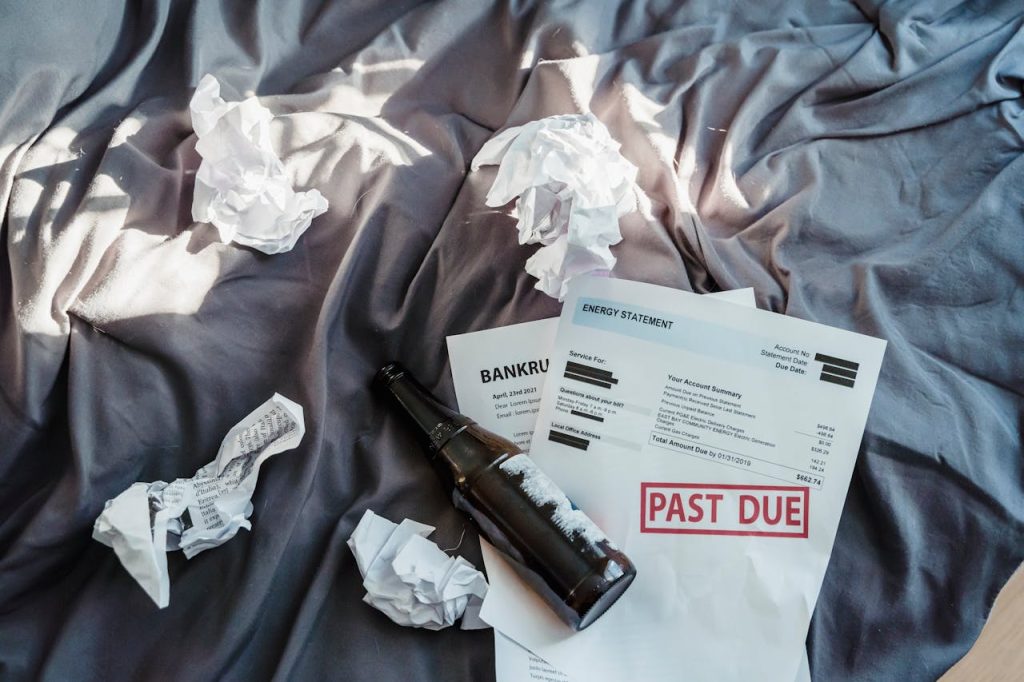

Natural disasters strike with little warning, leaving families scrambling to pick up the pieces, both emotionally and financially. You might think your insurance policy has you covered, but hidden loopholes can turn a safety net into a trap. When a hurricane, wildfire, or flood hits, the last thing you want is to find out your insurance won’t pay out when you need it most. Understanding these insurance loopholes is crucial for protecting your home, savings, and peace of mind. Let’s break down the most common pitfalls that could leave you financially exposed during a natural disaster, and what you can do to avoid them.

1. Exclusions for Specific Natural Disasters

Many homeowners assume their standard insurance policy covers all types of natural disasters, but that’s rarely the case. Most policies specifically exclude certain events, such as floods and earthquakes. For example, flood damage is seldom covered by a standard homeowners policy; you need separate flood insurance for that. The same goes for earthquakes in many regions. If you live in an area prone to these disasters and don’t have the right coverage, you could be left footing the entire bill for repairs or even a total rebuild. Always read the exclusions section of your policy and consider supplemental insurance if you’re at risk.

2. The Fine Print on Deductibles

Deductibles can be tricky, especially when it comes to natural disasters. Some policies have special deductibles for hurricanes, windstorms, or earthquakes that are much higher than your standard deductible. Instead of a flat dollar amount, these deductibles are often a percentage of your home’s insured value. For instance, a 5% hurricane deductible on a $300,000 home means you’d pay $15,000 out of pocket before insurance kicks in. This can be a devastating surprise if you’re not prepared. Review your policy’s deductible structure and ensure you have sufficient savings to cover it in the event of a disaster.

3. Actual Cash Value vs. Replacement Cost

How your insurance calculates payouts can significantly impact your recovery. Some policies pay out the “actual cash value” of your damaged property, which factors in depreciation. That means you’ll get less money for older items or structures. In contrast, “replacement cost” coverage pays what it would cost to replace the item at today’s prices, without deducting for age or wear. If your policy only covers actual cash value, you might not have enough to rebuild or replace your belongings after a disaster. Check your policy and consider upgrading to replacement cost coverage for better protection.

4. Coverage Limits That Don’t Match Your Needs

Insurance policies set maximum limits on how much they’ll pay for different types of losses. If your coverage limits are too low, you could be left with a huge financial gap after a natural disaster. This is especially common if you haven’t updated your policy in years or if you’ve made improvements to your home. Rising construction costs can also mean your coverage is outdated. Review your policy limits annually and adjust them to reflect your home’s current value and any major upgrades. This simple step can prevent a major financial shortfall when you need help the most.

5. Delays and Denials Due to Documentation

After a natural disaster, insurance companies require detailed documentation to process your claim. If you can’t provide proof of ownership or a home inventory, your claim could be delayed or even denied. Many people don’t realize how important it is to keep receipts, photos, and records of their belongings until it’s too late. Start a digital inventory of your home and update it regularly. Store copies of important documents in a secure, cloud-based location so you can access them even if your home is damaged. This preparation can make the claims process smoother and faster.

6. Mold, Sewage, and Secondary Damage Exclusions

Natural disasters often cause secondary damage, like mold growth or sewage backups, which many policies exclude or limit. For example, after a flood, mold can develop quickly, but your insurance might not cover the cleanup unless you have a specific rider. The same goes for water damage from backed-up sewers or drains. These repairs can be extremely costly and aren’t always obvious in your policy. Ask your insurer about endorsements or riders that cover these risks, especially if you live in a flood-prone area.

7. Underestimating the Need for Temporary Living Expenses

If your home is uninhabitable after a disaster, you’ll need somewhere to stay. Most policies include “loss of use” or additional living expenses (ALE) coverage, but the limits may not be enough for an extended displacement. Some policies cap ALE at a percentage of your dwelling coverage or set a strict time limit. If rebuilding takes longer than expected, you could run out of funds for rent, food, and other essentials. Review your ALE coverage and consider increasing it if you live in an area where rebuilding can be a slow process.

Protecting Your Financial Future Starts With Reading the Fine Print

Insurance loopholes can turn a natural disaster from a temporary setback into a financial catastrophe. The key to avoiding these pitfalls is understanding your policy, asking questions, and updating your coverage as your needs change. Don’t wait until after disaster strikes to find out what’s not covered. Take the time now to review your insurance, fill any gaps, and make sure you’re truly protected. Your financial future—and your peace of mind—depend on it.

What insurance surprises have you faced after a natural disaster? Share your story or tips in the comments below.

Read More

Find the Right Amount of Life Insurance in 10 Minutes

What’s the Right Type of Life Insurance?

The post Insurance Loopholes That Could Bankrupt You During a Natural Disaster appeared first on The Free Financial Advisor.