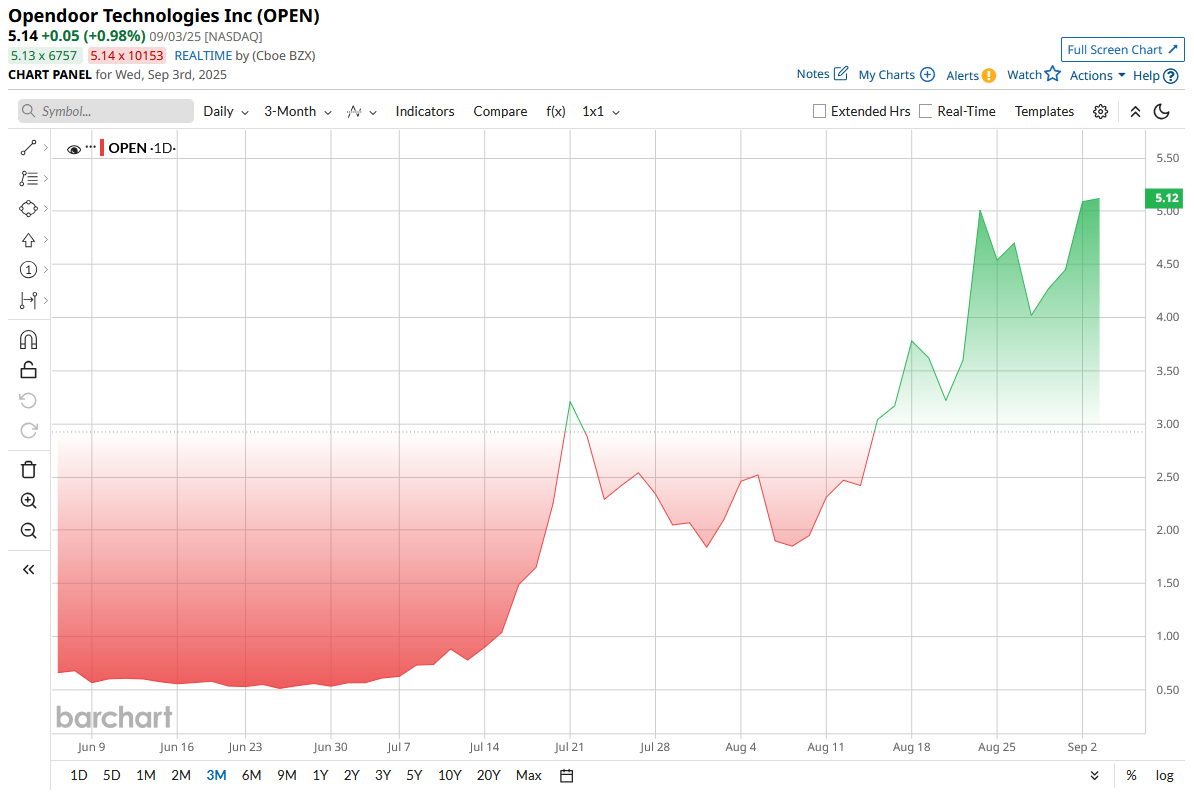

Insider buying often grabs headlines because it can signal management’s confidence, but it’s rarely a slam-dunk buy signal on its own. In Opendoor’s (OPEN) case, the company’s newly elevated leadership just put meaningful skin in the game. President Shrisha Radhakrishna bought roughly $128,340 of OPEN stock in late August, purchasing 28,400 shares at $4.27 and 1,600 shares at $4.42 and lifting his direct ownership to about 4.28 million shares.

That move arrives amid a volatile year for the digital real estate name, so Radhakrishna’s purchase could reflect renewed faith in Opendoor’s turnaround plans or simply a tactical bet by an insider who knows the company’s short-term cadence.

Here’s a closer look at what the trade might mean for investors deciding whether to follow suit or sit this one out in September 2025.

About OPEN Stock

Founded in 2014, Opendoor is an online home-buying company that makes selling and buying houses easier. It gives instant offers, handles paperwork, and helps with financing, so transactions are faster and less stressful. Opendoor operates nationwide and uses technology and data to simplify the real estate process for everyday people.

OPEN stock has been soaring since last year, jumping over 226% in 2025 alone. Investors piled in after meme hype, useful company changes, and social media buzz. Hopes for lower interest rates and short squeezes added fuel, turning cautious traders into buyers and pushing the price higher.

Following the bull run, the valuation of OPEN stock is elevated, trading at 66x forward earnings, while a fair multiple should be in the mid-single-digits.

Opendoor Beats Q2 Earnings Estimate

Opendoor posted $1.57 billion in revenue for Q2 2025, roughly a 5% year-over-year (YoY) gain and a small beat versus Street estimates. The top line still comes mainly from home sales and related services. The company sold 4,299 homes and acquired 1,757 during the quarter, showing that the core iBuyer engine still moves meaningful volume even as it shifts toward a more asset-light platform.

Adjusted EBITDA swung positive at about $23 million, a notable inflection after several loss quarters, while GAAP net losses narrowed sharply to roughly $29 million.

“While our full quarter performance was strong, we observed a consistent slowing of the housing market as the quarter progressed. We are transitioning our business model during a historically difficult macro environment the benefits of this evolution will take time to materialize,” CEO Carrie Wheeler wrote in the shareholder letter.

Cash flow and liquidity show real improvement. Free cash flow turned positive, reported around $821 million for the quarter, and Opendoor ended June with roughly $789 million in unrestricted cash plus $396 million in restricted cash and about $1.5 billion in real estate inventory on the balance sheet.

The company also completed a $325 million convertible notes exchange in May that added fresh liquidity and extended maturities. Still, the asset-heavy model leaves Opendoor exposed if resale margins compress sharply.

Looking ahead, management gave a cautious near-term outlook. Third-quarter revenue guidance sits at $800 to $875 million, and adjusted EBITDA guidance points back to a negative range (roughly -$28M to -$21M), implying a sharp sequential pullback in volumes and margin pressure.

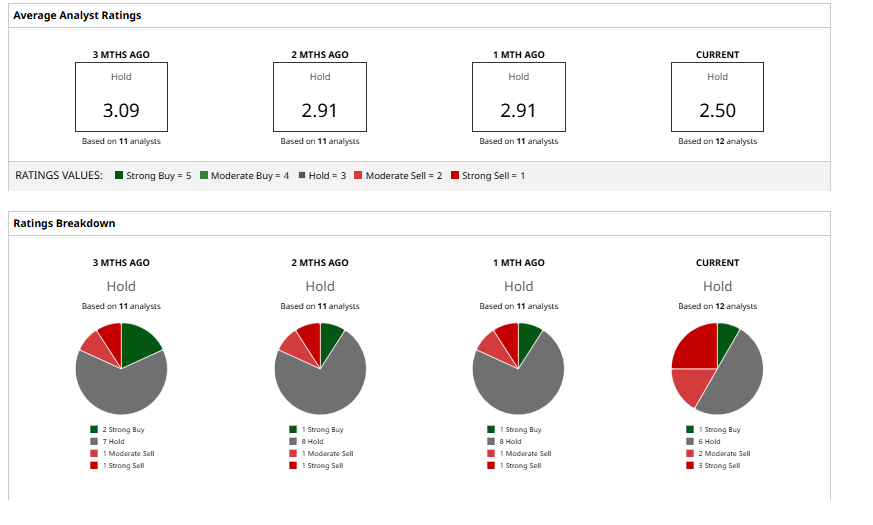

What Do Analysts Think About OPEN Stock?

In August, analysts adjusted mixed price targets on Opendoor. UBS raised its price target to $1.60 from $1.30 but warned it no longer assumes a return to year-over-year revenue growth in fiscal 2026 and flagged home-price depreciation as the main macro headwind.

Citigroup cut its rating to “Sell” with a $0.70 target, calling out weaker guidance and higher execution risk after the quarter.

Keefe, Bruyette & Woods moved to “Underperform” and set a $1.00 target, warning of widening losses in H2 2025 and uncertainty around Opendoor’s platform pivot. Together, the notes suggest analysts want clearer signs that the pivot and housing trends are stabilizing before turning more positive.

Overall, Wall Street analysts currently assign OPEN stock a consensus “Hold” rating. The stock not only surpassed its mean price target of $1 but is also trading at more than double the Street’s highest target of $2, highlighting a wide gap between analyst expectations and the market’s bullish momentum.

The Bottom Line on OPEN Stock

The insider buy is encouraging but small. For conservative investors, wait for clearer signs of sustained margin recovery, lower leverage risk, and management stability. For risk-tolerant traders who believe in the retail or AI narrative and can handle volatility, a small, speculative position with strict risk limits could make sense, but don’t treat this as a fundamentals-safe buy.