On the streets of Jakarta, more than 10,000 motorcycle drivers rush to provide ride-hailing, delivery and other services. They’re divided into two groups. Those wearing mostly green jackets with black trim work for Gojek. The other group wears mostly black jackets with green trim and drive for Grab.

Jakarta-based Gojek and Singapore-headquartered Grab are the two most valuable tech startups in Southeast Asia. Competing in ride-hailing, delivery of foods and other goods, digital payment and other services, the two are engaged in cash-burning turf wars in Indonesia, Vietnam, Singapore, Thailand and beyond. They are fighting to build a super app to dominate a Southeast Asia market of 600 million people.

The Gojek-Grab rivalry shows how Southeast Asia is turning into an extended battlefield between tech startups under the influence of Chinese industry giants and capital. As China’s internet sector cools following years of white-hot growth, companies and investors are turning to Southeast Asia as the next frontier, analysts said.

Following a wave of Chinese business expansion into the region in the early 20th century, the current tech-driven foray amounts to a second Chinese push in Southeast Asia, according to Qu Tian, founder of ATM Capital, an Indonesia-focused investment fund.

Backing Gojek and Grab are some of the world’s biggest investors, led by Chinese giants. Investors in Grab include China’s ride-hailing behemoth Didi Chuxing, the sovereign wealth fund China Investment Corp., equity investors Ping An Capital and Hillhouse Capital, and global partners such as Softbank, Toyota, Honda and Microsoft. Gojek boasts a similarly glittering list of funders including Tencent, Meituan Dianping, JD.com, Mitsubishi Motors Corp., Google, Visa Inc. and KKR & Co. Inc.

According to a report jointly issued by Google, Temasek Holdings and Bain Capital, the internet economy in Southeast Asia will reach $100 billion this year and triple to $300 billion by 2025. From 2015 to 2019, the online population in the region surged from 260 million to 360 million, of which about 90% use mobile internet, according to the report.

The heated battle between Gojek and Grab is reminiscent of the cut-throat battles among tech companies in China several years ago that redefined the industry landscape as behemoths including Alibaba Group, Tencent Holdings, Didi Chuxing and Meituan Dianping emerged to dominate the sector.

The way those companies poured billions of dollars into seizing business territories and squeezing out smaller rivals provides case studies for counterparts in neighboring countries.

The success of the on-demand service app Meituan Dianping and Tencent’s popular messaging app WeChat “inspired” Grab’s push to create a super app, said company co-founder Hooi Ling Tan. She said she realized that many Asian users prefer to access multiple services through a single application.

Established in 2012 as a ride-hailing app, Grab took over Uber’s business in Southeast Asia in 2018 and has since engaged in an aggressive expansion to diversify into food delivery, hotel booking and news aggregation. In July, the $14 billion company said it would invest $2 billion to expand its footprint in Indonesia — the region’s largest market.

Archrival Gojek started in 2010 as a call center-backed ride-hailing company. Since 2015, it expanded into delivery, food takeout and other on-demand services. The company currently has a valuation of about $9.5 billion.

Investors are turning to the region for new industry stars. As of the end of June this year, tech startups in Southeast Asia raised $37 billion, according Rohit Sipahimalani, head of the Portfolio Strategy & Risk Group at Temasek.

Among the region’s 11 tech unicorns — startups with valuations exceeding $1 billion — 10 have backing from Chinese investors. In addition to Grab and Gojek, Singapore-based e-commerce company Lazada Group is 83% owned by Alibaba while major rival Shopee is backed by Tencent.

The business experiences of Chinese rivals and their extensive supply chains in China are also key factors tying Southeast Asia’s tech startups closely to their Chinese counterparts. Companies including Indonesia’s online marketplace operator Tokopedia have regularly sent executives to China to learn from industry leaders there, while Chinese entrepreneurs and immigrants have become deeply involved in the tech boom in Southeast Asia.

The new battlefield

Southeast Asia is now in a golden era for tech startup growth as people’s livelihoods improve, according to Nicholas Nash, former president of Singapore’s gaming and e-commerce giant Sea Group.

In 2018, the average per capita income of Southeast Asia countries reached $4,600, similar to that of China in 2007 when the country started its tech boom.

Research by Google found that e-commerce, ride-hailing, online gaming, video streaming, and online travel services are the sectors with the most potential to breed new tech unicorns in Southeast Asia, while mobile payment and internet financial services are close to a boom.

The potential of the Southeast Asia market stems from its young people. About 26% of the region’s population is younger than 14, compared with 18% in China and 19% in the United States. In the Philippines, the average time people spend online reaches 10 hours a day, the world’s highest. In Thailand the average is as high as nine hours and in Indonesia, eight hours and 25 minutes, compared with nearly six hours for Chinese netizens.

Chinese tech leaders such as Tencent and Baidu Inc. started placing bets on Southeast Asia as early as 2012 by launching local versions of their services. But in the following years, the companies have faced challenges dealing with a market of high diversity in terms of culture, politics and religion.

It is difficult to apply a one-size-fits-all business model to the entire Southeast Asia region, given the big social and economic differences among countries. For instance, Grab customized its ride-hailing services to allow users to book tricycles in Thailand and Philippine, motorcycles in Indonesia and Vietnam, and automobiles in Singapore.

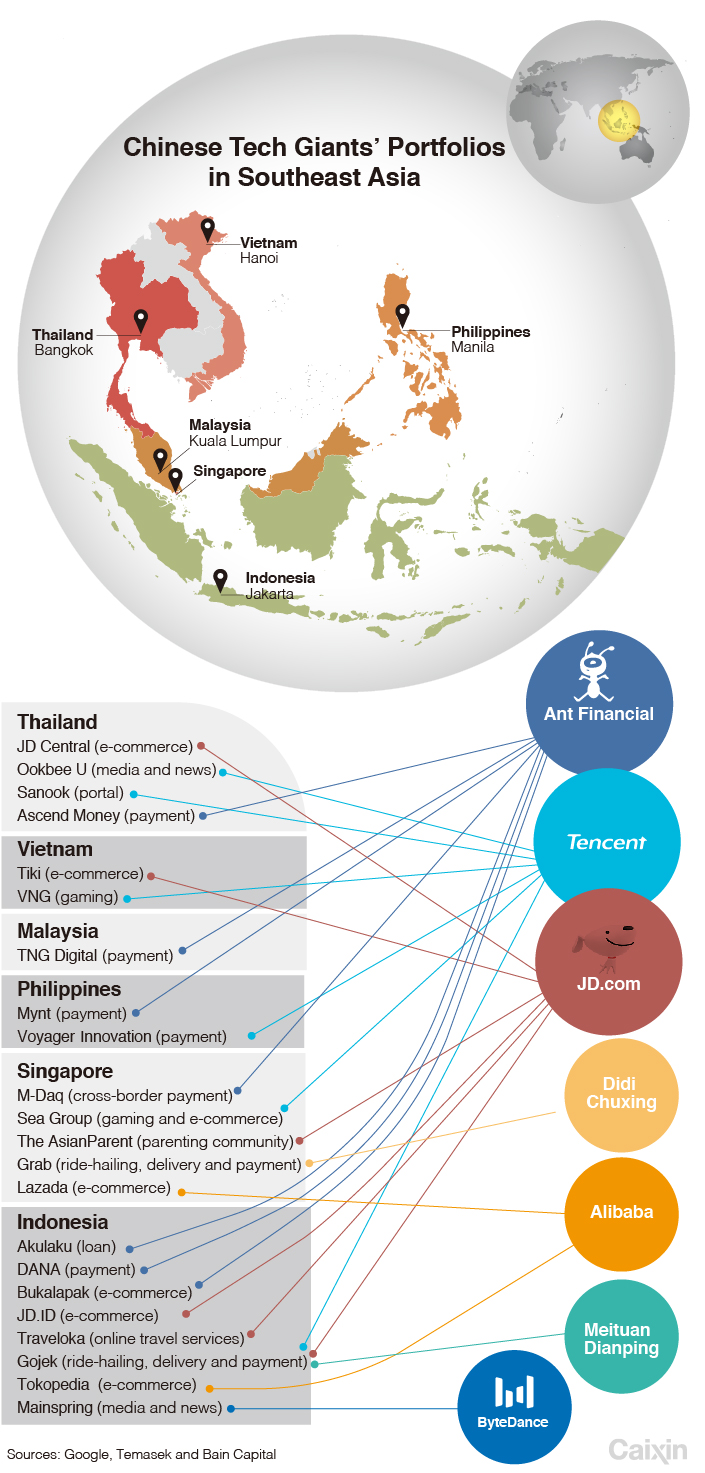

Chinese tech companies have thus gradually shifted their strategies in the region to tie up with local partners. Alibaba has invested in leading e-commerce platforms including Lazada and Tokopedia, while its Ant Financial Services Group holds stakes in Indonesia’s Bukalapak and DANA, the Philippines’ Mynt, Malaysia’s Touch’n Go, and Thailand’s Ascend Money.

Tencent is the backer of Singapore’s Sea Group and Vietnam’s gaming company VNG. JD.com has invested in Vietnam’s Tiki and Indonesian online travel agency Traveloka.

The partnerships have given Southeast Asia startups a closer look at the success stories of their Chinese counterparts. Andre Soelistyo, co-CEO of Gojek, said the company has been learning from Tencent’s experiences to build business ecosystems since Tencent invested $1.2 billion in Gojek in 2017.

Although Gojek will not completely copy the models of Chinese tech enterprises, it has sent employees to China to learn from them every half-year, Soelistyo said. Those working for the delivery business were sent to Meituan Dianping to learn how to work with small restaurants, and those in payment departments went to Tencent to learn the operations of WeChat Pay, he said.

The Chinese influence in Southeast Asia’s $38 billion e-commerce sector is significant. In 2016, China’s top e-commerce operator Alibaba invested $1 billion for 51% of Lazada and increased its stake to 83% the following year. Since then, Alibaba has dispatched technology support and management teams to the Singaporean company.

In addition to capital and experience, a more valuable resource for Southeast Asia e-commerce startups is the China supply chain that provides them access to plenty of China-made products. Lazada and its major rival Shopee, founded by Chinese entrepreneur Forrest Li in Singapore, have been heavily promoting cross-border e-commerce mainly with merchants in China. Research institution Mordor Intelligence said cross-border e-commerce accounts for 40% of the total e-commerce market in Southeast Asia.

Booming online businesses also fueled the growth of mobile payment in Southeast Asia. According to Google, the region’s online payment market is expected to expand to $1.1 trillion by 2025 from $600 million in 2019.

But there are also huge gaps between countries. Data from Grab showed that Singapore has the highest rate of digital payment penetration among all Southeast Asia countries at 57%, followed by Vietnam’s 11.5%. The rates in Indonesia and Malaysia are less than 5%. In China, online payment accounted for 65.8% of total transactions in 2016.

Jason Thompson, CEO of Grab-backed payment provider OVO, said Indonesia is copying the online payment development model of China by using heavy subsidies to fuel growth. Only 2% to 3% of transactions in Indonesia now involve e-money, and the central bank is aiming to lift the share to 8% in the next three years, Thompson said.

OVO hopes to bring the success of Ant Financial to Indonesia. The Indonesian payment provider is partnering with local wealth management company BareKsa to offer online investment products, modeling Ant Financial’s money market fund Yu’e Bao. The company is set to launch an insurance business as soon as late this year.

“I believe the fintech landscape in Indonesia will have profound changes in the next three to five years,” Thompson said.

Capital foray

As frictions mount among major trading countries, especially between China and the U.S., the emerging markets of Southeast Asia are increasingly seen as a safe haven for global investors. During the first six months this year, startups in Southeast Asia raised $7.6 billion, up 7% from the first half last year, according to Google. During the same period, fundraising in China’s technology, media and telecom industries dropped 60% to $14.9 billion.

Data from Refinitiv showed that during the first seven months this year, Chinese venture capitalists poured $1.78 billion into the region’s startups, an eight-fold increase from the same period last year.

“When I was in Indonesia in 2017, what I saw was a vibrant market that had yet to be dominated by any player, just like China 10 years ago when market dominance had yet to be built up,” said Qu Ping, founder of ATM Capital, the first Southeast Asia-focused tech investment fund.

In June, New York-based Warburg Pincus finished raising $9 billion to invest in China and Southeast Asia. It is the largest private equity fund focusing on the region.

GGV Capital, backer of Chinese tech leaders including Alibaba and Qunar, this year opened an office in Singapore for the Southeast Asia market. Founding partner Li Hongyi said the company invested $170 million in 10 projects in the region and reaped hefty gains. Li said she sees the next five to 10 years as a golden era for investors in the region.

Compared with China, the Southeast Asia market is relatively small and more fragmented. “Although there is less opportunity to see mega companies like Alibaba and Tencent to emerge in the region, there are plenty of opportunities for unicorns worth $1 billion to $10 billion,” Li said.

Some investors may soon see their investments pay off. In October, Tokopedia said it is likely to turn a profit in 2020 and start work on an initial public offering. Bukalapak, Gojek and Traveloka have also expressed intentions to go public.

The battle between Gojek and Grab will continue reshaping the market landscape. While some investors suggest the two may merge, others expect them to grow into the Southeast Asia version of Alibaba and Tencent.

Contact reporter Han Wei (weihan@caixin.com)