/Insulet%20Corporation%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $22.8 billion, Insulet Corporation (PODD) is a prominent medical device company specializing in innovative insulin delivery solutions, best known for its flagship Omnipod® Insulin Management System. Headquartered in Acton, Massachusetts, Insulet has carved out a strong niche in the global diabetes care market by offering a tubeless, wearable insulin pump designed to simplify diabetes management and improve quality of life for patients.

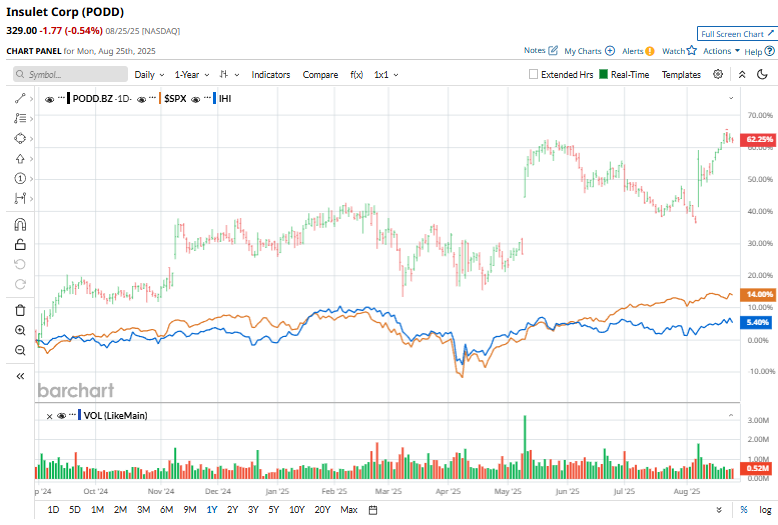

Shares of PODD have significantly outpaced the broader market over the past 52 weeks. PODD stock has soared 77.8% over this period, while the broader S&P 500 Index ($SPX) has gained 14.3%. Moreover, shares of PODD are up 26% on a YTD basis, compared to SPX’s 9.5% rise.

Zooming in further, Insulet has also outperformed the iShares U.S. Medical Devices ETF’s (IHI) 6.6% rise over the past year and 6.3% return in 2025.

On Aug. 7, Insulet released its fiscal 2025 second-quarter earnings, and its shares popped 9.5%. It posted a revenue of $649.1 million, up 32.9% year-over-year, driven by strong Omnipod growth in both the U.S. and international markets. Gross margin expanded to 69.7%, and adjusted EBITDA rose to $157.5 million, reflecting operational leverage. Moreover, adjusted net income more than doubled to $1.17 per share, beating expectations. Management also raised full-year revenue growth guidance to 24%–27%, signaling confidence in sustained momentum and fueling a sharp post-earnings stock rally.

For the current fiscal year 2025, ending in December, analysts expect PODD's adjusted EPS to increase 41.7% year-over-year to $4.59. The company has a robust earnings surprise history. It beat the Street's bottom-line estimates in each of the past four quarters.

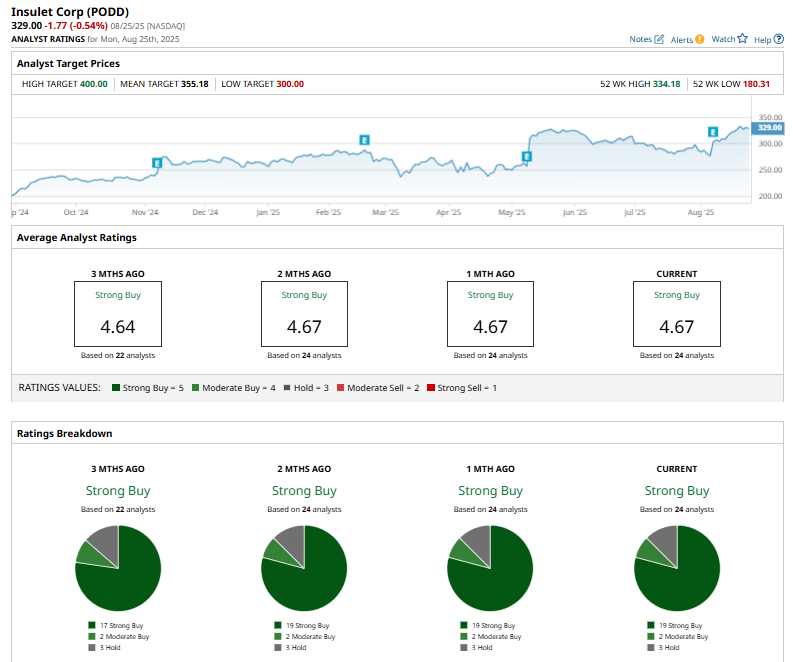

Among the 24 analysts covering PODD stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

The current configuration is bullish than three months ago when 17 analysts had suggested a “Strong Buy” rating for the stock.

On Aug. 21, Barclays maintained its “Equal-Weight” rating on Insulet and raised its price target to $300 from $266, citing stronger sales forecasts and EPS upgrades.

Insulet’s mean price target of $355.18 implies a modest 10% premium to current price levels. The Street-high target of $400 indicates that the stock could soar by 21.6% from the prevailing market prices.