/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

With a market cap of $162.9 billion, Intel Corporation (INTC) is one of the world’s largest semiconductor companies and a leading provider of microprocessors and chipsets for consumer and enterprise markets. The company is expanding its focus beyond PCs into data-centric businesses such as artificial intelligence, autonomous driving, cloud computing, and the intelligent edge.

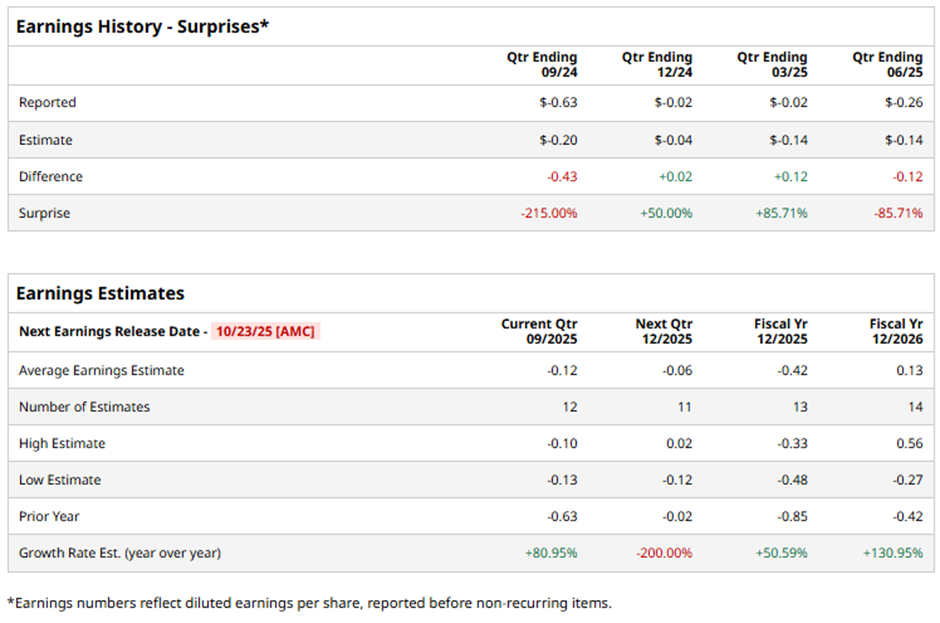

The Santa Clara, California-based company is slated to announce its fiscal Q3 2025 results after the market closes on Thursday, Oct. 23. Ahead of the event, analysts expect Intel to report a loss of $0.12 per share, an improvement of nearly 81% from a loss of $0.63 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the world's largest chipmaker to report a loss of $0.42 per share, a recovery of 50.6% from a loss of $0.85 per share in fiscal 2024. Moreover, EPS is anticipated to climb nearly 131% year-over-year to $0.13 in fiscal 2026.

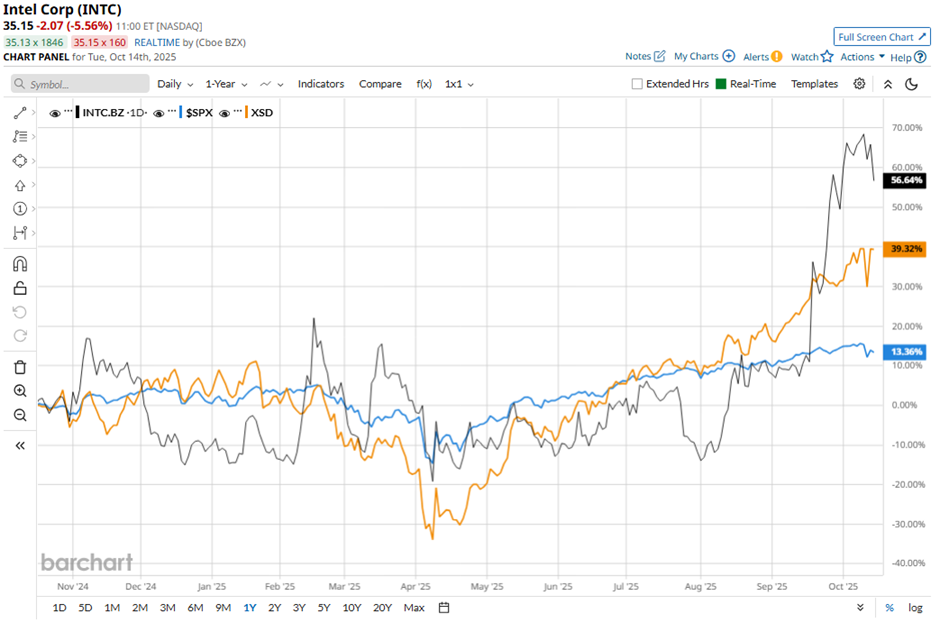

Shares of Intel have jumped 51.3% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 12.7% increase and the SPDR S&P Semiconductor ETF's (XSD) 34.8% surge over the same period.

Despite reporting better-than-expected Q2 2025 revenue of $12.86 billion on Jul. 24, Intel’s shares fell 8.5% the next day as the company posted an adjusted loss of $0.10 per share, missing Wall Street’s estimate. Investors were also rattled by Intel’s forecast for a steeper Q3 loss of $0.24 per share, worse than the expected, and its announcement of major workforce reductions of 22% by year-end.

Additionally, the management's comments about potentially limiting Intel’s 18A manufacturing process to internal use and slowing or halting factory projects in Ohio, Poland, and Germany raised concerns.

Analysts' consensus view on INTC stock remains cautious, with an overall "Hold" rating. Out of 41 analysts covering the stock, two recommend a "Strong Buy," 33 "Holds," one "Moderate Sell," and five "Strong Sells." As of writing, the stock is trading above the average analyst price target of $26.73.