UK inflation figures showed a surprise upward change between May and June, CPI rising 3.6 per cent, as the struggle to bring down costs continues. Increasing food and fuel prices last month underline the challenge to do so.

The Bank of England now have a key decision to determine the underlying reasons for inflation remaining high, as this will be a key factor - along with the job market and business confidence - in deciding whether to reduce interest rates next month.

Elsewhere, reaction to Rachel Reeves’ Mansion House speech last night is ongoing, where the chancellor explained her latest attempts to stimulate economic growth through a raft of financial changes spanning the mortgage market, investing and cutting red tape for businesses.

In the stock markets, the FTSE 100 briefly rose above the 9,000 points level this week for the first time ever, though closed down on Monday - while uncertainty continues around EU-US trade relations and eventual tariff levels.

Follow The Independent’s live coverage of the latest stock market and business news here:

Inflation and Business news - 16 July

- Inflation up to 3.6% for June in surprise increase

- Conservatives blame Labour's taxes and borrowing for heightened inflation levels

- Will the Bank of England cut interest rates with inflation rising?

- What inflation figures mean for your money

- Rachel Reeves vows to cut red tape for businesses

- Chancellor speaks out on encouraging the public to invest for the long term

- CEO of Diageo, firm which owns Guiness and other drinks brands, steps down with immediate effect

Inflation: UK sees another rise to 3.6% - but interest rates still likely to drop

16:03 , Karl MatchettThat’s it for us today, thanks for joining us and we’ll be back with our usual business blog across the rest of the week.

Highlights from today:

- Inflation rises to 3.6%, higher than anticipated

- Interest rates still expected to be cut to 4% next month

- Rachel Reeves’ plan to encourage investors sees first meaningful steps planned

- Barclays are fined £42m over poor money laundering checks

- Diageo chief steps down with immediate effect

- FTSE 100 set to close higher

See you next time!

Inflation and Business news - 16 July

05:58 , Karl MatchettGood morning and welcome to The Independent’s live business blog, where today we’re focusing on inflation figures for June as well as reaction to Rachel Reeves’ speech last night, stock market news and more.

Will Rachel Reeves’ mortgage bombshell do more harm than good?

06:05 , Karl MatchettThe chancellor is right to woo the City – she can’t risk alienating them when she needs their support, writes James Moore.

But he’s not convinced her plan to win them over will work...

Will Rachel Reeves’ mortgage bombshell do more harm than good?

UK inflation: Where next after 3.4 per cent in May?

06:14 , Karl MatchettAs a reminder and a look back, it was air fares and fuel which fell last month, but food was increasing at the highest rate in 12 months, with household goods also increasing in price.

That resulted in a 3.4 per cent inflation rate for May.

A month earlier the CPI figure was 3.5 per cent, which was later revised to 3.4 per cent due to errors in some figures regarding vehicles.

So, we’re expected to flatline again in terms of inflation for June - it could even tick up to 3.5 per cent again.

Experts estimate food prices to continue acceleration

06:24 , Karl MatchettLooking deeper into the numbers, Barclays analysts expect the same 3.4 per cent - but for food to carry on rising.

“Headline CPI inflation should remain at 3.4% in June, unchanged from May, with a deceleration of services price growth driving an easing in core CPI. We expect an acceleration of food price inflation but core goods and services to undershoot the BoE's expectations,” wrote analysts in a note.

Biggest financial reforms ‘in a decade’ to bring risk-taking back into City

06:40 , Karl MatchettRachel Reeves has unveiled a package of reforms to the UK’s financial system set to be the biggest in a decade, aimed at delivering economic growth and spurring on retail investing.

Changes include reforming the bank ring-fencing regime and reducing burdensome regulation in the City in order to reintroduce “informed risk-taking” into the financial system, the Government said.

The Chancellor said the “Leeds reforms”, unveiled in the West Yorkshire city, “represent the widest set of reforms to financial services for more than a decade”.

New measures are intended to help drive increased levels of investment among both financial firms and individuals.

More here from Anna Wise at PA:

Biggest financial reforms ‘in a decade’ to bring risk-taking back into City

Higher inflation mean lower business confidence

06:58 , Karl MatchettContinuing inflation is an issue for all, but growing inflation is a real problem to which businesses tend to react to worst - as a result of higher interest rates.

Charlie Ambler, co-chief investment officer at Saltus explained: “Another uptick in inflation would be frustrating, but not wholly unexpected. The Bank of England has already signalled that services inflation and energy price pressures would keep the headline rate sticky for some time. If CPI does climb again, markets are unlikely to take it well, particularly as hopes for an August rate cut start to look more ambitious.

“From an investor perspective, this continues to be a challenging environment to navigate. The UK economy is clearly cooling, contracting 0.1% in May, which further limit the Bank’s room for manoeuvre. But the longer rates stay restrictive, the greater the drag on confidence, especially among entrepreneurs and business owners - who are often the first to pull back from risk in uncertain times.”

Inflation in surprise rise to 3.6%

07:04 , Karl MatchettThe figures are in and they are higher than expected - CPI is in at 3.6 per cent for June.

Official ONS figures show transport, particularly motor fuels, making the largest upward contribution to the monthly change.

Housing and household services made “a large, partially offsetting”, downward contribution.

Inflation rises: Food, tobacco and fuel

07:12 , Karl MatchettFood and fuel continue to contribute significantly to the overall figure, with alcohol and tobacco also increasing notably last month.

Commenting on today’s inflation figures for June, ONS acting chief economist Richard Heys said:

“Inflation ticked up in June driven mainly by motor fuel prices which fell only slightly, compared with a much larger decrease at this time last year.

“Food price inflation has increased for the third consecutive month to its highest annual rate since February of last year. However, it remains well below the peak seen in early 2023.”

Inflation latest: Conservatives blame taxes and borrowing for inflation increase

07:15 , Karl MatchettChancellor Rachel Reeves has reacted to the latest inflation figures by saying much the same as last month: pointing to minimum wage increases and a couple of other money-saving ventures to keep money in pockets.

There’s more to do though, she said. “I know working people are still struggling with the cost of living. That is why we have already taken action by increasing the national minimum wage for three million workers, rolling out free breakfast clubs in every primary school and extending the £3 bus far cap. But there is more to do and I’m determined we deliver on our Plan for Change to put more money into people’s pockets.”

In contrast, Mel Stride MP, shadow chancellor of the exchequer, blamed Labour’s choices for borrowing as being behind the continued high inflation levels.

“This morning’s news that inflation remains well above the 2 per cent target is deeply worrying for families,” he said.

“Labour’s decision to tax jobs and ramp up borrowing is killing growth and stoking inflation – making every day essentials more expensive – and because Labour are too weak to take tough choices on spending, more tax rises are on the way, leaving families facing ever-rising costs.

“Only the Conservatives will break this cycle by taking the responsible approach and backing the makers - the people who work hard, create wealth and jobs, and fund public services.”

Inflation at 3.6 per cent: What does it really mean?

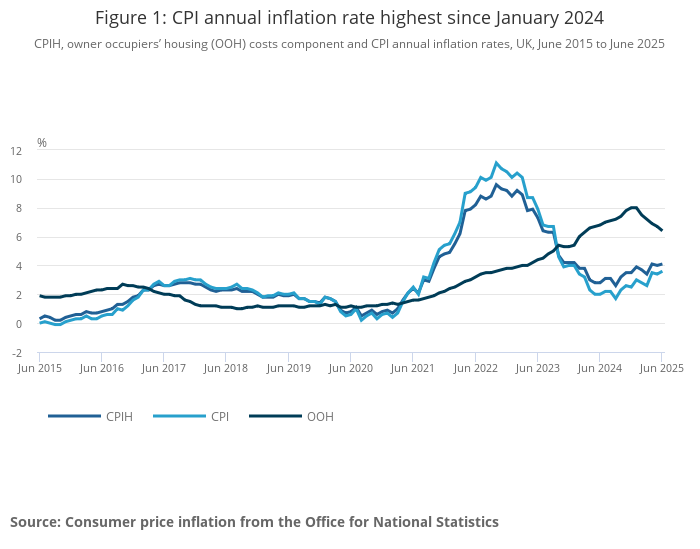

07:23 , Karl MatchettLet’s add a bit of context to these figures. There are three different lines on the chart below; the number we focus on usually is CPI - the light blue. (Apologies if making out the difference is difficult, this is an ONS graph: CPI is the lowest of the three lines on the right hand side.)

While this clearly shows inflation is a long way from the heights it reached in 2022 and 2023, it’s also still some distance from the 2 per cent target...and heading in the wrong direction.

As you can see from the flick upwards at the end, the past quarter-year has been disappointing; from 2.6 per cent in March, CPI has since been at 3.5, 3.4 and now 3.6 per cent.

As such, it means prices (as a whole) are on the increase compared to one year ago in each of those respective months, and a continued uptrend means we’re also seeing monthly increases - from May to June, the one-month CPI is 0.3 per cent.

Inflation at 3.6%: Lower spending power means fewer can buy property

07:34 , Karl MatchettRising inflation affects an awful lot beyond just prices you pay for things. The knock-on effects are widespread, some obvious, some less-so.

The impact it has on interest rates, for example, can make a difference to your savings, to your mortgage repayments, to your affordability if you’re seeking a mortgage, to the price of houses themselves that are being built...on it goes.

Nathan Emerson, CEO of Propertymark, noted that if the government want to hit their 1.5m homes target during the course of parliament, getting inflation under control is key: “This news will provide no respite for people who are struggling with their personal finances at a time when there is widespread data suggesting Britain’s finances are in a ‘perilous’ state.”

“Housing plays a pivotal role in the UK economy, and considering the UK Government and the devolved administrations have set themselves ambitious housing targets, it’s important that there is strong affordability to support consumers with their housing ambitions.”

More people buying property is a big driver of economic growth.

Will the Bank of England cut interest rates with inflation rising?

07:43 , Karl MatchettA key question, with the Monetary Policy Committee meeting next month and not having cut interest rates from 4.25 per cent last time around.

Quick basic primer, skip if you know it: Interest rates are one of the tools used for controlling inflation by the Bank of England. Higher rates make businesses less likely to invest in personnel and projects, meaning consumers may have less spending power, making them buy less overall, lowering demand, meaning prices must come down again.

So, with inflation back on an upward tick, it’s one mark against cutting interest rates this time - but there’s more at play.

The employment market is a closely watched metric and there have been signs that businesses are choosing to stop hiring and payrises as a consequence of April’s National Insurance Contributions increase.

That’s a particularly important tick in the box to cut interest rates.

Also economic growth has been almost non-existent in the past three months, which is again a reason to cut rates.

Only yesterday, markets were pricing an 85 per cent chance of a rate cut in August. We’ll see shortly how much that has changed.

Inflation latest: Harvests, weather and budget to blame for food prices

07:50 , Karl MatchettLet’s look at a few components individually, starting with food and non-alcoholic beverages.

Last month they were rising across 12 months at 4.4 per cent; this time around it’s 4.5 per cent, ONS data shows.

Kris Hamer, director at the British Retail Consortium, said the Budget last year has driven food inflation, as well as poor harvests around the world.

“While inflation has risen steadily over the last year, food inflation has seen a much more pronounced increase. Despite fierce competition between retailers, the ongoing impact of the last budget and poor harvests caused by the extreme weather have resulted in prices for consumers rising,” he explained.

“The price of many staples rose on the previous month, including bread, rice and pasta though consumers in the market for chocolate benefitted from a decrease.

“With rising costs already driving up prices at the till, the chancellor must take action now to protect consumers from inflation rising further. The proposed business rates reform would drive up costs for many high street stores, limiting investment and pushing up prices for everyone. If the Government wants to support households and high streets, they should ensure that no shop pays more as a result of these changes.”

Inflation latest: What it means for your money

07:56 , Karl MatchettThe usual question when it comes to inflation is...what now for my money?

Let’s be very clear, the first thing you must do is make sure your savings are protected. By the nature of inflation meaning higher prices, your cash is worth less over time. So with inflation at 3.6 per cent, the interest rate your savings earn need to be at least than that just to stand still.

Read: Best savings accounts earning 4.5 per cent and more

So once you’ve got that part sorted out for essential savings, it’s time to consider what you do next.

Dean Butler, managing director for retail direct at Standard Life, points out that those with more than a few months’ worth of expenses saved away should be looking to do more with some of that cash - particularly if it’s not expected to be needed over the next few years.

“For borrowers, higher for longer rates mean the prospect of sustained higher costs, particularly for mortgage holders and those with other forms of debt,” he said.

“On the other hand, savers continue to benefit from competitive rates, with some best buy easy-access savings accounts still offering between 4 and 5 per cent.

“It’s worth noting that any cash gains are still likely to be marginal with inflation considered – those willing and able to accept an element of risk could consider investing for a better chance of substantial returns above inflation, perhaps through a tax efficient product like a stocks and shares ISA or, taking a longer-term view, with a pension.”

Inflation figures likely to rise into autumn, economics expert says

08:05 , Karl MatchettEarlier this year, when inflation was down to around 2.6 per cent, not too many economists were getting carried away - there was always the expectation of a rise in April and across summer.

However it has been slightly higher than many have predicted in the end, with unexpected factors such as the trade tariff battle, the rising oil price over Iran-Israel and other external issues all impacting, even beyond the UK’s domestic problems.

Suren Thiru, economics cirector at The Institute of Chartered Accountants in England and Wales (ICAEW), believes there will be worse yet ahead too, with a bigger rise in inflation heading into autumn.

“These figures confirm that cost pressures on households and businesses remain disconcertingly high as rising fuel and food prices helped drag inflation further away from the Bank of England’s 2% target.

“June’s uptick is the start of a slight summer surge in inflation with skyrocketing business costs and global trade turbulence likely to lift the headline rate moderately higher by the autumn, despite July’s drop in energy bills.”

Inflation latest: Which foods have been hit hardest?

08:12 , Karl MatchettA few details now on where food price increases have stemmed from, courtesy of the Food and Drink Federation (FDF):

- Beef and veal rose 20.4%

- Butter (20.0%) also showed a big increase

- Chocolate (16.3%), coffee (12.3%), and lamb and goat (10.2%) were also notable rises

- Prices fell fastest for: olive oil (-9.6%), rice (-3.1%), sugar (-2.6%) and frozen seafood (-1.3%)

Balwinder Dhoot, director of sustainability and growth at the FDF, explained where exactly the food price rises have come from - and where the government can protect against it.

“Food and drink inflation has risen once again in June, continuing a concerning trend in 2025. Food and drink inflation has consistently outpaced the overall rate of inflation throughout the year, and seen sharp increase in the past 12 months - and we expect inflation to rise further this year.

“The pressure on food and drink manufacturers continues to build. With many key ingredients like chocolate, butter, coffee, beef, and lamb, climbing in price – alongside high energy and labour expenses – these rising costs are gradually making their way into the prices shoppers pay at the tills.

“The Government’s new Food Strategy is an opportunity to create a more resilient food system. This should include looking again at the costs and regulations facing food and drink manufacturers in order to address creeping price inflation.”

Inflation latest: Key economist still backs interest rates cut in August

08:20 , Karl MatchettThere will be plenty more discussion going forward over whether the Bank of England (BoE) will cut or not next month - but one analyst is still predicting an August interest rates cut.

Sanjay Raja is Deutsche Bank’s chief UK economist, a prominent voice in the sphere.

He notes the poor data from a BoE perspective, but thinks the Monetary Policy Committee’s (MPC) focus on jobs and growth means we’ll still see a rate cut.

“Perhaps given the focus on the labour market, tomorrow's data may hold more weight when it comes to shaping the monetary policy outlook,” he said.

“But today's data won't give the MPC any sense of comfort on the inflation side. Headline CPI, core CPI, services CPI, and core goods CPI now all sit above Bank staff projections. All of the Bank's core services measure have also increased in June.

“And we expect headline CPI to push closer to 4% year on year after the summer, before beginning its slow descent back to target later next year. The Bank, like us, will be watching closely the implications on inflation expectations, which already look a bit uncomfortable.

“This kind of data (in and of itself) won't motivate the MPC to contemplate faster or sequential rate cuts. In fact, the bar for a dovish surprise on tomorrow's labour market data will likely rise on the back of today's inflation reading.

“Is an August rate cut in jeopardy? No, we don't think so. There's enough of a slowdown in GDP and the labour market to warrant a 'gradual and careful' easing of monetary policy. But the onus now rests on the labour market to shape how far and how fast the MPC can cut this year and next.”

How rising inflation impacts your mortgage and savings

08:30 , Karl MatchettInflation has been on a difficult path in 2025, initially dropping before surging back up to 3.5 per cent in April and a marginal decrease to 3.4 per cent in May. For June, it’s back on the upward path, fuel and food costs contributing to a headline rate of 3.6 per cent.

In part as a result of this sticky inflation, the Bank of England (BoE)’s Monetary Policy Committee held their vote to maintain interest rates at 4.25 per cent in June, following a cut in May.

As interest rates are one of the primary ways the BoE looks to control inflation, they are often linked to each other, and each one can have knock-on effects on several areas for people in the UK.

Here’s how it all impacts your money, your mortgage and savings:

Inflation figures mean UK 'walking tightrope' for stagflation

08:44 , Karl MatchettNick Lawson, portfolio manager at Julius Baer, says the UK is looking wobbly in terms of stagflation now - not just through inflation rates but for where inflation is stemming from, alongside those poor growth figures we’ve seen.

“Wednesday’s CPI print might cause a headache for the Bank of England, and makes the Chancellor’s difficult job that little bit more intolerable,” Mr Lawson said.

“Coming in at 3.6%, ahead of analysts’ forecasts of 3.4%, means traders, mortgage holders and the Treasury will be anxiously awaiting the next Monetary Policy Committee decision.

“Core CPI – which removes the effects of energy, food, alcohol, and tobacco – was even higher, at 3.7%. This will likely mean nervousness in the Bank that today’s figures can’t be chalked up to the more volatile peripheral components of the data.

“Let us not forget the dismal recent performance of the UK economy, with negative growth in both April and May. We’re sure the Bank of England would dearly love to give borrowers and businesses a break by cutting rates, and that Ms Reeves would love to see a modicum of her fiscal headroom restored.

“Instead, as tariff and tax impacts seemingly start to bite, Britain teeters on the edge the nastiest of economic nightmares: stagflation. The Bank has long talked of ‘gradual and careful’ rate cuts. Today, the tightrope they walk got a little higher and a little more perilous.”

Savers to be offered deals that could see them more than quadruple their wealth

09:00 , Karl MatchettSavers with cash in low-interest bank accounts will be contacted and encouraged to consider more lucrative investments, under Rachel Reeves’ plans to boost the economy and raise wealth.

One example offered by the Treasury on how people can benefit showed that a saver investing £2,000, such as in a stocks and shares ISA or general investing account, rather than letting it sit in a low-interest account, could expect that to grow to £12,000 after 20 years.

That was compared to £2,700 if left in a savings account - a difference of more than £9,000 for families or individuals, or around 4.5 times more.

Savers to be offered deals that could see them more than quadruple their wealth

Inflation figures a 'punch to Bank of England' intent to cut interest rates

09:15 , Karl MatchettNot everyone feels it’s a done deal for an August rate cuts at this point.

Peter Stimson of MPowered Mortgages predicts that at least some of the MPC members will vote to hold interest rates at 4.25 per cent in a few weeks.

“The intake of breath at the Bank of England will have been audible. Such a big jump in CPI isn’t just a blow for the Bank’s ratecutting plans, it’s a punch to the solar plexus,” he said.

“Inflation like this can no longer be dismissed as a blip. It’s now a barrier to cutting interest rates.

“The Bank’s Governor has spent weeks hinting that a Base Rate cut in August was all but a done deal.

“But that certainty has evaporated in the face of today’s inflation data.

“Several members of the Bank’s ratesetting Monetary Policy Committee (MPC) had sounded unconvinced that the time is right to cut the Base Rate to give the stagnant economy the boost it needs.

“Britain’s inflationary relapse will crystallise that view, and when the MPC meets in three weeks’ time it’s likely several members will vote to hold off on a rate cut.

“While the weakness of the economy means the Bank will be keen to resume rate cuts in coming months, the likelihood of an August cut has plunged from near certain to barely 50/50.”

Will interest rates be cut in August? The key factors for the Bank of England and 2025 predictions

09:30 , Karl MatchettThe Bank of England’s (BoE) next meeting to determine interest rates is on Thursday 7 August, and all eyes will be on the Monetary Policy Committee (MPC) and whether its members opt to continue lowering rates.

The base rate - currently at 4.25 per cent following cuts in February and May - impacts consumers and taxpayers through everything from their mortgages to savings, so what do experts foresee both next week and beyond?

Will interest rates be cut in August? Key factors and 2025 predictions

Inflation, interest rates and stagflation - BoE face a fight

09:44 , Karl MatchettDan Coatsworth, investment analyst at AJ Bell, gives a rundown on the Bank of England’s journey over the last few years and where the battle lines are now to fight off stagflation:

“There is a real threat of stagflation as the rate of inflation moves higher and the economy is stuck in the mud. It puts the Bank of England in a tricky situation.

“Interest rates shot up between 2022 and 2023 to fight off the rapid rise in inflation. The central bank then began its journey in August 2024 to bring rates back down and markets were expecting the cost of borrowing to fall to 3.75% later this year.

“As it stands, the market expects an 81.9% chance of a rate cut in August, but there is a lot less confidence in future cuts. The latest inflation figures might encourage the Bank to sit on its hands and wait for more data to see if the spike in the cost of living is only temporary. However, its rate decisions are also influenced by what’s happening in the jobs market and the outlook is far from rosy.

“Plenty of companies are feeling the pressure of extra employment-related costs and they’re reluctant to hire new people when someone leaves; others are already cutting positions. This means the Bank is stuck between a rock and hard place.”

Inflation figures: Explaining the fuel situation

10:02 , Karl MatchettOne point worth picking up on is fuel.

That’s a contributor to rising inflation...but fuel prices are actually going down at present. So how does that work?

The answer is in the year-on-year comparison, as Steve Clayton, head of equity funds at Hargreaves Lansdown, explains.

“The Office for National Statistics highlighted fuel prices as the main driver of the increase. Fuel prices are actually going down, but not as quickly as they were a year ago, which means that increases elsewhere are felt more acutely in the overall figure,” he said.

“Services pricing remains stubbornly strong too, with the pace of service price inflation sticking at 4.7%.

“So far, the Bank of England has held to the view that rising unemployment will drag inflation back down later in the year. But traders will fret that cutting rates while prices are accelerating may be asking too much of the Bank’s confidence in its own predictions.

“Sterling has reacted positively to the news, with investors betting that the news could push rate cuts further out into the future. The pound has risen to just over $1.34, putting an end to now for the weakening trend that we have seen in the last few trading sessions.”

Analysts point to key labour data after rising inflation

10:21 , Karl MatchettAnalysts at Barclays says the UK’s CPI is “hot compared to international peers”, after rising to 3.6 per cent.

“UK inflation returned to the international pack over last year but the gap between UK inflation and the EA and US has opened up again, both in core and headline, since April's tax changes and indexation bump,” the report read.

On interest rates, they added:

“This tricky print for the BoE should keep it cautious and gradual. The overshoot in inflation itself is problematic but, we think, within the tolerance range of the MPC for data outturns relative to its forecast, especially given the role played by airfares and the fact that core goods is undershooting relative to the May forecast. Of more concern will be the lack of progress on underlying services, which will likely give the central MPC members enough reason to remain cautious, even as we expect the labour market loosens in the coming months.”

Councils retaining local taxes could supercharge growth

10:46 , Karl MatchettAllowing councils to administer and retain taxes generated locally would boost funding for services by more than £4 billion in many areas and “supercharge” economic growth, a new analysis suggests.

The report argues that new fiscal arrangements which enable authorities to a proportion of revenue from income tax, stamp duty and the apprenticeship levy alongside a new tourist tax could prove transformational and support the delivery of the Government’s priorities.

The County Councils Network, which commissioned the report, stressed the proposals do not advocate tax rises and acknowledged that a process of redistributing tax revenue would need to be established to address regional variations in the amounts generated.

Deputy Prime Minister Angela Rayner recently said she wanted “more push” towards fiscal devolution as part of the Government’s pledge to transfer central decision making to local areas.

Rachel Reeves wants to cut red tape for businesses

10:56 , Karl MatchettWorth a look now at last night’s Leeds reforms and the chancellor’s plans to boost growth.

Rachel Reeves said she wants to get rid of red tape which is a “boot on the neck” of businesses, calling for regulators to stop preventing innovation and growth with demands.

“It is clear that we must do more,” Reeves said last night. “In too many areas, regulation still acts as a boot on the neck of businesses, choking off the enterprise and innovation that is the lifeblood of growth.

“Regulators in other sectors must take up the call I make this evening, not to bend to the temptation of excessive caution, but to boldly regulate for growth in the service of prosperity across our country.”

Reeves wants risk-taking by businesses and consumers alike

11:10 , Karl MatchettMs Reeves’ calls to cut red tape are for a simple reason: to enable bolder and bigger pushes for businesses to grow more.

That of course creates a growing economy when they do well, but there’s more to the plans.

“We have been bold in regulating for growth in financial services and I have been clear on the benefits that that will drive: with a ripple effect across all sectors of our economy putting pounds in the pockets of working people; through better deals on their mortgages; better returns on their savings; more jobs paying good wages across our country,” she says.

The chancellor then wants everyday people to take more risk too, by putting their money to work in investments.

A starting point is to review language around investment products and opportunities, as well as an ad campaign encouraging people to start doing so if they don’t already.

Reeves demands investing be shown in more positive tones to encourage equities take-up by public

11:25 , Karl MatchettRachel Reeves has told City leaders to change the tune on investing to get more people putting long-term savings into equities.

Recent alterations to rules means people who don’t pay for financial advice can soon get targeted guidance, a bridge of the gap between specialist advice and just standard explanations.

Now more needs to be done to show why, and how, investing can be a long-term positive for people’s wealth.

“Our tangled system of financial advice and guidance has meant that people cannot get the right support to make decisions for themselves,” she said.

“For too long, we have presented investment in too negative a light, quick to warn people of the risks without giving proper weight to the benefits.”

Mark FitzPatrick, CEO of St. James's Place, said: “We strongly support the planned UK Investment Campaign announced yesterday, joining colleagues across the industry to develop a campaign that encourages the nation to invest.

“Building a culture of investing is vital – not just for people’s long-term financial wellbeing, but for the wider economy. With better awareness we can help more people feel confident about investing and nurture a stronger investment culture.”

Savings and investing platforms both give approval to Reeves' call to action

11:41 , Karl MatchettLots and lots of reaction on both sides of the divide over plans to start encouraging people to invest more money.

It’s easy to imagine wealth managers just want you to use their products, but the sense in this plan is visible with both investment and savings platforms alike speaking of their approval - and showing what actually needs to happen to change the narrative.

Here’s a selection of comments from those operating in the financial spheres...

Charlotte Kennedy, Rathbones:

“The emphasis on changing the narrative around investment risk is particularly welcome. Too often, risk is seen as something to be avoided entirely, when in reality, understanding and managing it is key to achieving better financial outcomes. Leaving money idle in savings accounts might feel safe, but it often fails to keep pace with inflation, let alone build wealth over the long term.

“Unlocking retail investment will be no easy feat. It means unpicking generations of overreliance on cash and the uniquely British tendency to favour bricks and mortar. Changing those deeply ingrained habits will take time - and, crucially, education.

“Greater financial education in schools is pivotal if we’re to lay the groundwork for long-term change. Children should leave school equipped not just with academic knowledge, but with the financial confidence to invest wisely in adulthood. If we’re serious about unlocking the nation’s capital and building a stronger economy, we need to start with the next generation.”

Brian Byrnes, Moneybox:

“Cash ISAs are not, and never have been, a blocker to investing—they’re a gateway. We’re pleased to see evidence of an increased focus on consumers, and finding the right balance between cash savings and investing for long term growth, rather than cutting allowances that motivate and reward positive saving behaviours and help people become financially resilient.

“We fully support the Government’s ambition to foster a stronger investment culture in the UK and while our research shows that there is an appetite to invest amongst most savers, people are held back by fear of financial loss, a lack of confidence and limited knowledge.

“Initiatives like the Advice Guidance Boundary Review, the Pensions Investment Review, easing overly cautious risk warning regulations along with consumer education campaigns will all be key to breaking down the barriers and building a nation of confident investors.”

Victor Trokoudes, Plum:

“After much speculation over Cash ISA changes, savers will be pleased that the Chancellor is not moving forward with ISA reforms for the time being. It’s important, at the very least, not to make ISAs any more complex than they are now by adding new versions which could confuse people, potentially deterring them from using an ISA.

“Encouraging a culture of investment to achieve the Chancellor’s goals is the right priority rather than reducing the Cash ISA allowance to make it harder for people to save.

“Our Freedom of Information (FOI) request revealed that the average value of the top 25 stocks and shares ISAs stands at £8.8million versus an average of £650,000 for the largest 25 cash ISAs, which is 13 times more. However, it is important that this initiative is delivered in a way that puts consumer interests first and supports their understanding of investing and its risks.”

Yana Skrebenkova, Revolut:

“For too long, a lower appetite for investing in the UK may have hindered many Brits from building long-term wealth. But creating wealth through investing should be accessible to everyone, not just a privileged few. By equipping people with the confidence to invest, starting with clear guidance and readily available, low-cost investment tools, we can encourage more consumers to take the first step. Opening up conversations about starting to invest will dismantle the barriers that have historically prevented people from getting started, leading to a truly positive shift.”

Key points from Rachel Reeves’s Leeds reforms

12:00 , Karl MatchettIt wasn’t all about investing and red tape.

Here’s a good run-down of the key points which might affect you, from ISA reform and mortgage changes to Ombudsman modernising and consumer protection rules.

House price index: 3.9% annual rise in property prices

12:18 , Karl MatchettWith inflation the key topic today, a lot of else has gone a little unnoticed.

Let’s look around the rest of the business, money and economics lines around lunch, starting with the UK house price index.

Gov.UK’s report today shows the average property price for May of this year was £269,000, resulting in an annual average price increase of 3.9 per cent.

That varies by region of course, with the highest being Northern Ireland 9.5 per cent, Scotland 6.4 per cent and the north east 6.3 per cent.

At the other end of the scale, the south west grew at 1.9 per cent, the south east 2.1 per cent and London at 2.2 per cent.

Jonathan Hopper, CEO of Garrington Property Finders, said:

“This is a reset rather than a resumption of business as usual.

“While April’s figures can be dismissed as an oddity - the weeks after the Stamp Duty deadline were ghostly quiet for many estate agents - May was supposed to see the market return to normality.

“Today’s figures suggest it has done so, but that in some areas the normality is sharper and harsher than before.”

FTSE 100 rises and price of oil drops

12:39 , Karl MatchettA look now at the equities and commodity markets - the FTSE 100, oil and gold, specifically.

Today’s stock market rise in the UK sees the index up 0.14 per cent, with British Airways owner IAG one of the highest flyers on the day, up 1.54 per cent.

It’s a mixed picture in Europe, with France’s CAC 40 pretty much at zero for the day, Germany’s DAX up 0.2 per cent and the Euro Stoxx 50 down 0.2 per cent.

Gold futures are slightly on the rise, up 0.22 per cent, but Brent Crude Oil has dropped almost half a percent down to $68.39 today.

Futures markets show the Nasdaq set to drop 0.17 per cent lower when it opens this afternoon.

Inflation has delivered a nasty shock – but don’t panic just yet...

13:00 , Karl MatchettJames Moore delivers his column today on inflation and why all is not as it seems...

Imagine “Don’t Panic” in large friendly letters – the pink ones that fans of The Hitchhiker's Guide to the Galaxy will know well – when you read that inflation did the dirty on us last month, coming in at 3.6 per cent.

The last few weeks have seen Bank of England governor Andrew Bailey dropping hints about rate cuts, even suggesting that the rate setting Monetary Policy Committee (MPC) could go further and faster if the jobs market continues to deteriorate.

But June’s inflation spoiled the party, hitting a near 18 month high, well ahead of the City’s consensus forecast compiled by Reuters.

Prices in the UK are running hot – far hotter than in Germany (2 per cent), or France (0.8 per cent). With inflation at 2 per cent for the Eurozone as a whole, the European Central Bank’s refinancing rate sits at just 2.15 per cent, making life much easier for the economies of those countries when compared to the welter burden of base rates at 4.25 per cent the British economy is struggling under.

Houston, do we have a problem? You could be forgiven for thinking as much, assuming the Office for National Statistics got its sums right.

Read more:

Inflation has delivered a nasty shock – but don’t panic just yet...

Trending business news: Barclays, Nissan, Nvidia

13:15 , Karl MatchettScanning around the world of business, a few big names are in the headlines for different reasons.

Barclays have been fined £42m by the FCA, related to a lack of oversight and “failing to adequately manage money laundering risks”, particularly relating to a company investigated by the police. Read more here.

Nissan are shutting a factory with nearly 4,000 workers in Japan, effective from 2027 and moving production further south. Read more here.

Nvidia say they will resume selling semiconductor chips to China after Washington removed licensing restrictions around their H20 AI chips.

Lifetime ISA vs personal pension: Which is better for higher retirement income?

13:30 , Karl MatchettIf you don’t qualify for an employer pension, or you’re looking for a way to supplement yours, both a Lifetime ISA and a personal pension, such as a SIPP (a self-invested personal pension), can be effective retirement planning tools.

They have a lot in common: they’re both tax-efficient, they hold a similar range of investments - Lifetime ISAs are a little more restricted - and most compellingly, contributions to either are topped up by 25 per cent, albeit in different ways.

At first glance, it may seem that you could pay the same amount into one or the other and they would deliver an equal income in retirement. This isn’t the case, however.

Lifetime ISA vs personal pension: Which is better for higher retirement income?

Drinking giant Diageo sees CEO step down with immediate effect

13:48 , Karl MatchettDiageo, the London-listed drinks firm which owns the likes of Guinness, Smirnoff and Baileys, has announced the departure of chief executive Debra Crew with immediate effect.

Ms Crew took over from former boss Sir Ivan Menezes, who died two years ago, but faced struggles including lower alcohol sales in some parts of the world and plenty of cost pressures.

Tariff uncertainty also weighed on the share price, which is down 23 per cent in the last year.

Chief financial officer Nik Jhangiani will step into the role on an interim basis until a permanent boss is found.

Shares are up 1.2 per cent today, though did initially surge around 3 per cent on the news.

Savers to be offered deals that could see them more than quadruple their wealth

14:00 , Karl MatchettSavers with cash in low-interest bank accounts will be contacted and encouraged to consider more lucrative investments, under Rachel Reeves’ plans to boost the economy and raise wealth.

One example offered by the Treasury on how people can benefit showed that a saver investing £2,000, such as in a stocks and shares ISA or general investing account, rather than letting it sit in a low-interest account, could expect that to grow to £12,000 after 20 years.

That was compared to £2,700 if left in a savings account - a difference of more than £9,000 for families or individuals, or around 4.5 times more.

Full details:

Savers to be offered deals that could see them more than quadruple their wealth

Pharmaceuticals tariff could come in next few weeks, says Trump

14:25 , Karl MatchettDonald Trump says pharmaceutical tariffs could come into effect as soon as the next two weeks - with the possibility for steep future rises.

The US want more pharma firms to produce on their soil, rather than exporting to the States.

UK-listed firms such as AstraZeneca and GSK derive a large portion of their income from the US.

The Telegraph report Trump saying tariffs could start “probably at the end of the month”.

He added: “We’re going to start off with a low tariff and give the pharmaceutical companies a year or so to build, and then we’re going to make it a very high tariff.”

The US president has previously said it could be up to a 200 per cent tariff on pharmaceuticals - which are paid by US consumers or businesses, not the nations or companies products are imported from.

Markets still bet on August interest rate cut

14:40 , Karl MatchettToday’s higher than expected inflation figure, which came in at 3.6 per cent, has not deterred the markets from predicting an interest rate cut in August.

While the picture is far less clear for the rest of the year, markets are still pricing an 87 per cent chance at present that the Bank of England moves the base rate down to 4 per cent.

Yesterday it stood at 89 per cent.

Jobs data could be the deciding factor ahead of the MPC vote.

US stocks mixed on opening as FTSE 100 continues to rise

14:59 , Karl MatchettThe benchmark for UK businesses, the FTSE 100, is up 0.37 per cent today with an early afternoon surge - but it’s a more mixed picture in the US after the opening bell.

For the tech-heavy Nasdaq, it’s 0.2 per cent down; the S&P 500 is exactly flat and the Dow Jones Industrial is 0.15 per cent up.

Tesla and BlackRock are up more than 2 per cent each, but for Micron, Ford Motor and Morgan Stanley, drops of around the same amount are the order of the day so far.

Co-op confirms data on 6.5m members stolen in cyber breach

15:20 , Karl MatchettCo-op have confirmed that names, addresses and contact details of all 6.5m registered members were stolen in a cyber attack in April.

CEO Shirine Khoury-Haq said she was “incredibly sorry” for the data breach.

Co-op has not given a figure for the total cost of the breach.

Marks & Spencer, which was also hit around the same time, gave an expected cost of around £300m from their cyber attack.

JPMorgan Chase boss says Fed chief should be independent to politics

15:47 , Karl MatchettJPMorgan Chase CEO Jamie Dimon says it’s “absolutely critical” that the Federal Reserve chair remains independence.

His comments come as Donald Trump continues to put pressure on the Fed to lower interest rates in the US, with the president also threatening to remove the current chair, Jerome Powell, for not doing as he wants.

The US have started the process for choosing Powell’s successor despite his term not ending until next year.

Trump called Powell “very dumb” for not slashing interest rates, while Powell said the Fed would have done so if not for Trump’s inflationary tariffs agenda.

“The independence of the Fed is absolutely critical – and not just for the current Fed chair, whom I respect, Jay Powell, but for the next Fed chair,” Dimon said. “Playing around with the Fed can often have adverse consequences, the absolute opposite of what you might be hoping for.”

How mortgage market changes could help first-time buyers onto the property ladder

16:00First-time buyers may be set for a leg-up onto the property ladder thanks to changing attitudes from the financial regulator - but there are risks to the changing landscape.

Getting on the property ladder has been made harder in recent years by record high house prices that have outpaced wage growth.

Even if you can find a property, many buyers have been restricted by tough mortgage regulations.

Here’s what’s changing to help that:

How mortgage market changes could help first-time buyers onto property ladder

.jpg?w=600)