/Ingersoll-Rand%20Inc%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $34.1 billion, Ingersoll Rand Inc. (IR) is a global industrial company specializing in mission-critical air, fluid, energy, and medical technologies. Operating through its Industrial Technologies & Services and Precision & Science Technologies segments, the company delivers a broad portfolio of products and solutions across diverse industries worldwide.

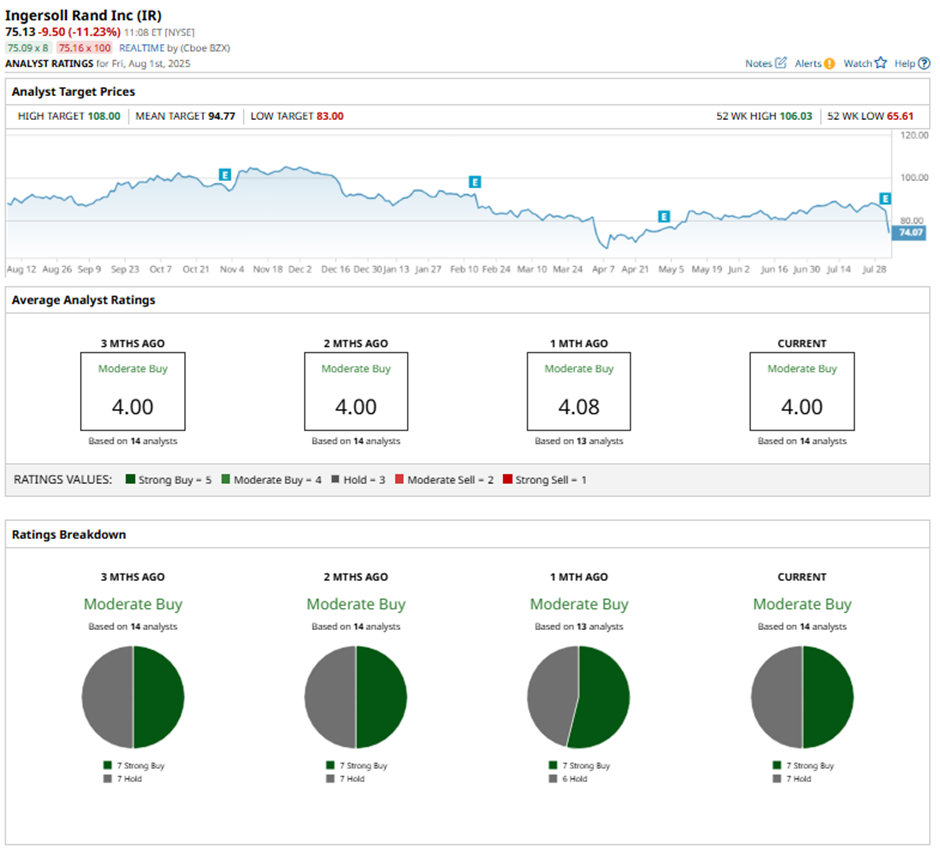

Shares of the Davidson, North Carolina-based company have underperformed the broader market over the past 52 weeks. IR stock has decreased 17.2% over this time frame, while the broader S&P 500 Index ($SPX) has returned 14.7%. Moreover, shares of Ingersoll Rand are down 16.5% on a YTD basis, compared to SPX’s 6.2% gain.

Focusing more closely, the flow control and compression equipment maker stock has also lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 19.1% return over the past 52 weeks.

Despite reporting better-than-expected Q2 2025 revenue of $1.9 billion and adjusted EPS of $0.80 in line with analyst estimates, shares of Ingersoll Rand fell 11.3% the next day. Specifically, organic revenues declined 4% in the Industrial Technologies & Services segment and 2% in the Precision & Science Technologies segment, signaling underlying demand softness. Additionally, a reported net loss of $115 million, driven by non-cash impairments and a lowered organic revenue growth guidance for the full year, weighed on investor sentiment.

For the fiscal year ending in December 2025, analysts expect Ingersoll Rand’s EPS to grow 1.9% year-over-year to $3.24. The company's earnings surprise history is mixed. It topped or met the consensus estimates in three of the last four quarters while missing on another occasion.

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings and seven “Holds.”

On Jul. 21, Stifel analyst Nathan Jones raised Ingersoll Rand's price target to $95 while maintaining a “Hold" rating, citing solid and stable demand based on management commentary and channel checks.

As of writing, the stock is trading below the mean price target of $94.77. The Street-high price target of $108 implies a potential upside of 43.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.