Two years after the start of the Covid-19 pandemic, the great romance between investors and certain startups seems to have waned.

We are witnessing a return to earth of companies whose activity had exploded with the lockdowns and other measures taken by the authorities to limit the spread of the disease.

The full reopening of the economy, and the return of employees to offices and consumers to shops and restaurants, dealt a blow to the activity of startups whose services and products made it possible to adapt to the new life caused by the pandemic.

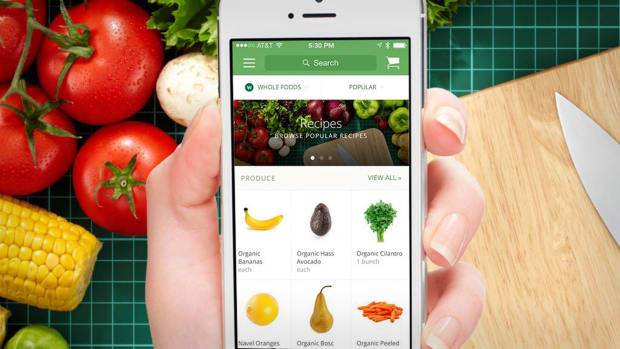

Instacart, the San Francisco-based food delivery service, was one of those businesses that grew at an unprecedented speed in two years. The group now seems to be stepping on the brakes.

Instacart

Valuation to $24 Billion From $39 Billion

Instacart has just decided to cut its valuation: It will decrease by 40% to $24 billion, a spokesperson told TheStreet, confirming information from Bloomberg, in order to adapt to new market conditions and to continue to attract talent.

It is therefore a return to earth.

“We are confident in the strength of our business, but we are not immune to the market turbulence that has impacted leading technology companies both public and private," the spokesperson said in an email statement. "We can’t control the market, but we can control how we respond."

Instacart has also aligned new equity awards to the new valuation. The startup is hoping that the company will eventually find favor with investors, a bet that could thus pay off for employees.

Instacart therefore hopes that by acting in this way the firm will be able to retain talent and attract others.

"We announced to our team that we will be aligning new equity awards - for existing employees and new hires, to an updated company valuation that reflects the current market conditions," the spokesperson said.

"Our team built Instacart into the market leader it is today, and we believe investing in them is the right thing to do. Markets go up and down, but we are focused on Instacart’s long-term opportunity to power the future of grocery with our partners.”

More often than not, when a company lowers its valuation so significantly, it's a sign that it recognizes that it may have overdone it or that let a frothy market go to its head.

In March 2021, Instacart announced that it had raised $265 million from a group of investors, including big names in venture capital like Andreessen Horowitz, Sequoia Capital, D1 Capital Partners, Fidelity Management & Research Company LLC, and T. Rowe Price Associates, Inc.

This fundraising pushed the valuation of Instacart to soar to $39 billion, more than double its $17.7 billion valuation when it raised its last financing, to a $200 million venture round in October 2020.

Instacart

Instacart Facing Lots of Headwinds

The reason behind this strong valuation last year was undoubtedly the pandemic.

Investors appeared to be rewarding the fact that they were seeing strong demand for food and grocery delivery services, as consumers avoided crowded places and preferred to stay in quarantine at home to avoid catching Covid.

"Today's fundraising reflects the strength of Instacart's business, the growth our teams have delivered and the incredible opportunity ahead," said at the time Nick Giovanni, chief financial officer for Instacart.

"This past year ushered in a new normal, changing the way people shop for groceries and goods. While grocery is the world's largest retail category with annual spend of $1.3 trillion in North America alone, it's still in the early stages of its digital transformation."

"As online grocery penetration increases over the coming years, we'll continue to invest in our people, products and partners to support all of the communities we serve."

The on-demand grocery delivery platform explained that it wanted to broaden its offerings from groceries to also to include same-day delivery on a wide range of products including prescription medicine, electronics, home décor, sports and exercise equipment.

Another sign that the startup was optimistic about the future at the time: Instacart also wanted to increase its corporate headcount by 50% in 2021.

But in addition to the reopening of the economy, Instacart, like other tech groups, is also dealing with investor disaffection with the sector as the Federal Reserve has started to hike interest rates. The company is also suffering from inflation and fears of recession.

Apart from Instacart, DoorDash (DASH), Zoom Technologies (ZOOM) and Uber(UBER), other darlings of the pandemic, have seen their market cap drop recently.

Instacart does not say if the group plans an IPO soon.