The cost of living in the UK rose higher than expected last month to a 19-month high as food prices and air fares continued to climb.

The rate of Consumer Prices Index inflation rose to 3.8 per cent in July from 3.6 cent in June, the Office for National Statistics said on Wednesday.

This is 0.1 of a percentage point higher than economists predicted, and means the headline rate remained at the highest level since January 2024, when it hit 4 per cent.

The ONS said transport was the biggest factor driving up overall inflation last month - particularly due to a spike in flight prices as families booked trips during the school summer holidays.

Food and drink inflation also rose to 4.9 per cent in July, from 4.5 per cent in June.

Chancellor Rachel Reeves said there was “more to do to ease the cost of living” following the latest official figures, adding the government had “taken the decisions needed to stabilise the public finances”.

Key Points

- UK inflation rate rises to 3.8%

- Rachel Reeves reacts to inflation figures

- Did Oasis push up prices? Definitely Maybe

- How a cup of tea is driving up shopping bills

- Food inflation forecast to keep rising all year

Full story: Inflation hits highest level since January 2024

10:41 , Athena Stavrou

When and why will train fares rise?

10:15 , Athena StavrouRegulated train fares in England may increase by 5.8% next year, based on a measure of inflation announced on Wednesday.

Fares are likely to increase next year, on dates to be determined.

This year, prices rose in England and Wales on March 2, and in Scotland on April 1.

The cap on regulated fare rises in England, Scotland and Wales is controlled by the UK, Scottish and Welsh governments respectively.

There will be an update on changes to regulated fares later this year, and no decisions have been made on 2026 rail fares.

House prices rise by 3.7%

09:59 , Athena StavrouThe average UK house price increased by 3.7 per cent to £269,000 in the 12 months to June, according to official figures.

The Office for National Statistics (ONS) revealed a slight slowdown in price growth after a 3.9 per cent rise was reported in the 12 months to May.

Average house prices increased to £291,000 (3.3%) in England, £210,000 (2.6 per cent) in Wales, and £192,000 (5.9 per cent) in Scotland, in the 12 months to June.

Meanwhile, average UK monthly private rents increased by 5.9 per cent, to £1,343, in the 12 months to July, the statistics body said.

A summary of the morning so far:

09:37 , Athena Stavrou- UK Consumer Prices Index (CPI) inflation rose to 3.8 per cent in July, up from 3.6 per cent in June, surpassing most economists' forecasts of 3.7 per cent.

- Transport was the main contributor to the inflation increase, primarily driven by a 30.2 per cent surge in air fares between June and July, the largest monthly rise since 2001.

- Petrol and diesel prices also increased in July, contrasting with a decline during the same period last year.

- Food and drink inflation continued its upward trend for the fourth consecutive month, reaching 4.9 per cent in July from 4.5 per cent in June.

- Chancellor Rachel Reeves acknowledged that further measures are required to alleviate the cost of living pressures on households.

Train passengers face potential 5.8% fares hike

09:17 , Athena StavrouRegulated train fares in England may increase by 5.8 per cent next year, despite punctuality in Britain at its lowest level since 2020.

The potential rise is based on the Office for National Statistics announcing that Retail Price Index (RPI) inflation rose to 4.8 per cent in July.

The Government has not confirmed how it will determine the cap on regulated fare rises in 2026, but this year’s 4.6 per cent hike was one percentage point above RPI in July 2024.

If that formula is used to set next year’s fare increase, the cost of train travel will jump by 5.8 per cent.

That would mean an annual season ticket from Woking to London rising by £247 to £4,507.

A flexi ticket for travel two days per week over a year from Liverpool to Manchester would increase by £120.30 to £2,195.10.

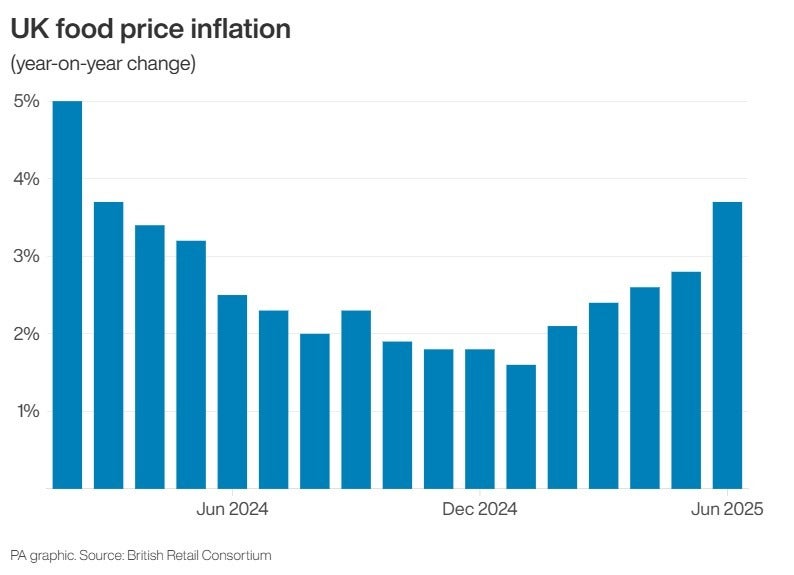

Surge in food inflation 'key driver' behind inflation, economists say

08:55 , Athena StavrouEconomists have been reacting to today’s inflation figures.

Kris Hamer, director of insight for trade body the British Retail Consortium, said: “Households are once again seeing the cost of their weekly shop climb, with food inflation now up by 1.9 percentage points in just four months.

“This surge has been a key driver behind headline inflation, alongside a rise in transport costs, piling fresh pressure on families already being forced to cut back.

“The Bank of England has been clear that Government policies, which have driven up the costs of employment, are fuelling price rises at the till, while poor harvests and global instability have also added further cost pressures.”

He added that there was some “limited relief” for consumers with clothing and footwear inflation easing and some everyday food items like olive oil, butter and cheese falling month-on-month.

Inflation figures 'deeply worrying for families', says shadow chancellor

08:37 , Athena StavrouThe shadow chancellor has criticised Labour after today’s inflation figures were released.

“This morning’s news that inflation has risen even higher than the 2 per cent target is deeply worrying for families,” Mel Stride said.

“Labour’s choices to tax jobs and ramp up borrowing are pushing up costs and stoking inflation – making everyday essentials more expensive.

"And with leading economists warning that the Chancellor has blown a colossal black hole in the public finances, families and businesses are bracing for yet more pain come the Autumn Budget.”

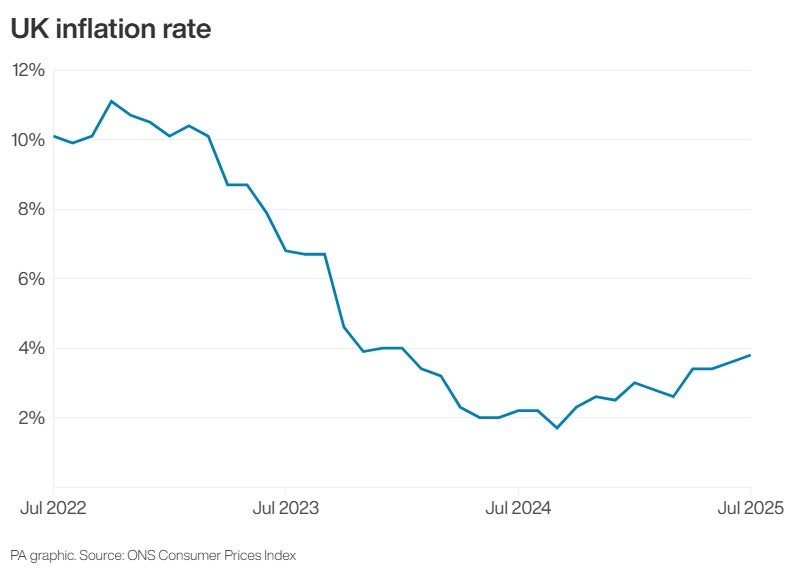

Graph: UK inflation rate

08:23 , Athena Stavrou

Why has inflation risen?

08:07 , Athena StavrouThe ONS said transport was the biggest factor driving up overall inflation last month - particularly due to a spike in flight prices as families booked trips during the school summer holidays.

Air fares soared by 30.2 per cent between June and July, the biggest jump since the collection of monthly data began in 2001.

The average price of petrol rose by 2p per litre between June and July, and the average diesel price by 2.9p per litre over the period, the data showed.

Prices across UK restaurants and hotels also increased last month, largely driven by a jump in overnight hotel stays booked the night before.

Food and drink inflation rose to 4.9 per cent in July, from 4.5 per cent in June.

Analysis: Clock is ticking for Labour as living standards lag

07:47 , Athena StavrouThe Independent’s political correspondent Archie Mitchell reports:

Sir Keir Starmer’s premiership has been rocked by a series of crises since last July, with U-turn after U-turn and a major row over freebies.

All are important, but will ultimately fade into the background by the next general election, when voters will largely decide who to back based on one question: Do I feel better off?

Wednesday's inflation figures are a wake-up call for Sir Keir and Rachel Reeves that the pressure is still on people’s pockets, and living standards continue to lag.

As well as restoring Britain’s crumbling infrastructure and public services, Labour must do more to bring down the cost of living and push up living standards if it is to have any hope of clinging to power.

It was a decade and a half of declining living standards which laid the ground for Rishi Sunak’s disastrous general election defeat. Voters desperate for change gave Sir Keir a chance to deliver it.

By failing them too, Labour risks gifting the next election to Nigel Farage and Reform UK.

Highest rate of inflation since January 2024

07:33 , Athena StavrouToday’s new figures have confirmed the UK has seen the highest rate of inflation in 19 months.

The headline rate remained at the highest level since January 2024, when it hit 4 per cent.

Rachel Reeves reacts to inflation figures

07:20 , Athena StavrouChancellor Rachel Reeves said there was “more to do to ease the cost of living” following the latest official figures showing UK inflation rose by more than expected last month.

She said: “We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do to ease the cost of living.

“That’s why we’ve raised the minimum wage, extended the £3 bus fare cap, expanded free school meals to over half a million more children and are rolling out free breakfast clubs for every child in the country.

“Through our plan for change we’re going further and faster to put more money in people’s pockets.”

Inflation figures higher than expected

07:17 , Athena StavrouThe inflation figures released by the Office for National Statistics this morning are higher than economists predicted.

It was widely believed inflation would rise to 3.7% in July.

But the figures have revealed the rate of Consumer Prices Index inflation rose to 3.8 per cent.

UK inflation rate rises to 3.8%

07:06 , Athena StavrouThe rate of Consumer Prices Index inflation rose to 3.8 per cent in July from 3.6 per cent in June, the Office for National Statistics said.

This is 0.1 of a percentage point higher than economists predicted, and means the headline rate remained at the highest level since January 2024, when it hit 4 per cent.

Explained: What rising inflation means for interest rates

07:00 , Jane Dalton

What does rising inflation mean for interest rates – and Rachel Reeves’s Budget?

Recap: CPI inflation expected to rise to 3.7%

06:45 , Jane DaltonNew figures from the Office for National Statistics set to be revealed soon are expected to show the rate of Consumer Prices Index (CPI) inflation increased to 3.7 per cent last month.

The Bank of England earlier this month warned chancellor Rachel Reeves that headline inflation would accelerate to 4 per cent by September, while food inflation would hit 5.5 per cent by Christmas – putting a squeeze on household budgets.

Oasis help drive up inflation - definitely maybe

06:30 , Jane DaltonSanjay Raja, senior economist for Deutsche Bank, said any rise in inflation last month could partly be attributed to British band Oasis kicking off their reunion tour.

The concerts brought hordes of fans to arenas in Cardiff, Manchester, London and Edinburgh, which could have driven greater demand for hotel rooms.

Accommodation prices could have risen by as much as 9 per cent compared with June, the Oasis concerts having a strong effect on Manchester prices alone, the economist said.

Mr Raja is predicting headline UK inflation will have risen to 3.8 per cent.

Susannah Streeter, head of money and markets for Hargreaves Lansdown, said: "The Oasis tour, which saw high demand for hospitality around the gig dates, has the potential to push up inflation in the sector during July.

"We are unlikely to see the Gallagher effect show up in quite the same way as Taylor Swift's bump to prices in June 2024.

"But demand for hotel rooms, beer, bucket hats and Nineties-style gear could be one of the factors that keep inflation heading higher."

Reeves faces increasing pressure

06:15 , Jane DaltonA rise in inflation for six months running is likely to increase pressure on chancellor Rachel Reeves.

She urged the public this month to be patient with Labour on the economy, saying the change they voted for in last summer’s election was “never going to happen overnight”.

The word “embattled” has started to appear next to her name in headlines.

And bookmakers have made Ms Reeves favourite to be the next cabinet minister to lose her post.

-copy.jpeg?trim=0,0,0,0&width=1200&height=800&crop=1200:800)

Embattled Rachel Reeves urges public to be patient with Labour on rescuing economy

Food price inflation still increasing

06:00 , Jane DaltonAnnual food price inflation increased for the third month in a row in June, hitting the highest rate since February last year.

Victoria Scholar, head of investment for Interactive Investor, said there were "particular worries about domestic food price inflation as well as uncertainty around how (US President Donald) Trump's tariffs could push up prices".

Rail fares could jump 5.5%

05:45 , Jane DaltonCommuters will brace themselves for a hike in rail fares.

July's Retail Prices Index (RPI) measure of inflation, which may determine rail fare rises, will also be announced later.

The government has not said how it will decide the cap on regulated train fare rises in England next year, but this year's 4.6% hike was one percentage point above RPI in July last year.

Banking group Investec has forecast this year's July RPI figure will be 4.5%, which means fares could jump by 5.5%.

Pressure group Railfuture said it would be outrageous if fares rose by that much.

July’s RPI figure will be announced on Wednesday. If predictions are correct, we could see an inflation-linked fare rise of 5.5% next year. We spoke to the @Independent to explain why the Gov't should be protecting passengers from excessive fare rises: https://t.co/ic1E9jUDuk

— Campaign for Better Transport (@CBTransport) August 18, 2025

Food inflation forecast to keep rising all year

05:30 , Jane DaltonEarlier this month, the Bank of England warned the public of months of sharp price rises ahead, driven by higher food costs.

The Bank said headline inflation would accelerate to 4 per cent by September, while food inflation would hit 5.5 per cent by Christmas.

Holiday travel drove up prices, analysts say

05:15 , Jane DaltonAir fares rose considerably last month, the ONS figures are expected to show, as airlines typically bump up prices in July amid stronger demand from families.

Analysts for Pantheon Macroeconomics forecast that air fares could have surged by 17.1 per cent between June and July.

Rail costs and package holidays are also set to have jumped amid the spike in summer travel.

Higher airfares and hotel prices predicted to push up UK inflation in July

How a cup of tea is driving up prices

05:00 , Jane Dalton

You’ll never guess the everyday item that’s putting up the cost of your weekly shop…

'Oasis bump' pushed up July hotel costs

04:20 , Jane DaltonSome experts say an "Oasis bump" could have contributed to higher accommodation prices in July.

The band began a reunion tour last month, appearing live for the first time since 2009.

Tickets sold out at all UK venues, causing local spikes in demand for hotel rooms.

Prices to rise for sixth month running

03:40 , Jane DaltonUK inflation is thought to have edged higher last month to 3.7 per cent.

It would mark the sixth month in a row that consumer prices will have risen.

They went up by 3.6 per cent in June, an acceleration from 3.4 percent in May.

Food prices continued to climb and summer spending pushed up flight and hotel costs in July, analysts say.

Welcome to our live coverage of the UK’s latest inflation figures, set to be unveiled by the Office for National Statistics at 7am.