/Incyte%20Corp_%20office%20sign-by%20Bo%20Shen%20via%20iStock.jpg)

Incyte Corporation (INCY), headquartered in Wilmington, Delaware, discovers, develops, and commercializes therapeutics for hematology/oncology, as well as inflammation and autoimmunity areas. Valued at $16.8 billion by market cap, the company follows science to find solutions for patients with unmet medical needs. The global biopharmaceutical company is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Tuesday, Oct. 28.

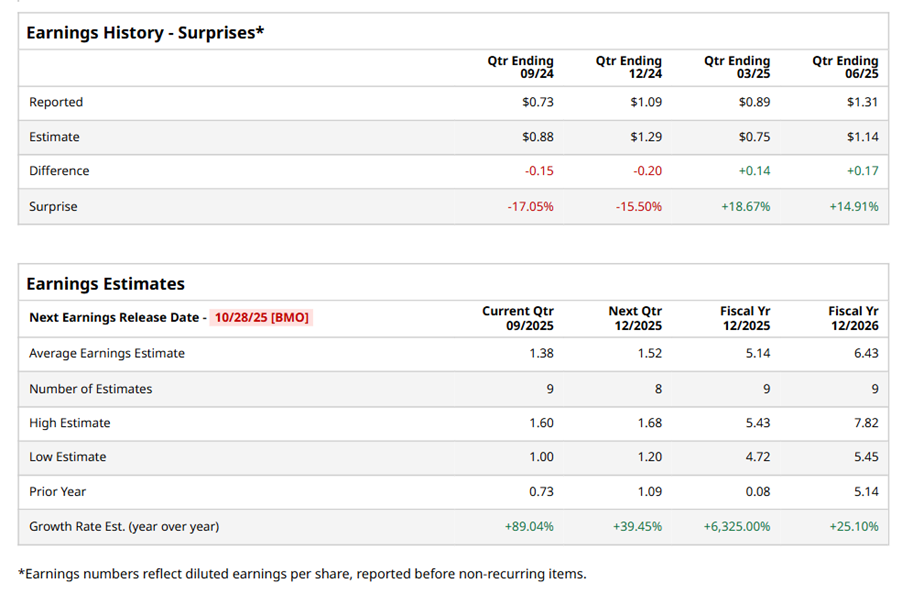

Ahead of the event, analysts expect INCY to report a profit of $1.38 per share on a diluted basis, up 89% from $0.73 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect INCY to report EPS of $5.14, up significantly from $0.08 in fiscal 2024. Its EPS is expected to rise 25.1% year over year to $6.43 in fiscal 2026.

INCY stock has outperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares up 29.8% during this period. Similarly, it outperformed the Health Care Select Sector SPDR Fund’s (XLV) 5.5% losses over the same time frame.

INCY is outperforming due to strong sales of its lead drug Jakafi and the successful launch of Opzelura cream. Recent FDA approvals for new treatments, including Zynyz and Niktimvo, have also contributed to its success. Additionally, Incyte receives royalties from partnered drugs like Tabrecta and Olumiant, further boosting its performance.

On Jul. 29, INCY shares closed up more than 10% after reporting its Q2 results. Its adjusted EPS of $1.57 topped Wall Street expectations of $1.39. The company’s revenue was $1.22 billion, exceeding Wall Street forecasts of $1.15 billion.

Analysts’ consensus opinion on INCY stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 26 analysts covering the stock, 11 advise a “Strong Buy” rating, 14 give a “Hold,” and one recommends a “Strong Sell.” While INCY currently trades above its mean price target of $85.67, the Street-high price target of $115 suggests a notable upside potential of 33.5%.