Innoviz Technologies’ (NASDAQ: INVZ) stock jumped 15% Monday as investors bet on new design wins and growth in autonomous driving.

INVZ shares are powering higher on strong volume. See the market dynamics here.

Shares gained despite the company trading at a discount to lidar peers, with optimism fueled by potential major automaker deals.

Goldman Sachs analyst Mark Delaney upgraded the stock rating from Neutral to Buy and raised its price target from $1.50 to $2.50.

Also Read: Innoviz Technologies Secures LiDAR Supply Deal With Mobileye

Delaney cited near-term design win opportunities and attractive relative valuation. The analyst raised his price forecast, implying a 47% upside compared to the group median of 13%.

He argued that as autonomous driving technology becomes increasingly important for automakers, new advanced driver-assistance and autonomous vehicle program awards should accelerate, particularly as tariff volatility subsides.

Delaney highlighted Innoviz’s development program with a top-five global passenger auto manufacturer, which he believes strengthens the company’s chances of securing a series production award. Innoviz’s recent Class 8 trucking OEM win, along with prior awards from Volkswagen and Mobileye, already positions the lidar maker as a sector leader, the analyst noted.

Despite that, Innoviz trades at a meaningful discount to lidar peers. According to Delaney, another series production award from a major automaker could solidify Innoviz’s market position and fuel stock outperformance.

The analyst projected that if both the Volkswagen program and the top-five OEM award scale by 2028, Innoviz could approach or reach positive EBITDA. Conversely, delays in converting design wins or program launches could weigh on his base case and force him to turn less optimistic on the stock, he said.

Delaney estimated EPS, including stock-based compensation (SBC), at $(0.32), $(0.30), and $(0.25) in 2025, 2026, and 2027, respectively, and introduced a 2028 EPS forecast of 20 cents. Excluding SBC, the analyst forecast EPS of $(0.24), $(0.22), $(0.17) and $(0.10) across 2025–2028. He modeled 2028 revenue at $150 million under his base case, reflecting lidar shipments for more than 1,000 autonomous vehicles, 100,000–200,000 consumer lidar units and some non-automotive revenue. In an upside scenario with stronger AV adoption, revenue could climb to approximately $250 million, and EBITDA could turn positive, according to Delaney.

The analyst also noted Innoviz’s potential outside the auto sector, including in robotics, security and traffic management, which could expand its long-term total addressable market. Delaney concluded that a significant design win could serve as a key catalyst, given how lidar stocks have historically reacted to new program awards.

INVZ Price Action: Innoviz stock is up 15% at $1.96 at publication on Monday.

Read Next:

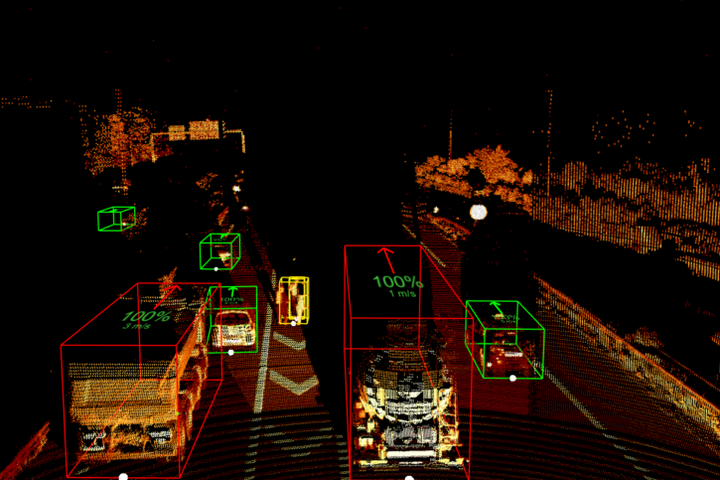

Photo: Courtesy Innoviz