The Yankees beat Boston last night to win the American League wildcard series. New York moves on to the AL Division Series, which pits them against my hometown Toronto Blue Jays. The series starts tomorrow afternoon in Toronto. Go Jays.

In the markets, it’s becoming somewhat monotonous, with every day seemingly a positive one, thanks to AI. The S&P 500 and Nasdaq 100 both set record highs yesterday. Fair Isaac (FICO) jumped 17% after it announced it would soon let credit report providers directly access its proprietary FICO scores.

Government shutdown? Apparently, not a concern for investors. They’re too busy making money.

Turning to Thursday’s unusual options activity, there were 1,370 options with Vol/OI (volume-to-open-interest) ratios of 1.24 or higher expiring in seven days or more. The calls outweighed the puts 858 to 512.

The third-highest Vol/OI ratio yesterday was Intel’s (INTC) Oct. 31 $50 call. The Halloween expiry sets up nicely for those bullish about Intel and looking for income. Here’s how.

Have an excellent weekend.

The Options Strategy in Play

As I mentioned in the introduction, Intel’s Oct. 31 $50 call had a Vol/OI ratio of 134.59, the third-highest on the day, one of seven with a ratio of 100 or higher.

In past years, I’ve been more bullish than bearish about Intel. Unfortunately, the numerous issues that plagued its business also hindered its stock. In 2025, with a bit of help from the White House, Intel’s stock is up 86% year-to-date. Unfortunately, despite the gain, it remains down 27% over the past five years. Nvidia (NVDA) is up 1,347% over the same period.

In past years, I’ve been more bullish than bearish about Intel. Unfortunately, the numerous issues that plagued its business also hindered its stock. In 2025, with a bit of help from the White House, Intel’s stock is up 86% year-to-date. Unfortunately, despite the gain, it remains down 27% over the past five years. Nvidia (NVDA) is up 1,347% over the same period.

Nonetheless, there are several reasons why it’s not too late to win with Intel.

Leaning into yesterday’s unusually active call, investors might consider a Covered Combination to benefit from future appreciation while generating income at the same time.

What is the options strategy?

It involves owning Intel stock, while also selling a call OTM (out-of-the-money) and an OTM put, both with the same expiration; in this case, Halloween. Essentially, you’re doing a Covered Call, plus a Naked Put.

The $50 call is the covered call part of the combination. We now have to figure out which Oct. 31 put strike makes sense for the naked put. Remember, if the share price falls below the put strike at expiration, the buyer of the put could force you to buy 100 shares at the strike price. As a result, you want to be at least moderately bullish about INTC long-term.

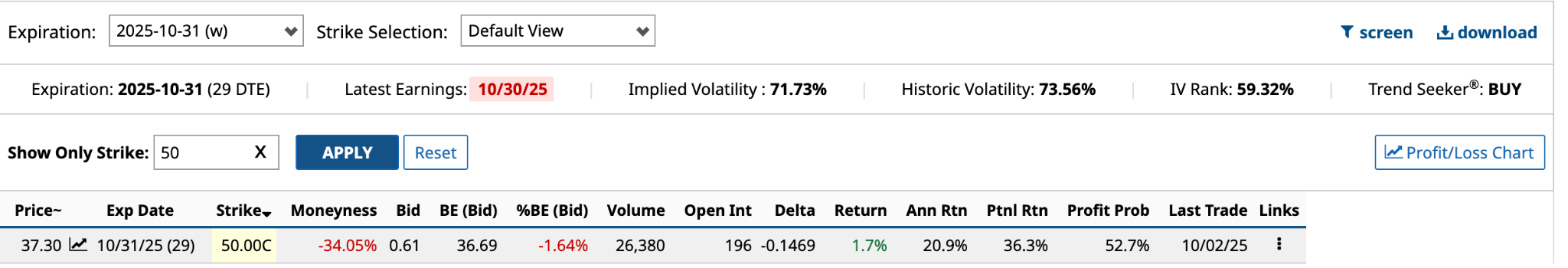

The Covered Call

The covered call is the set part of the strategy. You’re selling a $50 call and simultaneously buying 100 INTC shares.

Let’s assume that you buy 100 shares at yesterday’s closing price of $37.30. You simultaneously sell one October 31 $50 call with a bid price of $0.61. Assuming the share price doesn’t move higher than $50 by Halloween, you keep the $61 premium income--an annualized return of 20.9%--and continue to own 100 Intel shares.

However, should the share price move higher over the next 29 days, trading above $50 at expiration, you could be asked to sell your 100 shares at $50, effectively capping your upside at $13.31 a share [$50 strike price - $37.30 buy price + $0.61 premium] or 35.7%.

It’s a good return over 29 days, but if you’re bullish about Intel--its shares once traded in the $70s in the dot.com boom in 2000--you might feel as though you’re leaving money on the table.

The Naked Put

The naked put requires some thought. You are selling a put for income that is OTM. There are two questions to ask yourself: 1) How much income are you looking to generate? And 2) Do you want to own 100 more shares of Intel at the strike price?

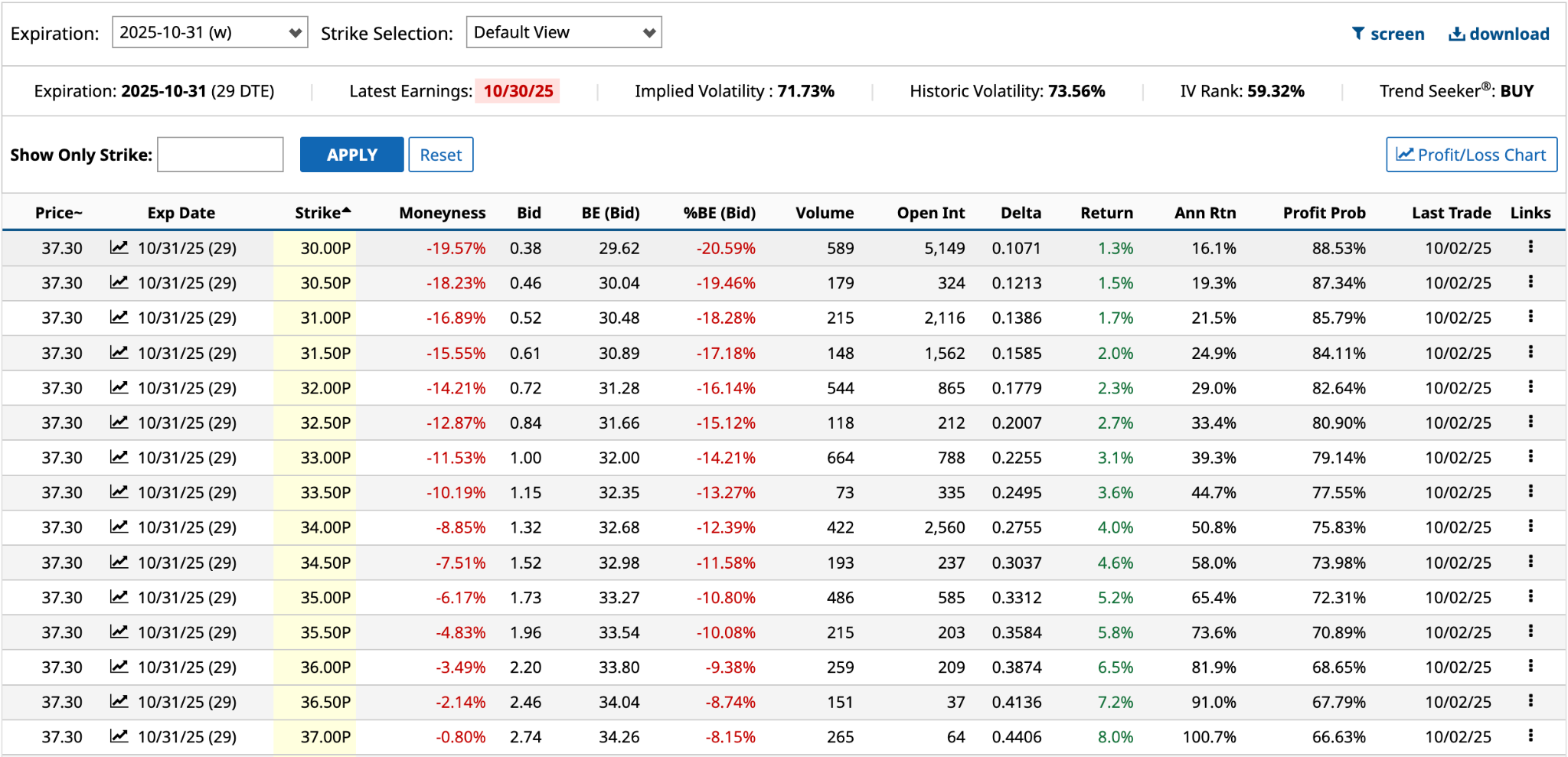

Here are potential Oct. 31 put strike prices that were OTM based on yesterday’s closing data.

The strike prices range from a high of $37 down to $30, dropping by 50-cent increments. The income from selling the puts ranges from a high of $274 for the $37 strike price to a low of $38 for the $30 strike price.

It makes more sense to answer the second question, whether you want to own another 100 shares of Intel, or not, before answering the first. If you don’t mind owning another 100 shares, I would go for a higher breakeven price, at or near the money. Let’s say 4.83% OTM, or the $35.50 strike price. It delivers an annualized return of 73.6% [$1.96 bid price / ($35.50 strike price - $1.96 bid price) * 365 / 29].

However, if you don’t want to own any more shares of Intel, you’d be wise to go for a strike price further OTM, say 19.57%, and the $30 strike. It generates an annualized return of 16.1%, which is still decent, while increasing the profit probability to 88.53%, considerably higher than the $35.50 strike.

Four Scenarios Play Out

It’s important to note that Intel reports quarterly earnings on Oct. 30, the day before Halloween and the expiration date of the two options.

Let’s assume that over the next 29 days, INTC moves up or down by the expected move of $5.15, or 13.81%. That’s an upside price of $42.45 and a downside price of $32.15.

Based on the upside price of $42.45 and selling the $30 put, you would generate a 16.5% total return [($515 in capital gains + $61 in premium income for the call + $38 in premium income for the put) / $3,730 cost of the stock]. Annualized, that’s a 207.2% return [($614 / $3,730) * 365 / 29].

Based on the upside price of $42.45 and selling the $33.50 put, you would generate an 18.5% total return [$515 in capital gains + $61 in premium income for the call + $115 in premium income for the put / $3,730 cost of the stock]. Annualized, that’s a 232.8% return [($691 / $3,730) * 365 / 29].

Based on the downside price of $32.15 and selling the $30 put, you would generate an -11.2% total return [($515 in capital losses + $61 in premium income for the call + $38 in premium income for the put) / $3,730 cost of the stock]. Annualized, that’s a -141.1% return [(-$416 / $3,730) * 365 / 29].

Based on the downside price of $32.15 and selling the $33.50 put, you would generate a -9.1% total return [$515 in capital losses + $61 in premium income for the call + $115 in premium income for the put / $3,730 cost of the stock]. Annualized, that’s a -114.5% return [(-$339 / $3,730) * 365 / 29].

So, based on these four scenarios, your annualized returns range from 232.8% on the high side, and -141.1% on the low side.

.png?w=600)