Choosing a reliable online broker can be a challenging task — however, one can simplify it by sticking to a trusted checklist. This article will share a set of criteria to pay attention to when comparing the offers. The parameters will be arranged by priority, the first one being the most crucial one, and so on. These criteria will be applied in our INFINOX review, using this broker as a practical example.

Geographical Availability

One should choose between the brokers that operate legally in one’s country of residence. Otherwise, it would be impossible to sign up for the platform and perform any activities on it.

INFINOX operates in over 20 countries across different regions worldwide. It adjusts its terms and policies to each territory to comply with the local legal norms.

License

A license is vital for an online broker, proving that the company complies with financial regulations and protects its customers’ funds and data. The license also eliminates the risk of fraud and ensures the transparency of rules that regulate trading and additional services. If a problem arises with a licensed broker, its customers can complain to the governmental bodies, and the latter will fix the issue.

Licenses can be national or international. If a broker obtains a document of the latter type, it can grant it the right to operate in several countries. For instance, INFINOX has three licenses, issued respectively in Mauritius, the Bahamas, and the UK. The broker does not need any additional permits to work in over 15 countries.

Insurance

Online brokers can offer insurance to protect clients from financial losses not related to market changes or the customer’s own trading decisions. This compensation might come in handy in case of the platform’s bankruptcy or mistakes. Such incidents are infrequent, but having a safety margin is always advisable.

INFINOX keeps clients’ funds in segregated accounts. Additionally, client deposits are protected by a combination of regulatory safeguards and supplementary insurance, which may offer coverage in the event of broker insolvency.

User Feedback

The next step is to check the impartial reviews that the broker’s clients leave about it on review platforms. Negative opinions deserve special attention, but only if they do not try to promote the services of some other companies. Here are five examples of the INFINOX trading platform feedback.

Shawn’s INFINOX review confirms that this platform is beginner-friendly.

Nathan’s INFINOX Forex review highlights the broker’s reliability and the convenience of conducting financial transactions.

Madison’s INFINOX review praises the design, deposits and withdrawals, fast KYC, and the mobile app.

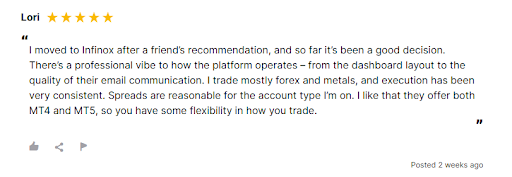

Some INFINOX opinions emphasize the overall professionalism of the broker.

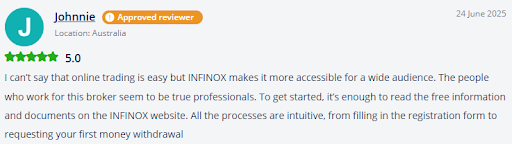

Other INFINOX opinions express the same idea in other words, accentuating the intuitiveness.

Support Services

It makes sense to test the professionalism of the support assistance before signing up for the broker. Most companies are ready to answer the questions of people who have not yet become their clients. Here are the four points to assess:

- Working hours of the support department. International brokers should remain accessible round the clock to cater to customers from various time zones.

- Range of supported communication channels. It should include live chat with almost instant replies and some alternatives, such as phone or email.

- Speed of response. It depends on how busy the operators currently are — but the faster they react, the better.

- Quality of answers. The operators should be polite, friendly, and able to explain complex notions in simple language.

INFINOX broker reviews prove that this broker performs well according to all these four points. When one opens the Contact page, the first communication channel they will be suggested to use is a fill-in form — one can type in their message there and get a response to their email. Alternatively, the user can click the icon in the right-lower part of the page to initiate a dialog in live chat. Besides, one can reach out to the support department via support@infinox.com or through five major social networks. The operators reply to client requests 24/7, providing comprehensive and detailed answers.

Account Varieties

There is no one-fits-all answer to the question about how many account types an ideal online broker should offer. Some people believe it is enough to have just two or three options to choose from — otherwise, it would be hard to make a reasonable decision. Others would prefer to have more variants to experiment with, differing in trading terms. Top brokers also offer demo accounts for newcomers to train and Islamic ones for people who can not use swaps because of their religious beliefs.

When outlining the INFINOX pros and cons, people express varied opinions about the only two available account types. Some think it would be better to have more, while others appreciate the ease of choice. The STP account offers spreads starting from 0.9 pips with no trading commissions. The ECN account features tighter spreads from 0.2 pips but includes a commission starting at 7 units of the base currency. Both offer leverage up to 1:1000. Apart from an individual account, one can open a corporate or a joint one with INFINOX. Demo and Islamic accounts are available as well.

Registration and KYC Procedure

In terms of registration and verification, online brokers do not differ too much. The industry regulations are more or less identical for all territories. The point of difference is the speed and smoothness of processing the applications.

Normally, to sign up, a new client needs to fill in a form with their basic and private contact details — and then, the broker’s representative will get back to them. For verification, one has to upload their passport or ID and a recent household bill to prove the place of residency.

In these two aspects, INFINOX does not stand out too much from its competitors. However, it strives to make the sign-up process fast and intuitive thanks to well-thought-out UX/UI. After clicking the Open Live Account button on the broker’s website, a new user will find themselves on a page with a fill-in form. At the bottom of the page, there are convenient links to legal documents that new clients should read — no need to dig through the website looking for them. The INFINOX managers strive to process the incoming applications as promptly as possible, but the speed of their decision-making will depend on their current workload.

Deposits and Withdrawals

The range of the supported banking options should be tailored to each territory of the broker’s presence. Due to the legal requirements, it can be wider for some countries and narrower for others. It can include cards, bank transfers, digital wallets, cryptocurrencies, Internet banking, local depositors, and some other options. One should choose a broker with a suitable list of payment systems — for instance, if a person is used to Visa and MasterCard, the selected service provider should accept them.

INFINOX lets its customers choose from around a dozen banking options, the available range of which differs depending on the territory. It can include cards, wire, crypto, Internet banking, QR code, Neteller, Skrill, Sticpay, Payretailers, EBuy, and others.

The next important point related to financial transfers is their maximum and minimum limits. These are determined both by the broker and the payment providers.

Regarding INFINOX pros and cons, the minimum deposit requirement is $50 or its equivalent in other currencies. While this amount may be accessible for some traders, others might find it relatively high compared to brokers that accept deposits starting from $5.

The $50 minimum deposit does serve a practical purpose, however. This amount provides traders with sufficient capital to potentially generate meaningful returns on their investments. With smaller deposits like $5, profit potential would naturally be more limited, typically resulting in minimal gains even in favorable market conditions.

Trading Environment

The term “environment” in this context means the available trading terminals and the conditions for handling them. A broker can build a custom digital solution for buying and selling assets, but this is not always necessary. There are high-quality third-party products on the market that brokers can offer to their clients.

A typical INFINOX Forex review praises the ease of trading with the MT4 and the MT5 terminals. These external trading solutions are available for free download through the broker. Both platforms come equipped with dozens of practical features like technical indicators, trading hints, and automated tools.

Quite a few INFINOX broker reviews praise its IX Social mobile app, which is a custom solution. It enables users with limited expertise to follow the trades of their more experienced colleagues in exchange for a fee. Both parties involved enjoy a win-win situation.

It is also essential to assess the scope of assets that the broker supports and the flexibility of the terms for buying and selling them. INFINOX is focused on Forex, indices, commodities, equities, and futures — all these asset classes generate a steadily high demand among a wide audience. The minimum trade size is just 0.01.

Extra Offers

These can include, for instance, the affiliate program and the opportunity to manage other people’s accounts in exchange for remuneration. The first option comes in handy for people who value socialization, and the second one — for experienced traders.

When weighing up the INFINOX pros and cons, customers tend to highlight the convenience of using its PAMM accounts — this abbreviation stands for Percentage Allocation Module Manager. One can link their account to that of the preferred PAMM, so that the experienced trader takes care of buying and selling the assets, and their customers get a share of the profits. PAMM’s clients can keep track of their investments in real time and withdraw their incomes whenever they wish.

To Sum It Up

The checklist from this article can help one select a trustworthy online broker that provides favorable conditions for making an income. Judging by the provided INFINOX review, one can see that this is one of the noteworthy options on the market. After signing up for a reputable company, one should continuously improve their skills and leverage the available tools to boost their profits.