Today, Intel announced it had generated its first profit in two quarters, raking in $1.5 billion in net income on $12.9 billion in revenue during the second quarter of 2023, and the company posted a more optimistic outlook than expected. Much of the success came on the back of unexpected income from Intel's PC division, sending its stock up 8% in after-hours trading. Intel beat both its own projections and market consensus handily, with its EPS of $0.13 beating consensus estimates of -$0.19.

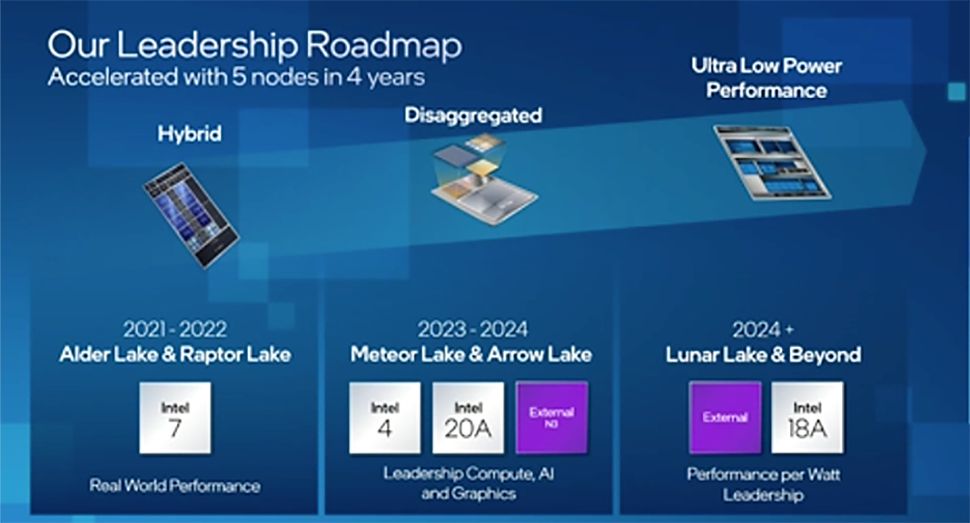

Intel CEO Pat Gelsinger reported that the company remains on track with its audacious goal to deliver five nodes in four years, noting that the company's next-gen Meteor Lake chips, the first to use the 'Intel 4' node, are in production and on schedule for a Q3 launch. These will be the company's first high-volume consumer chips to use a chiplet-based architecture tied together with the 3D Foveros interconnect tech.

Intel's next-next-gen Arrow Lake chips, which build on that same design methodology, are already progressing through the fab, too. These chips are the company's first to use Intel's 20A node (2nm), which includes new innovations like the PowerVia backside power delivery, which Intel will be first to use, and RibbonFet Gate-All-Around (GAA) technology.

Gelsinger noted that the first stepping of the Arrow Lake chips are moving through the fab, meaning these are the first test chips of the new architecture to be put through their manufacturing paces.

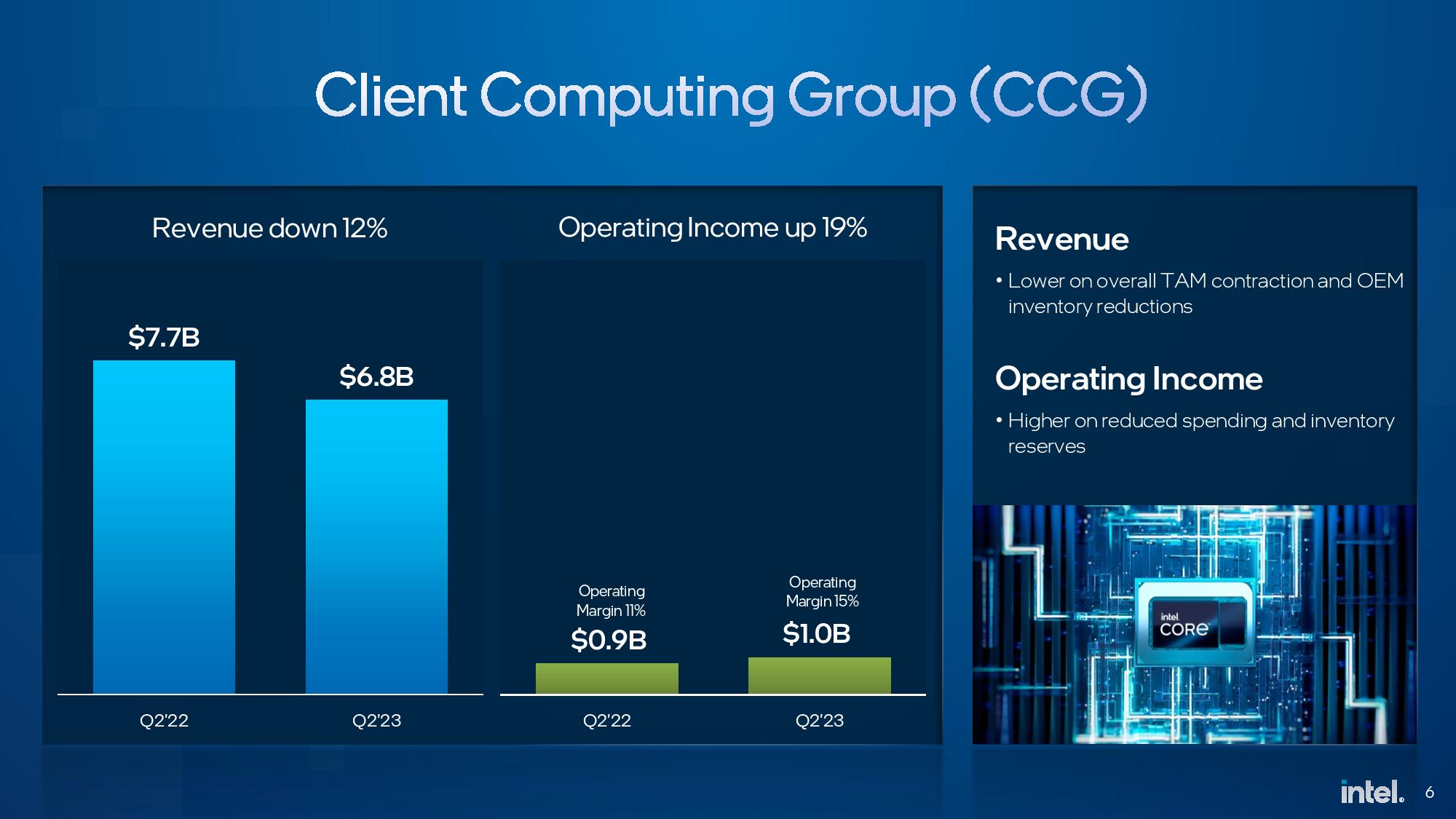

Intel's consumer CPU sales in the quarter remained depressed, with revenue down 12% while operating income increased 19%. Still, Gelsinger said he expects sell-in (the number of CPUs sold into the channel) to nearly match sell-through (the number sold to customers) soon, signaling that the end of the consumer CPU oversupply looms.

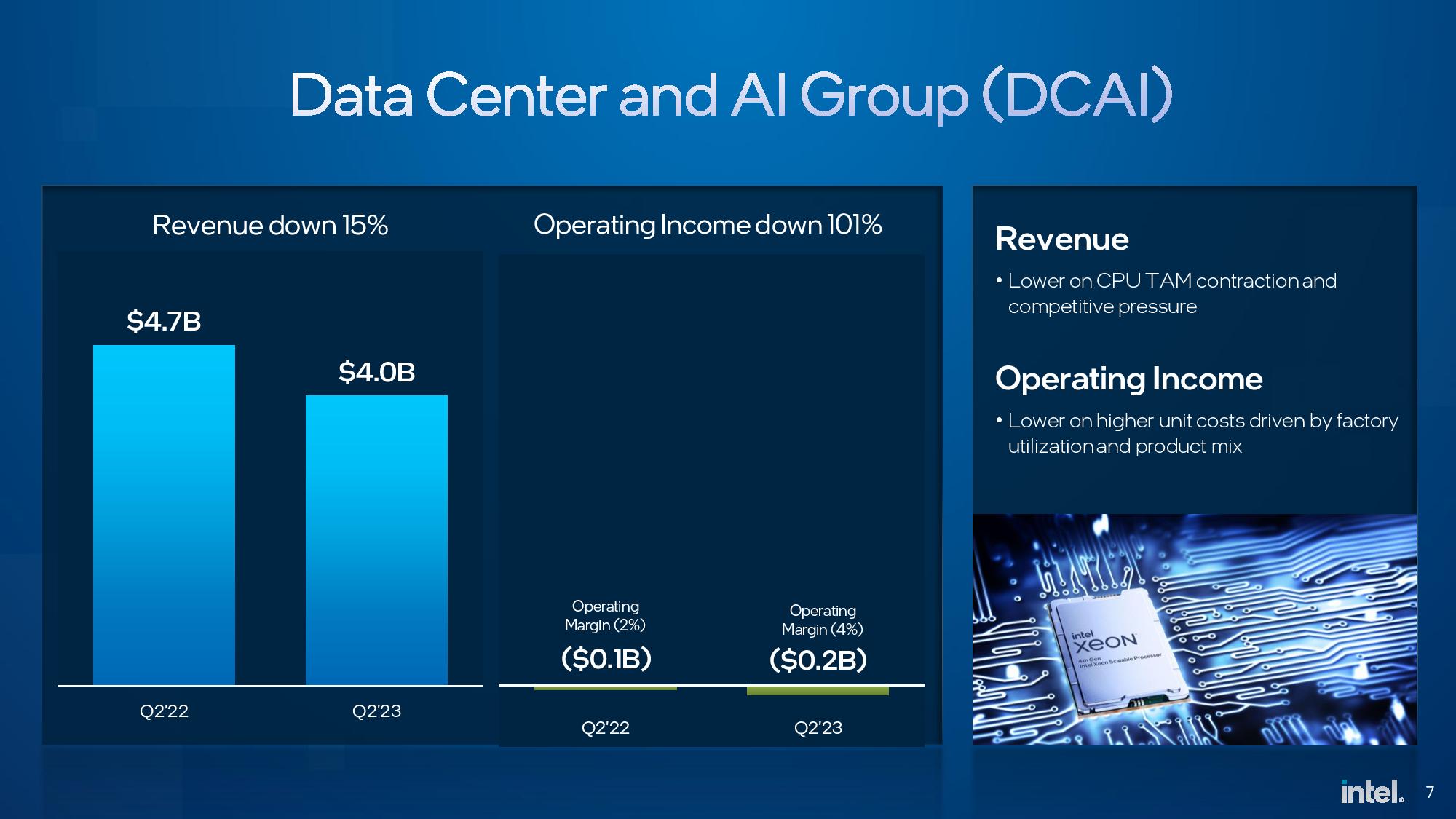

Intel expects to sell its millionth fourth-gen Xeon "Sapphire Rapids" processor in the coming days, but things still aren't very rosy on the data center side of the business. Intel's Data Center and AI Group (DCAI) saw revenue drop by 15% for the quarter while operating margins remained negative (-$200M).

Gelsinger tempered expectations for a quick rebound in server CPU sales, reporting that a significant portion of the data center and cloud spend for the rest of the year will be devoted to AI buildouts, meaning GPUs will steal from the data center budgets typically reserved for CPUs. That will result in lower sales next quarter for Intel's DCAI as more investments get diverted to Nvidia's data center GPUs.

Intel also continues to face fierce competition from AMD's server chips, and the China market has been slow to recover. As such, the data center CPU recovery likely won't occur until the latter part of the year. Intel did note that it has seen strong interest in its Gaudi chips for AI workloads, and it now has its first Gaudi 3 wafers in hand.

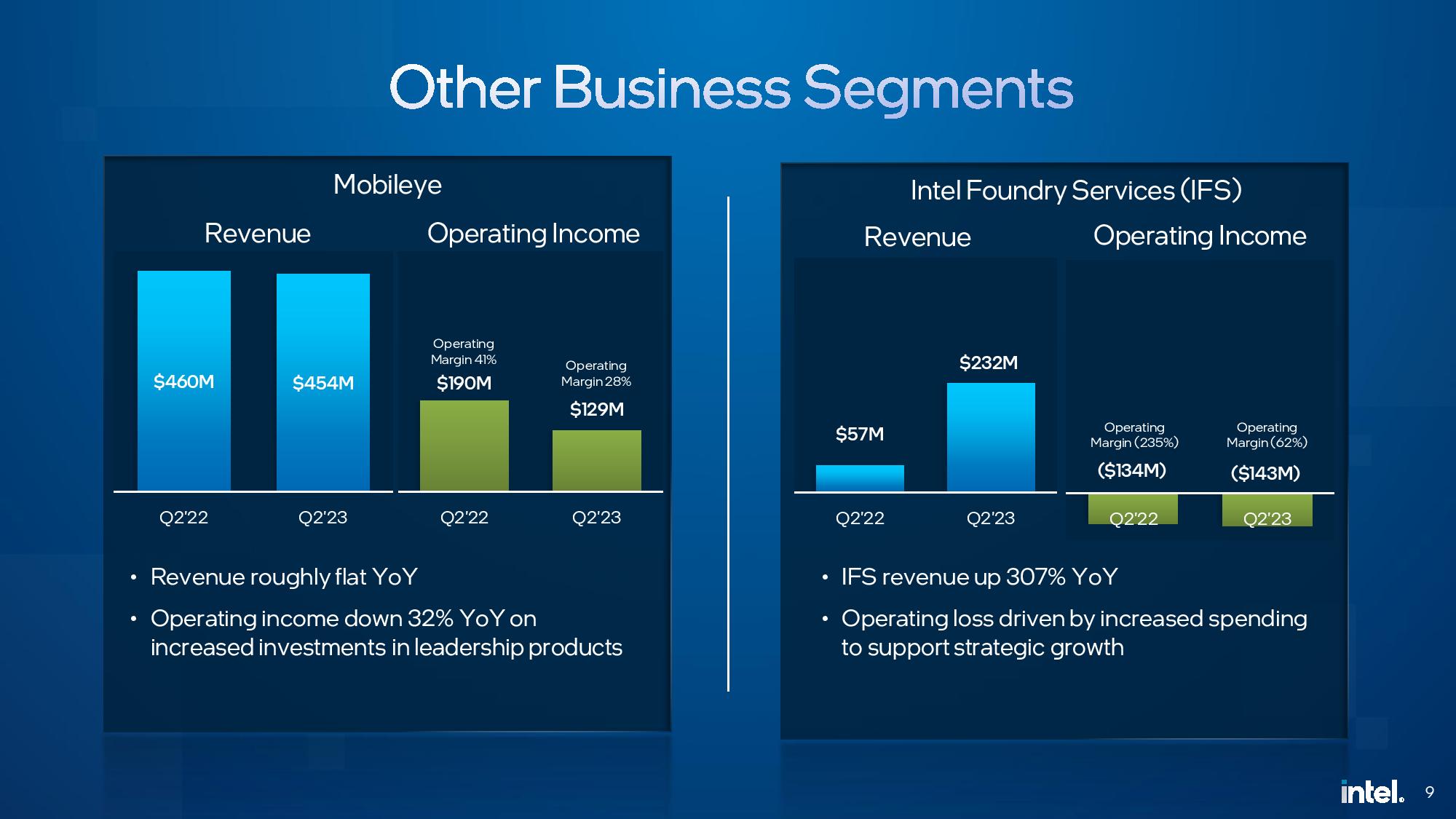

Intel Foundry Services (IFS) saw an impressive 307% year-over-year uptick in revenue, much of it from new packaging deals and sales of IMS nanofabrication tools. Still, it's important to remember that Intel's accountings have separated IFS into its own P&L, so much of its revenue comes from Intel's own internal groups. However, Gelsinger did note that the company had seen interest in its packaging services from external customers. This news comes amid a broad shortage of advanced packaging capacity in the industry, particularly for AI accelerators and GPUs. Intel has set up a packaging business unit in its foundry, so it is primed to capitalize on that opportunity.

Intel has continued to adjust its strategy as it slims down to focus on core competencies and foundry expansions, having now exited nine businesses during Gelsinger's tenure. That has saved the company $1.7 billion this year alone, putting it on track to save $3 billion for the full year.

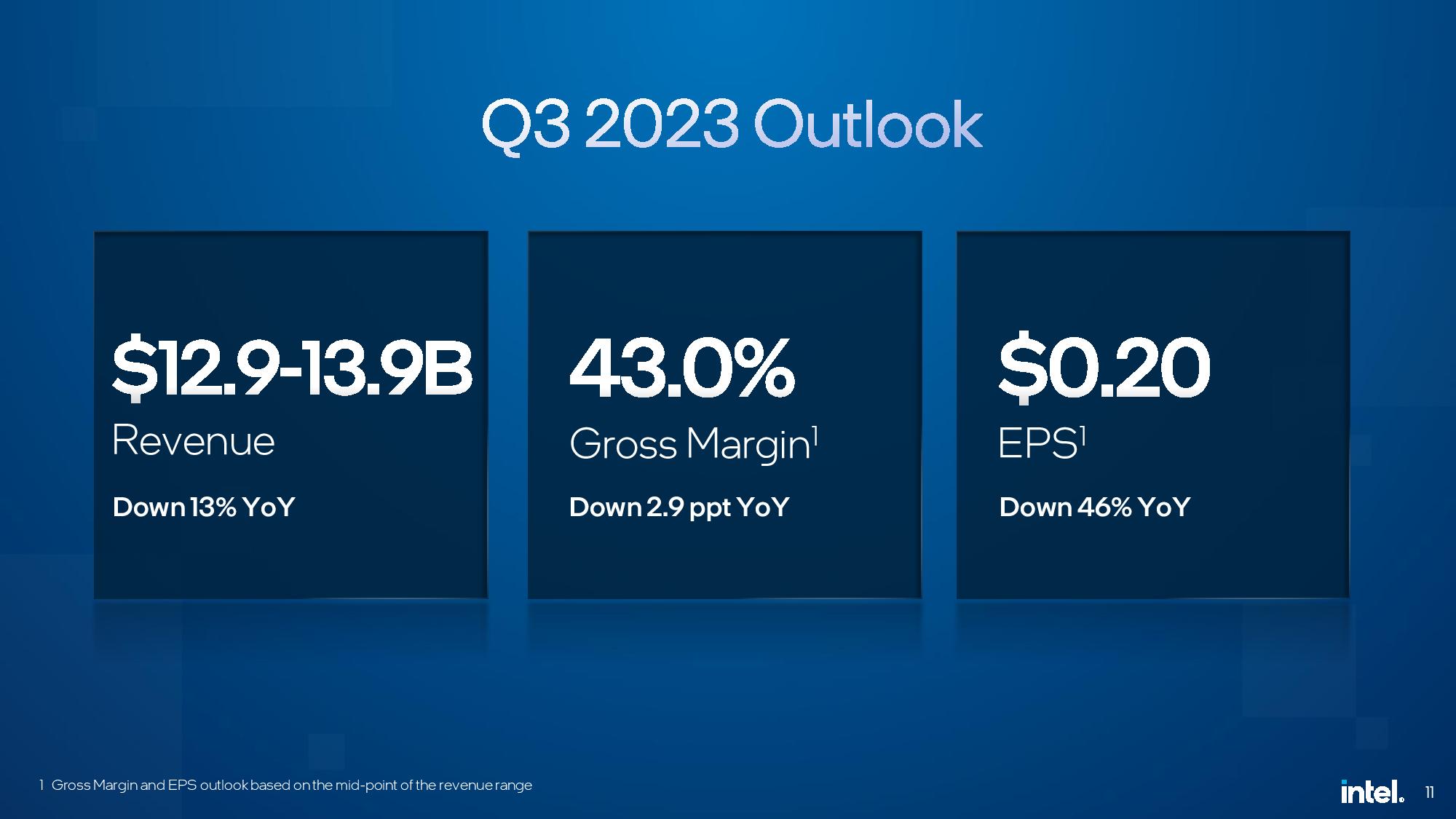

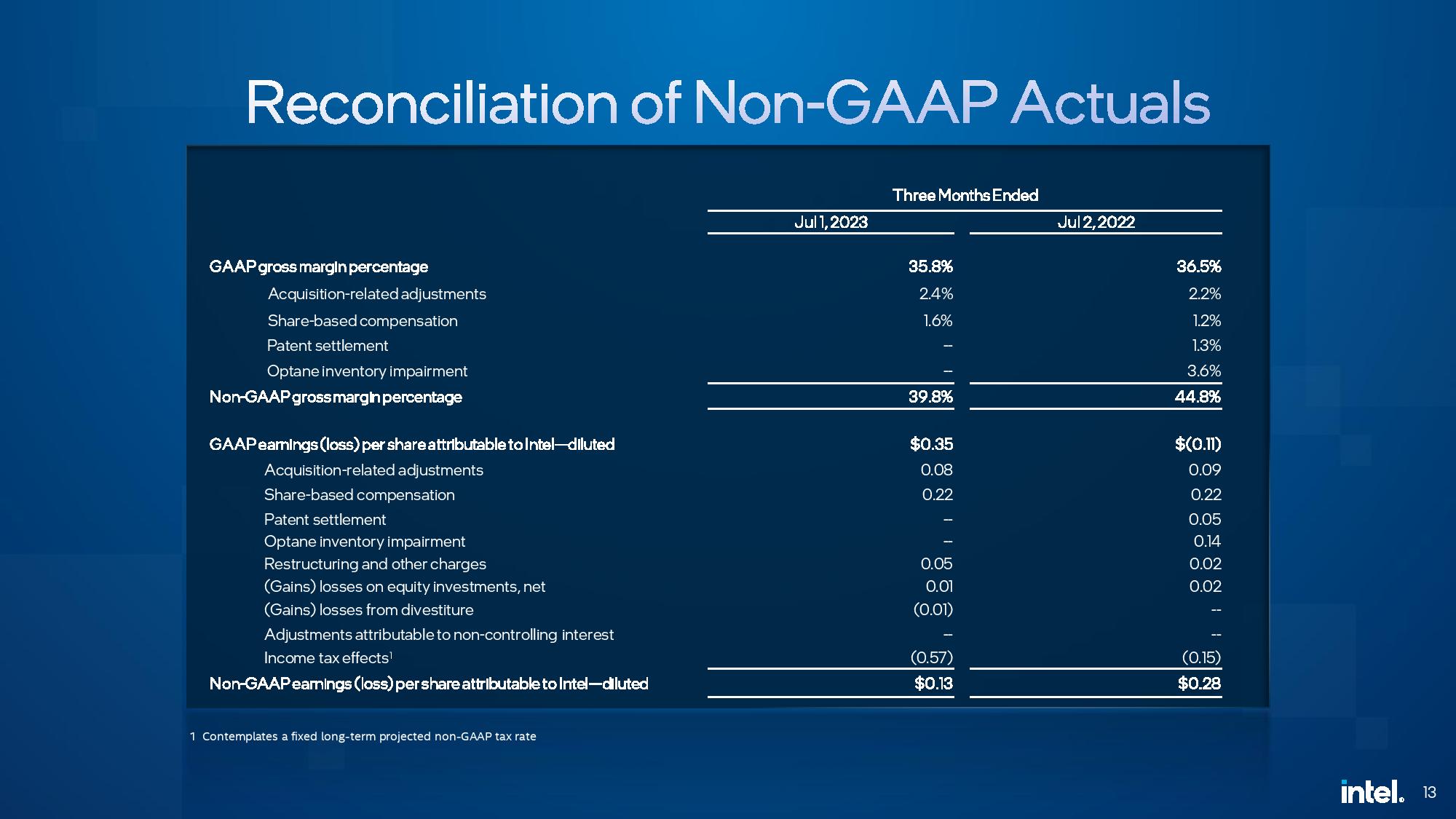

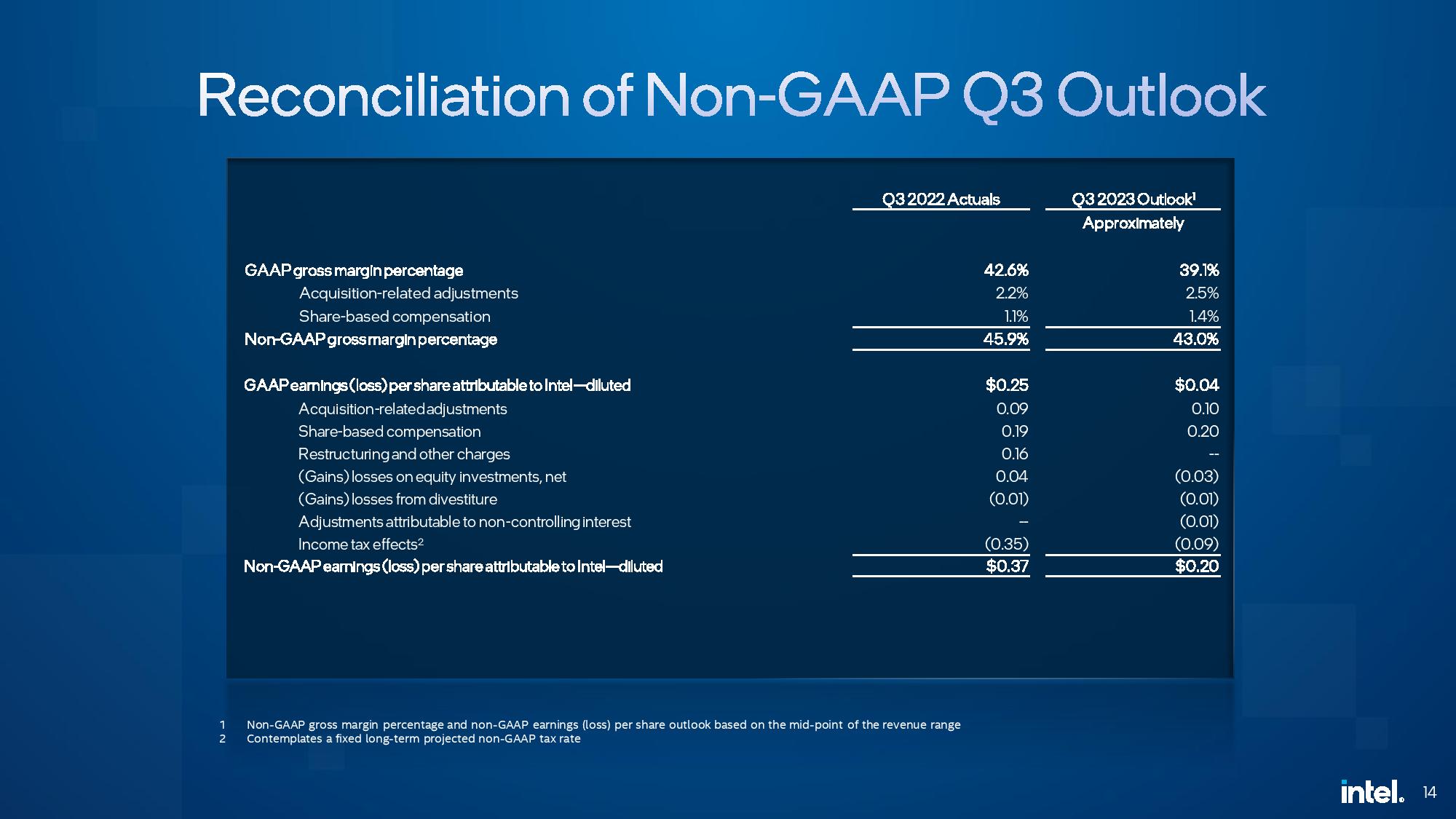

Intel's revenue fell 15% year-over-year, but its trajectory looks better than analysts expected. Intel's gross margin for the quarter improved to 39.8%, a far cry from the +60% of yesteryear but still better than last quarter's 34%. The company guides for a 43% gross margin in Q3, along with $12.9 to $13.9 billion in revenue and $0.20 EPS, all of which outstripped consensus expectations.

However, while this quarter's results and forecast look much better than expected, it will still be several years before Intel overcomes the primary hurdle to recovery — regaining its lost lead in process node technology. In the meantime, on-time delivery of its Meteor Lake and Emerald Rapids processors is paramount.

$INTC Intel Q2 FY23:• Revenue -15% Y/Y to $12.9B ($0.8B beat).• Operating loss margin -8% (-3pp Y/Y).• Non-GAAP EPS $0.13 ($0.16 beat).Q3 FY23 Guidance: • Revenue ~$12.9B-13.9B ($13.3B expected).• Non-GAAP EPS $0.20 ($0.03 beat). pic.twitter.com/Opfex57jQTJuly 27, 2023