/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

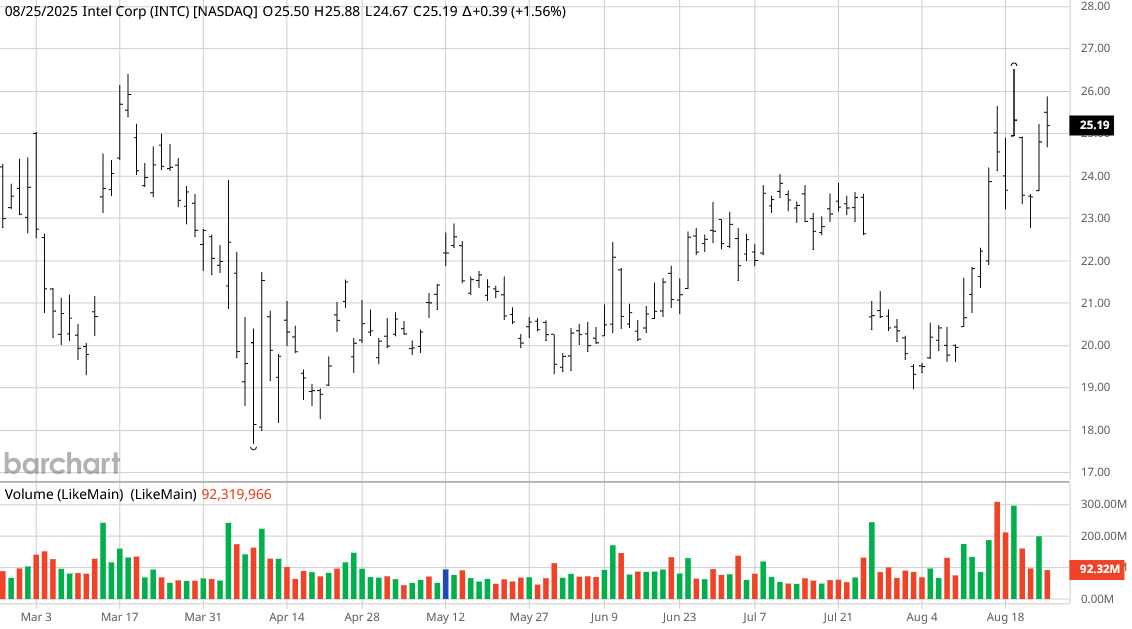

Intel (INTC) stock is on fire, up 22% in August after striking a deal with the Trump administration that would see the government take a 10% stake in the chipmaker.

But while investors are certainly happy that INTC stock is finally showing signs of life, the stock’s recent move is leaving Intel trading at an alarming valuation.

About Intel Stock

Based in Santa Clara, California, Intel is a major semiconductor company that makes graphics processing units (GPUs) and central processing units (CPUs) and other hardware for servers and personal computers.

The company has a massive footprint – it says that roughly 70% of personal computers in the world use Intel products, and roughly 75% of global data center workloads use Intel silicon. The company also has a growing foundry business that is the centerpiece of its turnaround effort. However, it badly trails both Taiwan Semiconductor Manufacturing (TSM) and Samsung (SMSN.L.EB) in market share.

After its recent run higher, INTC stock is more than doubling the year-to-date return of the S&P 500 ($SPX), which is up nearly 11%. Intel now trades just 9% off its 52-week high of $27.55, but is still 64% off its all-time high set near the turn of the century.

However, it’s the company’s valuation that is raising eyebrows right now. Intel’s price-to-earnings (P/E) ratio is 88, with a forward P/E of 227, indicating that there are massively high expectations baked into the stock. Expectations are high because the federal government announced it was taking a 10% stake in Intel by investing $8.9 billion into the company. However, the company also disclosed that $5.7 billion of the funding would be in the form of grants that were previously awarded, but not yet paid, to Intel under the 2022 U.S. CHIPS and Science Act. The act was passed with the intention of increasing semiconductor research and manufacturing in the U.S. Intel is also receiving $3.2 billion as part of the Secure Enclave program, which is funded by the Commerce Department to support manufacturing of advanced chips for the military and intelligence agencies.

Combined with $2.2 billion the government already issued to Intel, the government’s total commitment is $11.1 billion.

The U.S. is purchasing 433.3 million shares of Intel stock at $20.47 per share and will receive a five-year warrant at $20 per share for an additional 5% of Intel shares. The option can be executed if Intel does not own at least 51% of its foundry business.

SoftBank (SFTBY), based in Japan, also announced a $2 billion investment in Intel. SoftBank is paying $23 per share for Intel stock. “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” SoftBank CEO Masayoshi Son said.

Intel’s Continues to Reposition

Intel’s deal with the Trump administration marks the latest in a series of major changes the company has made since CEO Lip-Bu Tan replaced Pat Gelsinger in the top job in March. Tan is repositioning the company by cutting 15% of the workforce and is terminating planned chip facility projects in Germany and Poland. In addition, it disclosed in a regulatory filing that it may be forced to “pause or discontinue” its foundry business entirely if it fails to secure a customer on its next technology cycle.

Taiwan Semiconductor is the dominant player in the foundry space, with an estimated 67% of the market share. Samsung has 11%, with no other company having more than a 5% share.

Intel’s second-quarter earnings report showed revenue of $12.86 billion, which was better than analysts’ consensus expectation for $11.92 billion. But the company posted a net loss of $2.9 billion, or $0.67 per share, versus a year ago when Intel’s net loss was $1.61 billion and $0.38 per share. The loss included an $800 million impairment charge from “excess tools with no identified re-use,” the company said.

Intel issued third-quarter guidance for revenue in the range of $12.6 billion to $13.6 billion.

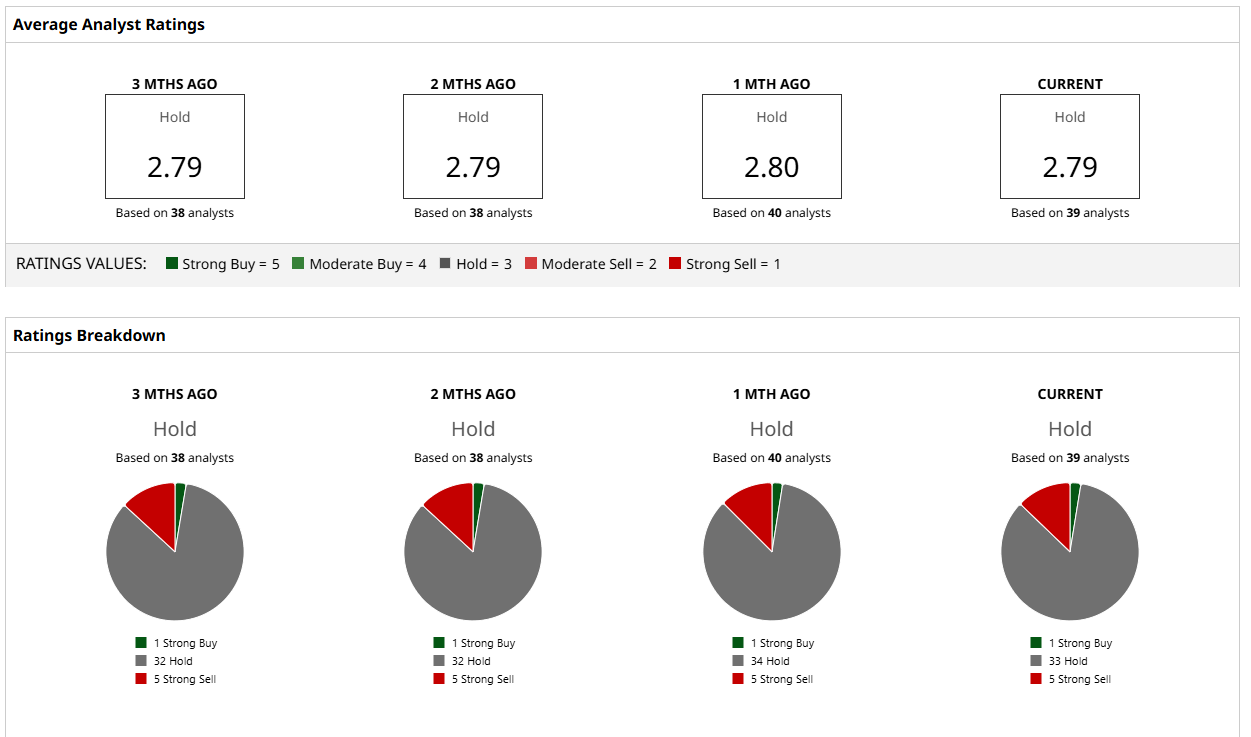

What Do Analysts Expect for INTC Stock?

Most analysts appear to be viewing Intel with caution – of the 39 analysts surveyed at Barchart, only one gives it a “Strong Buy” rating, with five listing INTC stock as a “Strong Sell” and the rest recommending a “Hold.”

Following the announcements of the U.S. government and SoftBank investments, analysts at Morgan Stanley, Bank of America, Truist Financial, and UBS all reiterated their hold ratings.

Analysts have a mean price target of $23.09, or roughly $2 below Intel’s current trading price. Although there is one bullish outlier with a price target of $62, the consensus sentiment is that Intel stock is already ahead of itself. Investors would be better off biding their time and waiting for more developments before taking a position.