Intel Corporation (NASDAQ:INTC) shares tumbled on Wednesday as the struggling chipmaker reportedly searches for more investors after a $2 billion capital injection from SoftBank Group (OTC:SFTBF) (OTC:SFTBY), while the Donald Trump administration considers taking a direct stake in the company.

Intel Exploring More Equity After Softbank Deal

Intel stock slid nearly 7%, erasing gains from earlier in the week that followed news of SoftBank's investment and speculation about potential U.S. government involvement.

Intel is now exploring additional equity financing at a discount from other large investors, reported CNBC's David Faber, citing people familiar with the matter.

"They need money to build whatever it is that the customers may actually, ultimately want," Faber said on "Squawk on the Street."

Adding, "And having the CHIPS Act money, which is free, so to speak, no strings attached, become equity is not helpful to them because it's dilutive."

See Also: American Airlines CFO Declares Worst Is Over, But Cautious Outlook Sinks Stock

Trump Administration Pushes For Equity Stake

Earlier, Commerce Secretary Howard Lutnick told CNBC that Washington should secure an equity stake in Intel in exchange for federal subsidies under the CHIPS Act, which was designed to boost domestic semiconductor production.

Reports have also surfaced that the Trump administration is weighing a 10% government stake in Intel — a rare move that would make the U.S. a direct shareholder in one of the nation's most important technology companies.

Wall Street Reaction And Kevin O'Leary's Criticism

The possibility of government ownership sparked mixed reactions. Daniel Newman, CEO of Futurum Group, argued the "smartest capital Intel could raise" would come from co-investment with customers, which could accelerate its foundry roadmap.

However, Kevin O'Leary, best known from "Shark Tank," blasted the idea of taxpayer money flowing into Intel.

"I hate this idea a lot," he said on NewsNation, calling Intel a "loser" stock. He argued America should let failing companies collapse and have their assets absorbed by stronger rivals.

"In technology, we let the losers die and their assets get acquired by the winners. That's what makes America great."

O'Leary suggested that instead of subsidies or equity stakes, the U.S. should rely on tax incentives to spur private investment. "Let the private sector buy this thing and fix it," he said.

Intel's Deepening Struggles With Competition

The company reported a staggering $18.8 billion loss in its foundry unit in 2024, despite receiving $8.5 billion in subsidies.

Fitch Ratings has downgraded Intel's credit, citing leadership turmoil, delays in its Ohio fabrication plant and weak profitability.

Intel's 18A process technology has faced repeated yield problems, leaving the firm trailing Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), Advanced Micro Devices, Inc. (NASDAQ:AMD) and Arm Holdings Inc. (NASDAQ:ARM) in the race for advanced chips and AI readiness.

In July, Intel posted second-quarter revenue of $12.86 billion, surpassing analyst expectations of $11.91 billion. However, the chipmaker reported an adjusted loss of $0.10 per share, falling short of projections for a profit of $0.01 per share.

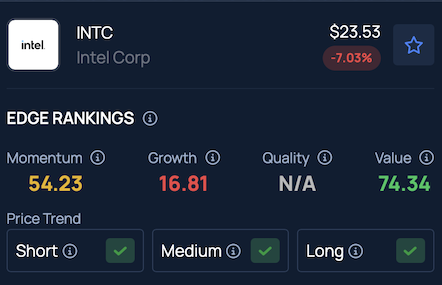

Price Action: Intel shares fell 6.99% in regular trading and dipped slightly further in after-hours trading, according to Benzinga Pro data.

Benzinga's Edge Stock Rankings show that INTC continues to maintain positive momentum across short, medium and long-term periods. More performance details are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock