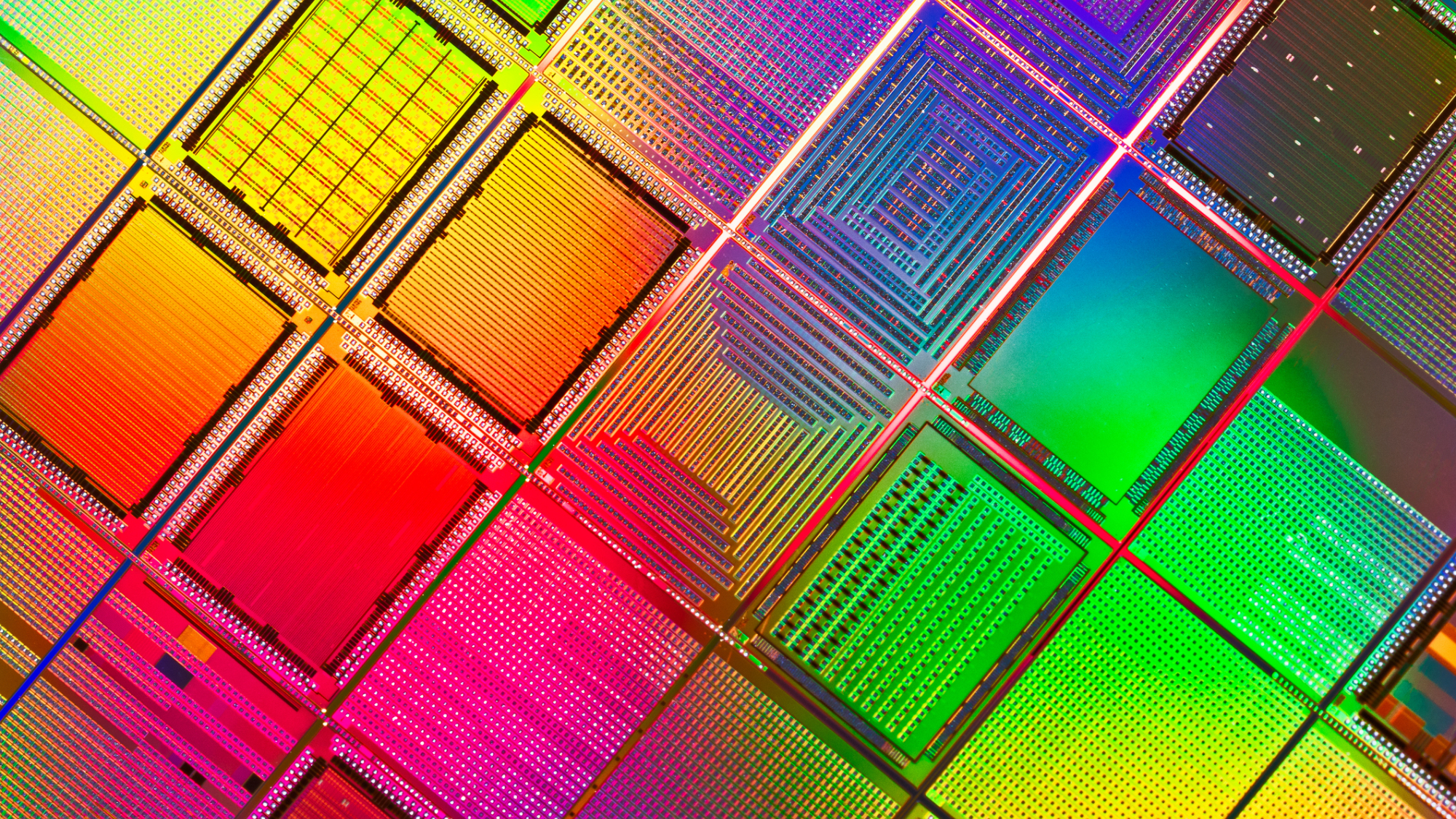

A new report claims that U.S. sanctions and restrictions placed on the semiconductor market to stifle China's growth may actually be fueling a rise in China's own semiconductor industry, building a more resilient ecosystem, and inadvertently accelerating China's ambitions in the market.

As reported by Digitimes, although the U.S. and China have agreed on a 90-day trade agreement to suspend the harshest tariffs between the two nations, "tensions in the semiconductor sector are escalating."

Digitimes says the rising temperature has put Taiwan's IC substrate manufacturers operating in China under renewed scrutiny, revealing some doubt about the efficacy of U.S. Sanctions.

As noted by the report, Taiwan's substrate supply chain delivered unexpectedly strong results in Q1 2025. According to Digitimes, a "stark difference" in positioning of companies in Taiwan versus China reveals the possibility that "China's semiconductor ecosystem may be accelerating its rise, even under U.S. restrictions."

As the report notes, President Trump has jettisoned the Biden administration's tiered chip diffusion rules in favor of a blanket ban on the global use of Huawei's Ascend AI chips and measures to prevent the export of other AI chips to China, a move Nvidia CEO Jensen Huang branded "a failure."

The report highlights the contrasting fortunes of Unimicron and Zhen Ding Technology. The former has reported depressed high-end capacity utilization at its China plants as a result of tightened chip restrictions. The world's foremost IC substrate maker has seen a rebound in orders at its Taiwan facilities to offset the slump, but executives remain concerned that escalating sanctions could see a permanent reduction in high-margin business from China's premium electronics sector.

Conversely, Zhen Ding – the case study behind the theory that sanctions are buoying China's chip industry – is reportedly seeing strong momentum in China's domestic markets. It reportedly credits its "China for China" strategy (prioritizing local production for local demand) as a key factor behind a 30% YoY revenue increase in its substrate division.

According to Digitimes, continued increase in China demand could even see Zhen Ding leverage its Taiwan Kaohsiung AI park to meet demand needs, reversing the flow of the supply chain.

The upshot, according to industry observers cited in the report, is that this strong performance points to a "critical paradox," namely, Digitimes says that "instead of crippling China's semiconductor ambitions, U.S. sanctions may be inadvertently accelerating them," with domestic demand and supply chain localization creating a resilient ecosystem that "that could emerge stronger in the face of adversity."

The sentiment broadly reflects Nvidia CEO Jensen Huang's comments on the ban on AI chip exports recently. As mentioned, he branded the measures a failure, and specifically noted that companies are turning to Nvidia's Chinese rivals to make up for the dearth in U.S.-developed chips like its H20, giving its competitors a leg up rather than stifling the industry.

Recently, a report claimed that Nvidia is planning to launch new Blackwell-based solutions for China towards the end of the year to supersede its banned H20.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.