intel's long-delayed Ohio fab project.

Intel CEO Was Facing Trump's Wrath Just Days Ago

Intel CEO Tan earlier this month faced criticism from Trump over his business ties to China, with the president calling for his removal.

The criticism primarily stemmed from Tan's tenure at Cadence Design Systems, where his venture capital firm invested in Chinese companies and participated in a business that engaged with institutions linked to China's military.

Following this, Tan went to meet Trump at the White House, after which a company statement described the Monday meeting as "candid and constructive," signaling Tan's likely continuation as CEO.

See Also: American Airlines CFO Declares Worst Is Over, But Cautious Outlook Sinks Stock

Jim Cramer And Others React To Intel-Trump's Latest Development

Wall Street analysts offered mixed reactions. CNBC's Jim Cramer took to X, formerly Twitter, and noted that Intel's balance sheet "is not good," and suggested a government stake could complete projects that former CEO Pat Gelsinger struggled to fund.

Meanwhile, Tim Seymour of Seymour Asset Management appeared on a CNBC segment and warned that nationalizing a company is "not conventional" and historically triggers sell-offs, though he acknowledged the political and strategic context.

Ohio Fab Revival Could Reshape Intel's Future

The government backing would specifically target Intel's Ohio factory hub, which has faced repeated delays and financial hurdles, with completion now projected into the 2030s.

When completed, it could fulfill earlier promises of becoming the world's largest chipmaking facility.

But, Intel Still Faces Competitive Pressures And Executive Challenges

Intel is already under pressure from rivals Advanced Micro Devices, Inc. (NASDAQ:AMD) and Qualcomm Inc. (NASDAQ:QCOM), which are gaining market share in key segments.

Executive instability and workforce reductions under Tan, coupled with delayed projects, have added to investor concern. Fitch earlier this month downgraded Intel's credit rating due to uncertainty in its foundry pivot.

Intel's Financial Performance And Stock Outlook

Intel reported second-quarter revenue of $12.86 billion, beating estimates of $11.91 billion, but missed on adjusted earnings, posting a 10-cent loss per share versus expectations of a one-cent gain.

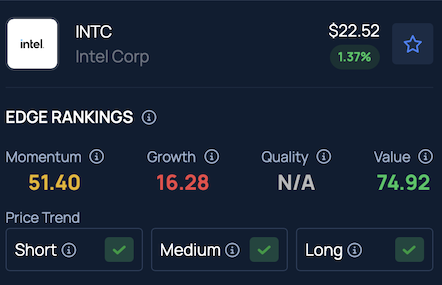

Analysts' consensus price target stands at $23.77, with a high of $36 and a low of $14. Based on the latest ratings from JPMorgan, Rosenblatt and Loop Capital, Intel has an average price target of $20, which implies a 19.78% downside.

Benzinga's Edge Stock Rankings show Intel maintaining an upward trend across short, medium and long-term periods. Additional performance details are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Tada Images via Shutterstock.com