/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC) shares opened comfortably in the green on Friday after the Nasdaq-listed firm posted its first quarterly profit in nearly two years.

Under its new chief executive, Lip-Bu Tan, the semiconductor behemoth reported $4.1 billion net income for its Q3, a sharp turnaround from an over $16 billion loss in the same quarter last year.

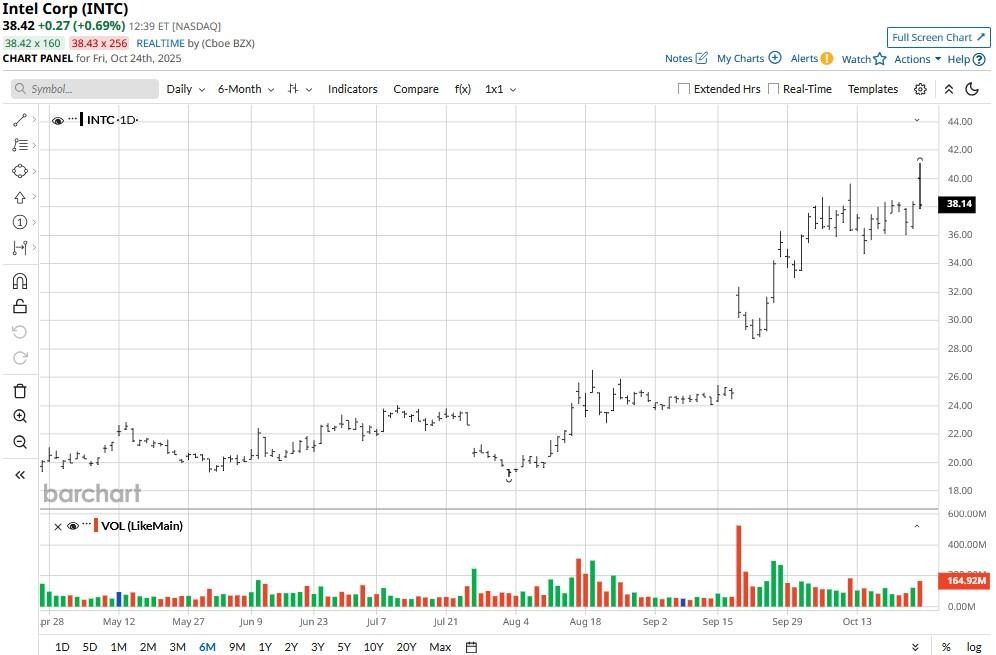

At its intraday peak, Intel stock was seen trading over 115% above its year-to-date low on Friday.

Is Intel Stock Worth Buying for the Long Term?

Intel’s better-than-expected Q3 earnings arrive shortly after a report that Microsoft (MSFT) has signed on to manufacture its next-gen Maia artificial intelligence (AI) chips using INTC’s advanced 18A or 18A-P process.

Media reports earlier this month also suggested Advanced Micro Devices (AMD) is in early talks to begin manufacturing its sophisticated chips at Intel Foundry.

These speculations, together with the company’s strong third-quarter print on Friday, signal Intel may just succeed in “pulling [its turnaround] off,” Ray Wang, chairman of Constellation Research, told CNBC today.

If confirmed, MSFT’s vote of confidence could bring other hyperscalers to Intel Foundry as well, potentially transforming INTC stock into a long-term AI winner.

Where Options Data Suggests INTC Shares Are Headed

While challenges remain, options traders seem to be pricing in continued upside in Intel stock over the next few months.

According to Barchart, contracts expiring Jan. 16 currently indicate potential for INTC shares to print a new high above $45.

In the near term, through the end of next week, the expected move is 6.01%, with the upper bound at $40.92 and the lower bound at $3.6.28.

Given that Intel has already secured billions in commitments from Nvidia (NVDA), Softbank (SFTBY), and the White House to accelerate its foundry offensive against Taiwan Semi (TSM), the upside indeed looks more likely to play out in this semiconductor stock.

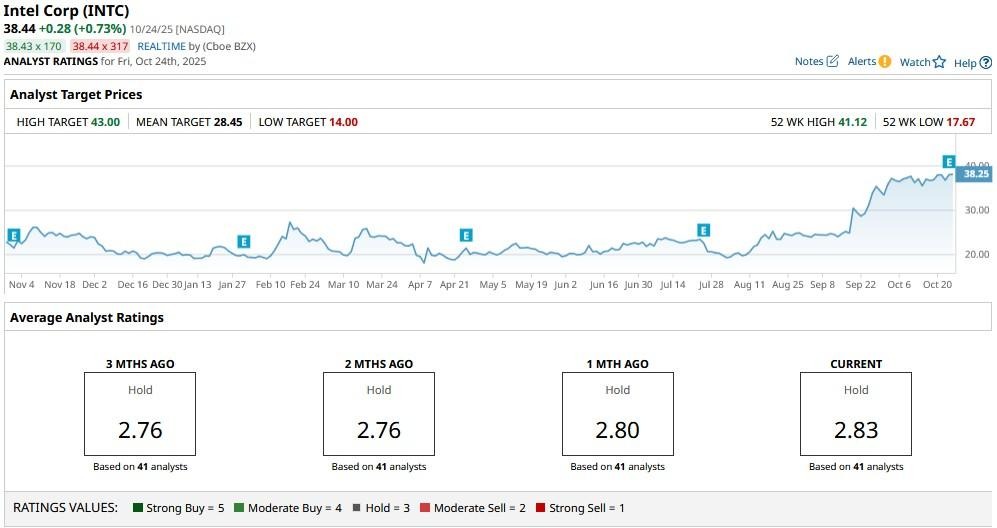

Intel Remains a ‘Hold’ Among Wall Street Firms

Investors should note that Wall Street, nonetheless, remains divided on Intel stock heading into 2026.

While the consensus rating on INTC shares currently sits at “Hold” only, price targets go as high as $43, indicating potential upside of nearly 15% from here.