A few notable software application companies are showing signs of slowing momentum. These firms have experienced a significant drop in their momentum percentile scores over the past week, signaling a potential cooling of investor enthusiasm.

What Does Benzinga Edge’s Momentum Ranking Entail?

This reversal, as pointed out by Benzinga’s Edge Rankings system, suggests that the powerful upward trends that previously defined these stocks are beginning to fade.

The data reveals a clear downturn for five software application companies, which were all recently in the upper echelon of momentum rankings.

Momentum ranking measures a stock's relative strength based on its price movement patterns and volatility over multiple timeframes, ranked as a percentile against other stocks.

Thus, the decline in their scores indicates that their stock performance is beginning to lag compared to their peers.

5 Key Software Application Stocks Losing Momentum

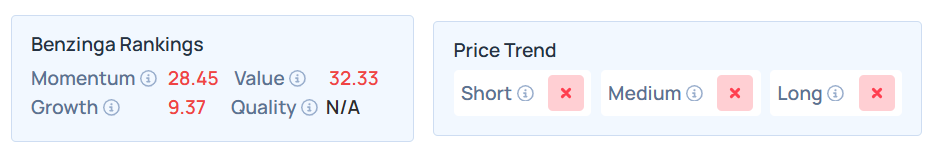

Nukkleus Inc.

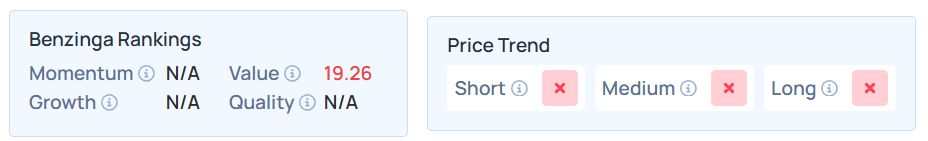

- This stock saw its momentum score plummet from 86.16 a week ago to its current score of 28.45.

- The shares of Nukkleus (NASDAQ:NUKK) have declined 0.87% over the last five days and 52.68% over the last month.

- It maintains a weaker price trend in the short, medium, and long terms. Furthermore, the stock scores poorly on value and growth rankings. Additional performance details are available here.

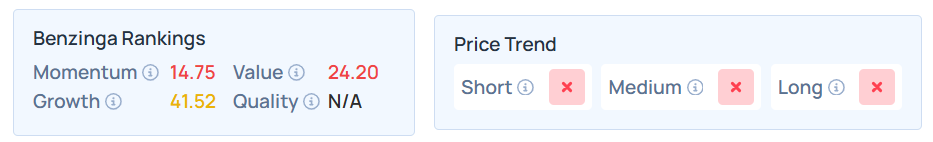

Blend Labs Inc.

- Previously a strong performer, Blend Labs Inc. (NYSE:BLND) score receded sharply from 67.69 to just 14.75.

- Despite rising 8.93% over the last five days, the stock was down 12.10% over the last month and 23.17% over the past year.

- BLND’s price trend in the short, medium, and long terms remains weak, whereas its growth ranking is relatively moderate. Additional performance details are available here.

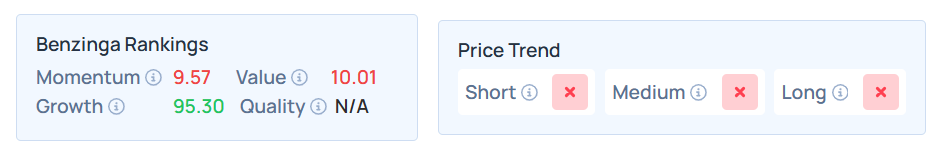

Monday.Com Ltd.

- Monday.Com Ltd.’s (NASDAQ:MNDY) score fell precipitously from 60.59 seven days ago to 9.57 currently.

- Down 0.61% over the last five sessions, MNDY dropped 37.00% over a month and -33.70% over the past year.

- With a poor price trend over the short, medium, and long terms, its growth ranking remains very strong. Additional performance details are available here.

See Also: Short Seller Andrew Left Says ‘OpenAI At $500 Billion Puts Palantir At $40’ — And That’s Generous

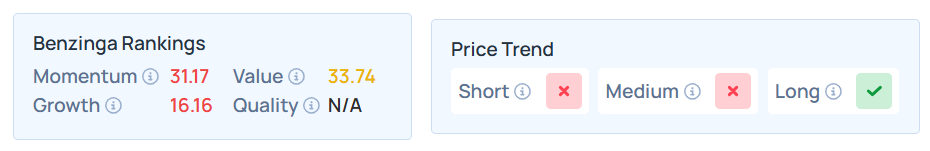

Digital Turbine Inc.

- Digital Turbine Inc.‘s (NASDAQ:APPS) momentum percentile has receded by more than half, dropping from a high of 97.68 to 31.17 over the last week.

- The stock was 3.48% lower over the last five trading sessions, whereas it dropped 25.05% in the last month and 0.48% over the year.

- Edge rankings show a moderate value score but a poor price trend over the short and medium terms, with a strong price trend in the long term. Additional performance details are available here.

Marti Technologies Inc.

- Marti Technologies Inc. (NYSE:MRT) score was more than halved, declining from 78.34 to 36.49 in the past seven days.

- MRT was up 4.53% in the last five days, but down 8.30% and 24.40% over the last month and the year, respectively.

- Along with a poor value ranking, the stock had a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.025% at $643.14, while the QQQ declined 0.071% to $576.70, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock