Cryptocurrencies often attract retail investors looking for big wins, and meme coins like Dogecoin (DOGE) have become central to that story. Despite sharp swings and lingering skepticism, Dogecoin still commands a massive following, with its market cap ranking among the largest in the crypto world. Many investors keep wondering: could DOGE really climb to the long-anticipated $1 milestone?

For those who believe it can, one penny stock stands out as a leveraged play on Dogecoin’s next big move. Thumzup Media (TZUP), linked to Donald Trump Jr., recently announced a pivot into large-scale Dogecoin mining that could generate up to $103 million in annual revenue if DOGE reaches a dollar.

Backed by a risky strategy and growing crypto exposure, TZUP looks like a speculative wager, but can it turn hype into real returns? Let's find out.

About TZUP Stock

Based in Los Angeles, Thumzup Media is a U.S. software-as-a-service company (SaaS). Its Thumzup app helps build an influencer and gig economy community by rewarding everyday people to create and share genuine social media posts about brands and their products.

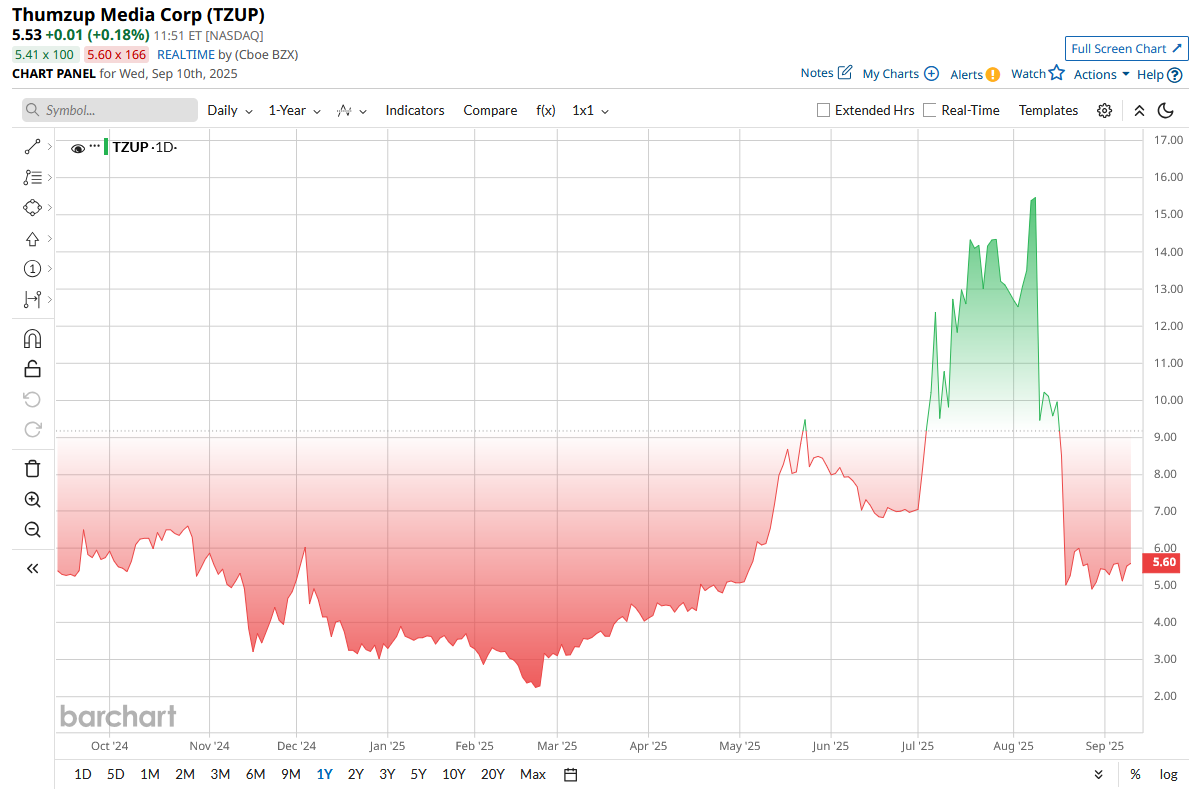

Valued at $90 million by market cap, shares of TZUP have rallied about 61% in 2025, largely because the company shifted strategy toward digital-asset accumulation and mining, announcing a Bitcoin-accumulation plan, buying BTC (BTCUSD), and securing a Coinbase (COIN) Prime-backed facility that made investors view it as a crypto play rather than pure ad-tech.

At the same time, Thumzup completed sizable capital raises and filed shelf offering documents to fund mining, treasury investments, and potential acquisitions (including a proposed DogeHash deal), which boosted liquidity and growth expectations.

Trump Ties and Crypto Partners

Investor interest in TZUP has been stoked by its links to the Trump family’s crypto ventures. President Trump’s son, Donald Jr., became a large shareholder after purchasing 350,000 shares in mid-2025. The company’s capital raises have been managed by Dominari Securities, an investment bank with deep ties to the Trump family, reinforcing the political-crypto angle.

TZUP has also formed a crypto advisory board with DogeOS founder Alex Hoffman and broadened partnerships (Coinbase Prime credit facility) to legitimize its blockchain strategy

In short, the “Trump-linked” narrative is real; TZUP is now explicitly presented as part of the Trump family’s burgeoning crypto empire.

Dogecoin $1 Scenario: A “Screaming Buy?”

In late 2024, Thumzup Media IPOed with only $741,000 in revenue and almost $4 million in net loss. It secured new capital of up to $50 million by mid-2025, increasing the cash reserves to a new level. It shifted to crypto by acquiring DogeHash Technologies, which added 3,500 Dogecoin mining rigs to its portfolio. According to the company's projections, the revenue these rigs will raise per year is between $22 and $103 million, depending on the price of Dogecoin.

Proponents explain that when Dogecoin takes off, TZUP can gain exponentially. In theory, 1 DOGE would generate roughly $103 million of annual revenue in the rigs, which would be much higher than the existing sales. Even at 50 cents, the projected revenue of $51.6 million is an order of magnitude improvement on previous performance. When large-scale Dogecoin miners are as appreciated in markets as they are Bitcoin miners, TZUP, at its present market cap of around $89 million, might appear to be a bargain.

Yet this would still be a very optimistic picture.

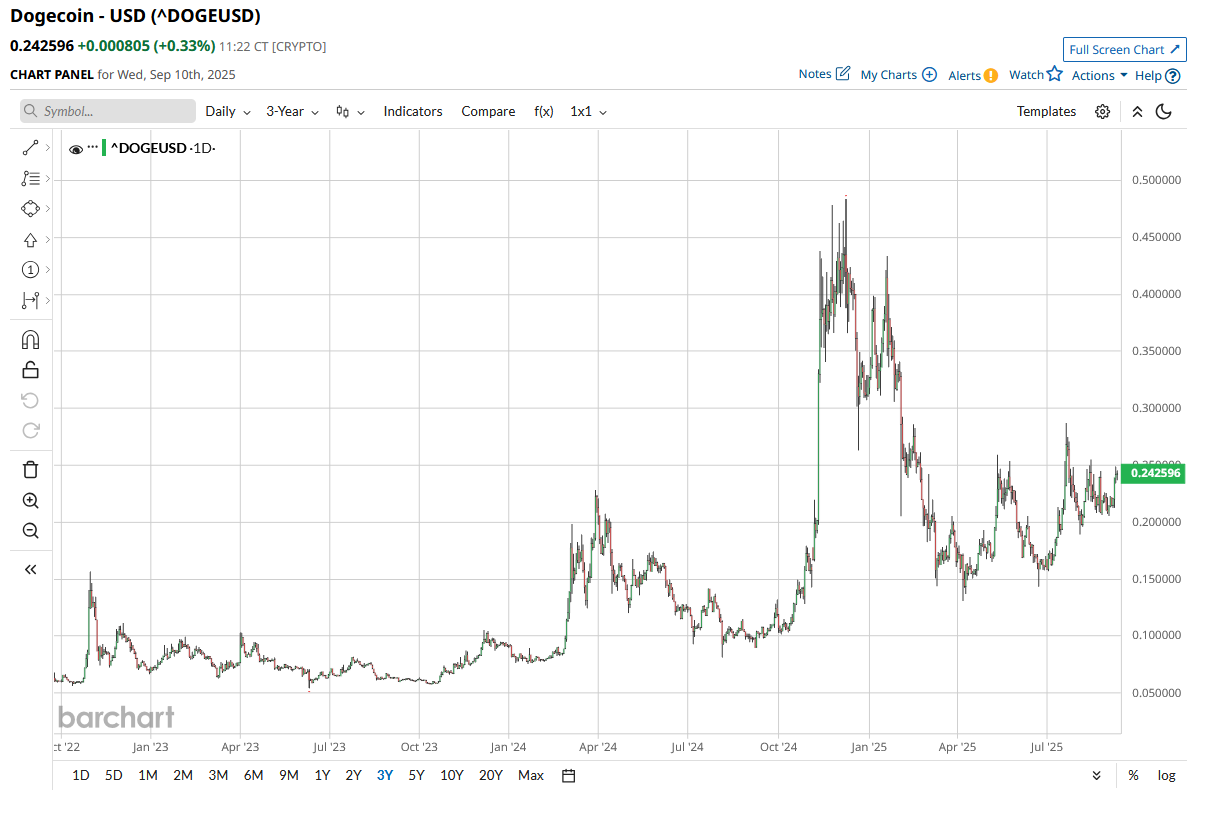

Today, DOGE trades near $0.24 as of Sept. 10, so the $1 scenario remains highly speculative. When DOGE halts or declines, TZUP still needs a few tens of millions to run its mining operations, and it is insufficient to pay off its recent cash burn. In addition, TZUP remains a small penny stock with a thin float, high volatility, and no assurance that mining activities will be scaled easily. It is important to note that law firms issued an investor warning in August 2025, noting the speculative risks surrounding the stock.